No. Central Banks Should Not Sell Gold

Why Central Banks Will Likely Not Sell

Authored by GoldFix

Some analysts are now arguing that central banks should dump gold. They say the metal’s overvalued, that it doesn’t yield, that it’s time to take profits. The Financial Times even went so far as to say no central bank should “invest in a single commodity.”

But that completely misreads what central banks are actually doing. As Bank of America and Goldman have both noted, many central banks are still well below their own target gold allocations. Most only resumed buying two years ago, after spending a decade watching their dollar exposure rise. With reserves still far from where they want them, the incentive is to keep accumulating—not selling.

And let’s be clear: central banks don’t invest. They don’t chase returns. They hold, they own, and they manage risk. Investors seek yield. Central banks seek safety and stability. The idea that they should behave like portfolio managers is simply wrong.

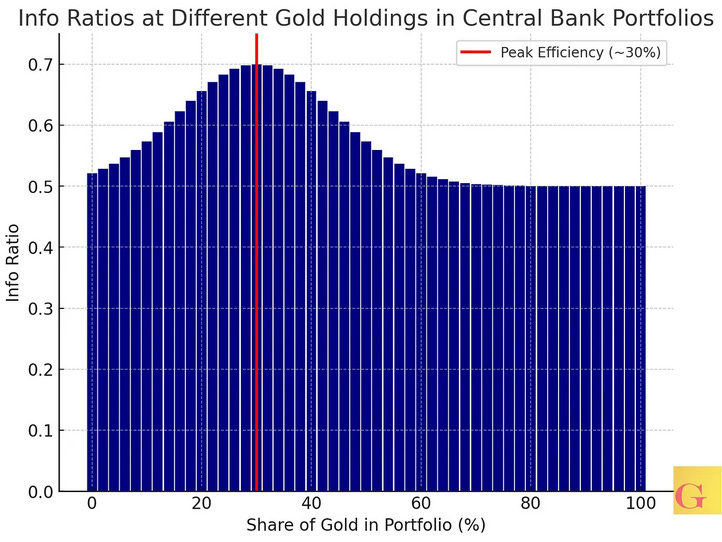

Bank of America argued just 3 months ago that central bank portfolios are most “efficient” when gold accounts for roughly 30% of reserve assets. At present, the share of gold in reported reserves in our research sits closer to 20%, up from about 11% two decades ago. This rise reflects the steady accumulation of bullion by central banks, a trend highlighted by the World Gold Council and IMF statistics.

How Much More Gold Do Central Banks Need to Buy?

The fact of the matter is, According to Bank of America Central Banks have been seen as needing to hold over 30% of their reserves in Gold to be efficient in the new reality. This was noted several months ago. So to be discussing them as potential sellers we feel is ridiculous.

Then there’s that phrase—“a single commodity.” That’s another misunderstanding. If gold were truly just a commodity (something consumed, burned up, or irretrievably lost) it would make no sense for a central bank to hold it. But gold isn’t like that. Gold is money. It’s useless for anything else, and precisely because it’s useless, it’s permanent. That’s what makes it a reserve asset.

The questiob is for the ft, what other commodity would they have central Banks diversify into if too much in only 1 is pistachios? oil, Wheat? maybe silver?

Should Central Banks Sell Gold? No.https://t.co/F0HUdQ1vWQ

— VBL’s Ghost (@Sorenthek) October 17, 2025

So let’s move out of the abstraction. When countries talk about de-dollarizing...when they want to hold something other than U.S. Treasuries—what are they buying? Gold. Gold is the collateral that the world is returning to, just as it did before the fiat experiment began.

To suggest central banks should sell gold is absurd on several fronts. First, as I said, they don’t invest in anything. Second, gold isn’t treated as a commodity...it’s being re-monetized. That’s why it’s been reclassified from a Tier-3 to a Tier-1 asset. That’s why foreign central banks are building vaults and buying more. And that’s why it’s now being considered as a high-quality liquid asset under bank regulations.

Central Banks are still buying; maybe less urgently, but they most certainly are not selling months after they have been buying. It’s ludicrous for central banks to trade gold in this manner. They will sell eventually. when the geopolitical situation becomes less certain. Ask yourself, are things more or less certain than one year ago? If anything, they would lease it first. Finally, remember what’s driving this entire movement: the need for a hedge against debasement risk. That’s what this is all about.

Why "Central Banks Should Sell Gold" is Nonsense

Some analysts now argue central banks should dump gold in light of the rally, pointing to overvaluation and lack of yield. For example, the FT recently contended that no central bank should “invest in a single commodity.”

But such calls misread central banks’ position. As BOA and Goldman have noted, many are still well below their target gold allocations. They only recently resumed buying after years of dollar risks. With reserves far from optimal, the incentive remains to accumulate—not sell. So the bull trend endures, not ends. Read full story

Gold isn’t a trade. It’s insurance on the system itself.

When your next door neighbor's house goes on fire, you don't sell your own fire insurance.

Continues here

Free Posts To Your Mailbox