Key Market Levels and Mining Stocks to Watch

Do NOT chase this market today. Long bonds appear to be the current hedge in this environment. When markets build absurd momentum and price action feels completely detached from reality, there’s usually one asset that takes center stage before the reversal—and that’s gold, which hit new highs overnight.

Friday’s selloff wasn’t even a true flush. The VIX term structure remains in contango. Friday was more of a rush to protect positions than a rush to exit them entirely.

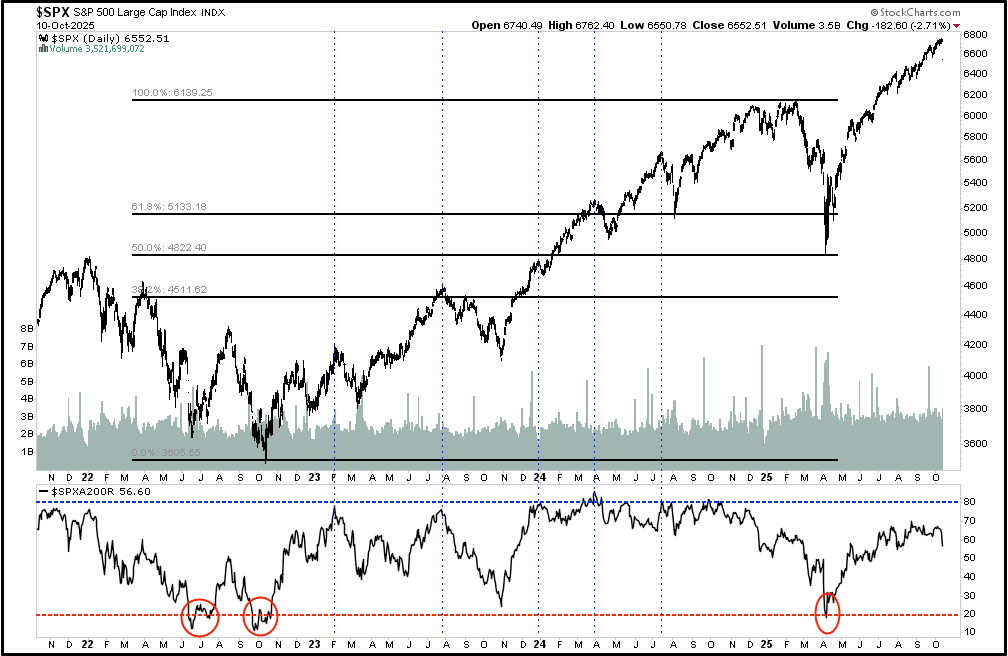

The best indicators in a drawdown

Volume profile

% of stocks below 20ma (still high)

% of stocks below 200ma (still high)

Gold Volatility

Spot VIX vs 3m VIX (needs to be greater than 18pts)

VIX going from backwardation to contango (still in contango)

Indescriminate selling