Change in Market Structure

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 10,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

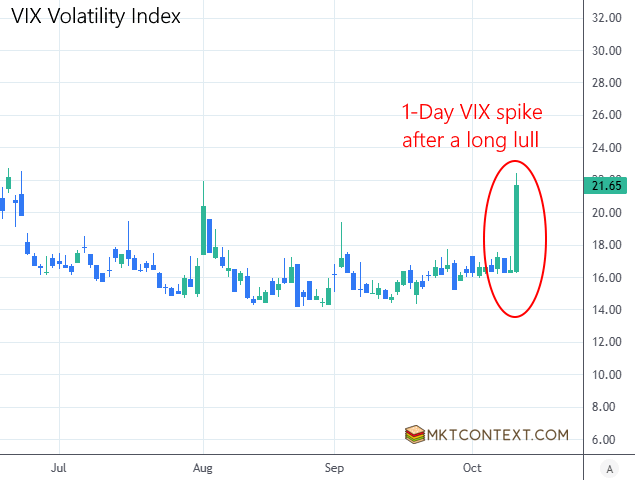

The market structure has changed this week with the massive selloff on Fri. In one trading session, the SPX has sliced all the way back down to the 50-day moving average and VIX has spiked up to 22. This triggered a forced deleveraging of trend-following and vol-control systems. When volatility compresses, as it has over the last 3 months, it allows the use of more leverage. Then, when volatility spikes again, all of that leverage has to be unwound.

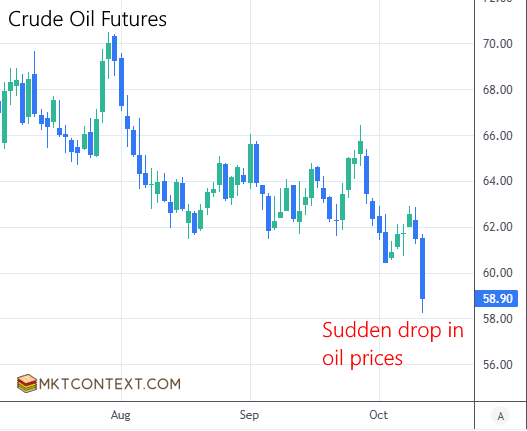

This was a positioning shock on top of already-stretched valuations and bubble nervousness. Expensive stocks and exuberant AI growth was met with fresh policy risk (an external shock). We saw three things that tell us markets are pricing in growth uncertainty: 1) yield curves flattening and long-term bonds bid up, meaning a flight to safety; 2) a spike in Japanese Yen, which is often a risk-off barometer; and 3) oil prices collapsing below $60:

Paradoxically, it is healthy to see a -2.7% day on SPX, after nearly 5 months without a real pullback. This “cleanses” some of the unstable positioning and gamma that had built up in the system, making further rallies more supported. A rally that goes straight up, like a short squeeze, is vulnerable to reversion as there are few fundamental buyers. A rally that chops and pulls back along the way shows that real buyers are willing to support the rally. Hence the “higher lows” pattern that market technicians often look for.

Bigger picture, the stock market these days are not the same as they were 20 years ago. The market today is abundant in liquidity, as we’ve highlighted often, but also has a lot of options selling as well as “fast money” (retail investors, margined traders, quants, algos, etc). This breeds eye-watering short squeezes to the upside, but also drawdowns that are more aggressive, like the one seen on Friday. Then when the dust settles, volatility sellers step back in ferociously, creating the buy-the-dip mentality that we’ve documented in past crashes.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!