Bitcoin: The Gold of Digital Fools

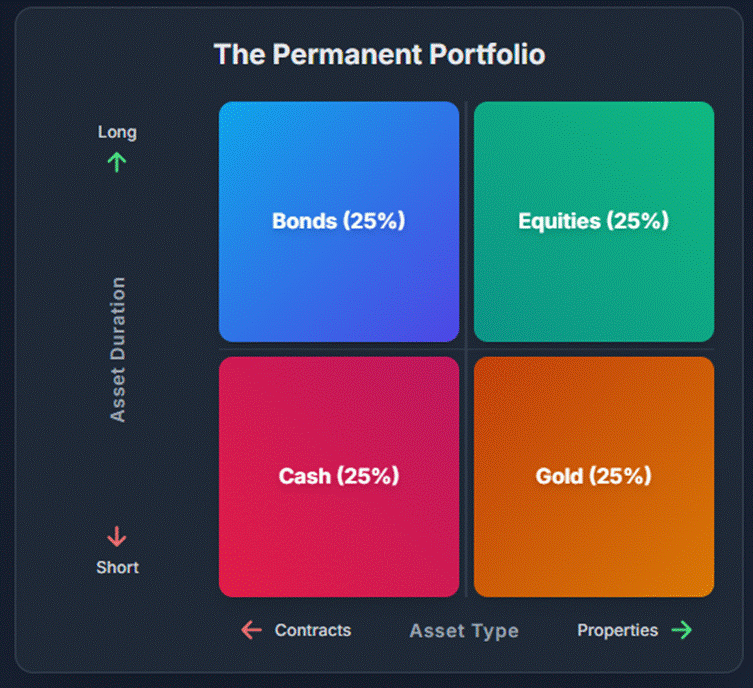

Anyone who’s spent more time hunting for real, inflation-beating returns than watching CNBC’s “expert” clown show already knows the truth: the secret isn’t some magical Wall Street algorithm—it’s Harry Browne’s good old-fashioned Permanent Portfolio. Four simple ingredients, equally weighted: Cash, Bonds, Equities, and Gold. That’s it. No hedge fund wizardry, no crypto moonshots—just a balanced cocktail for sane investors in an insane world.

Within the Permanent Portfolio, financial assets fall into two main camps: contracts—legally binding promises of future payments, like bonds and cash —and properties, which represent ownership claims, through stocks and gold. Some of these assets have long maturities, such as government bonds and equities, while others are short-term, like cash and gold. In essence, this “forever portfolio” can be visualized as four quadrants formed by two axes: properties versus contracts, and long versus short duration—a simple yet elegant framework for balancing risk, reward, and resilience across time.

The genius of the Permanent Portfolio lies in its ability to perform through all four seasons of the business cycle. In a deflationary boom, Bonds, Cash, and Stocks rise while Gold naps; in an inflationary boom, Stocks and Gold shine as Bonds sulk and Cash stays calm; in an inflationary bust, Gold takes the lead while Stocks and Bonds stumble; and in a deflationary bust, Cash and Bonds rally as Stocks fall and Gold holds steady. In three out of four scenarios, at least two assets perform well, one is neutral, and one takes the hit. Regular rebalancing keeps the strategy humming—selling what’s hot to buy what’s not. The key isn’t predicting the future, but recognizing where you are in the cycle and letting diversification and discipline quietly protect and grow your wealth.

Among the four assets in the Permanent Portfolio, one stands out like a rebel at a bankers’ convention: GOLD. It’s not a promise, a contract, or a line on a balance sheet—it’s a shiny lump of defiance. Universally prized for its scarcity, durability, and intrinsic value, gold is the only truly antifragile asset: it doesn’t just survive chaos, it thrives on it. You can hold it, trade it anywhere, and no central banker can print more of it. Legally, it’s property, not debt—meaning it’s yours outright. As J.P. Morgan dryly reminded his peers: “Gold is money. Everything else is credit.”

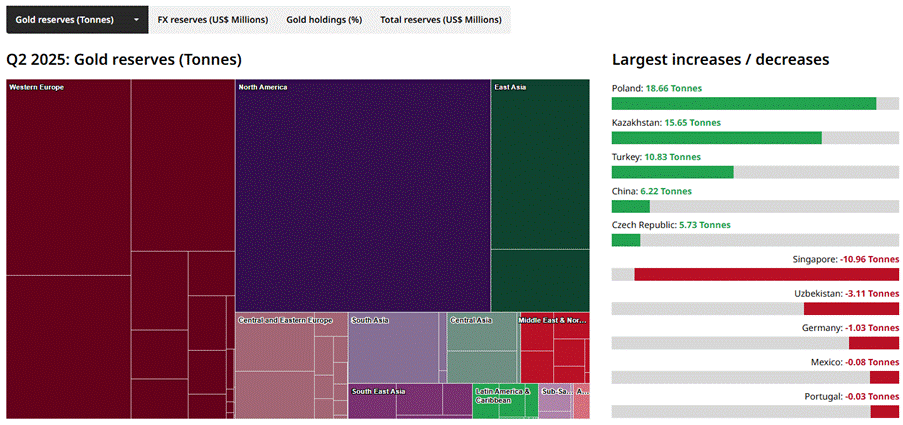

Gold: humanity’s “in case of emergency, break glass” asset, trusted for its scarcity, durability, and universal appeal—not because some government said so. From ancient coins to the Gold Standard to Bretton Woods, it anchored global stability, and even after Nixon slammed the gold window shut in 1971, central banks hoarded it like kids in a candy store. Fast-forward to 2025: tariff wars, geopolitical jitters, and doubts about the Fed’s so called “independence” have gold flying, with central banks—especially those wary of “Trumperialism”—stockpiling at any price. Sure, the U.S. officially holds 8,133 tonnes (78% of reserves), but gold wasn’t always the superstar it is today. Wars, crashes, and Roosevelt’s 1933 Gold Reserve Act made it a Federal Reserve monopoly, and Nixon’s fiat chaos only added to the drama. Central banks dumped gold for decades, then regretted it post-2008, sprinting back to the shiny stuff—proving that while trends fade, humanity’s love for unprintable glitter never dies.

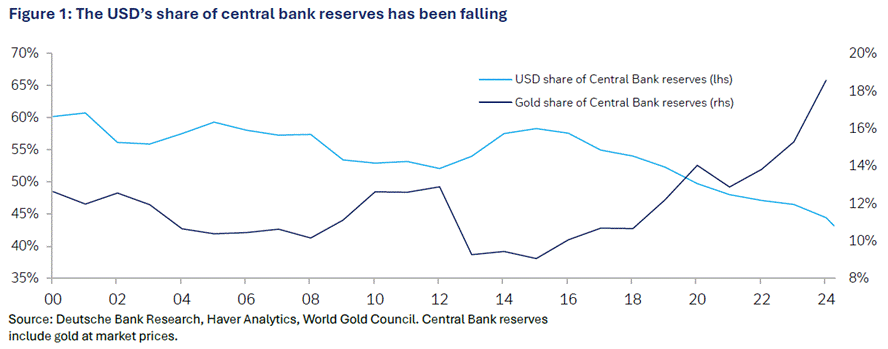

The gold bugs—arguably as brainwashed as their Keynesian opponents—have long seen gold as the ultimate anti-USD asset. Watching the dollar’s share of global reserves slide from 60% in 2000 to 43% in 2024, these same enthusiasts are now whispering about a potential U.S. strategic move into alternative reserves.

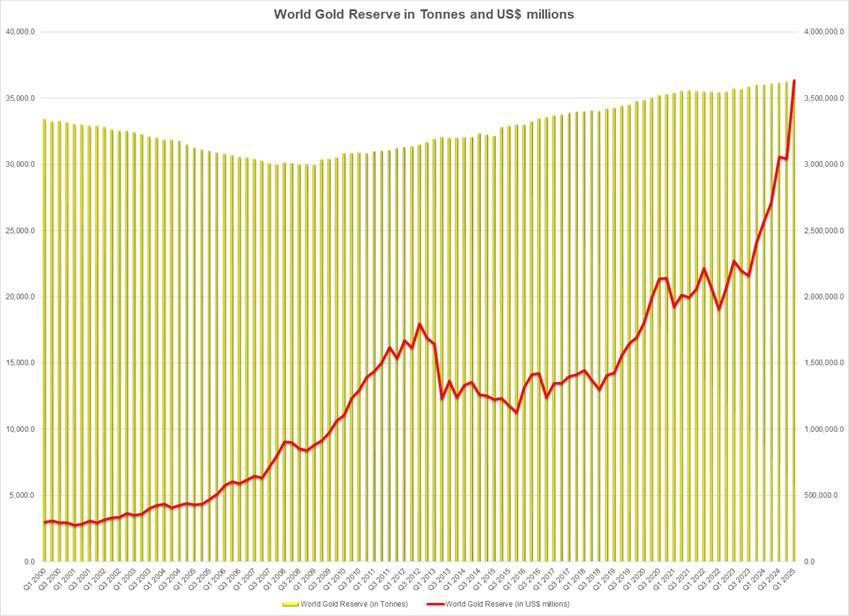

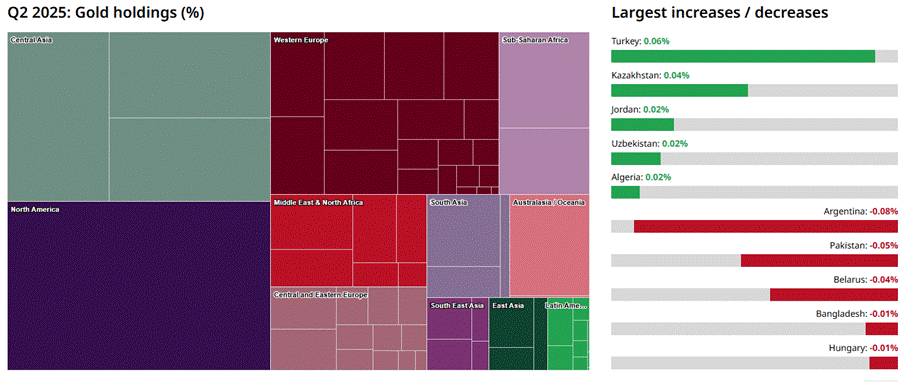

Ah, the eternal gold bug fantasy: central banks are supposedly hoarding gold and ditching USD like it is going out of style. The inconvenient truth? Most of the “increase” is just the dollar value of gold skyrocketing—thanks to a 1300% price surge since 1999—rather than actual ounces piling up in vaults. Sure, headlines trumpet that central banks now “hold more gold than U.S. Treasuries,” but scratch the surface and it’s mostly accounting wizardry and valuation effects, not a mass exodus from dollar assets, especially in the western world. Some euro exposure has been trimmed, war jitters and ‘Tariff Man’ ‘s sanctions aside, but let’s not pretend the world is suddenly abandoning Treasuries wholesale. The GOLD ONLY narrative is seductive for headline writers and conspiracy-minded investors, but when you count ounces instead of dollar signs, not much has really changed. Traditionally, central bank reserves have been all about gold and perceived “safe-haven” fiat currencies—boring, reliable, and liquid.

https://www.gold.org/goldhub/data/gold-demand-by-country

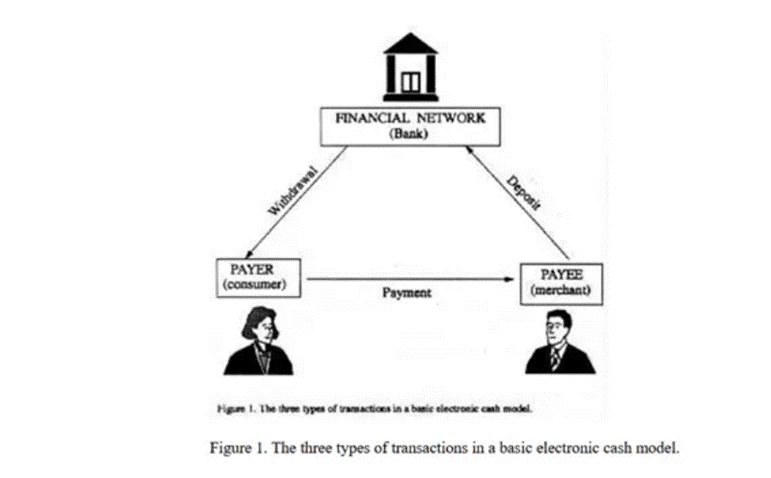

Officially born in 2008 from the ashes of the financial crisis, Bitcoin was supposed to be the hero rescuing money from the clutches of central banks. Its mysterious creator, Satoshi Nakamoto—whose name could be loosely interpreted as “central origin”—sounds more like a cover for some Alphabet-branded intelligence operation than a benevolent digital Robin Hood. Fast-forward, and Bitcoin is now mostly worshipped by TikTok “experts” who think decentralization means posting trading tips with cat filters and nepotist plutocrats looking to enrich themselves by creating a digital gulag. The grand rebellion against bailouts has morphed into a supposedly “Digital Gold,” a speculative playground run by the very institutions it claimed to overthrow. From buying two pizzas for 10,000 BTC to legal tender in El Salvador—and even a U.S. “strategic reserve”—the irony is delicious. Bitcoin doesn’t overthrow the system; it props up the illusion of freedom while quietly funneling capital into companies controlled by the nepotistic Washington plutocracy. In short, it’s a shiny Trojan horse that turned revolution into just another Wall Street subscription plan and could just have its origin in the mint that the NSA created much earlier.

https://groups.csail.mit.edu/mac/classes/6.805/articles/money/nsamint/nsamint.htm

Some have turned Bitcoin into a full-blown religion, promising to make YOLO investors rich—preferably before they bother learning about the four quadrants of Harry Browne’s Permanent Portfolio and how they perfectly map to the business cycle. These preachers insist Bitcoin is scarce, liquid, and “risk-free”—basically a rollercoaster you can hold in your wallet. From its dark-web Silk Road debut to the MT Gox meltdown, Bitcoin has weathered fraud, regulatory crackdowns, and multiple “crypto winters” to earn the self-proclaimed title of “Digital Gold.” The realioty is that today, it sports an approximative $2.3 trillion market cap—cute, if you compare it to all the gold ever mined, valued at around $27.3 trillion, or the U.S. stock market at around $67.3 trillion, or global government debt at around $99.2 trillion.

For a little visual fun: all the gold ever mined would fit in a cube just 22 meters (72 feet) on each side. So yes, Bitcoin may already feel big—but in the grand scheme of actual wealth, it’s still looks like Nemo in the ocean of finance.

https://www.gold.org/goldhub/data/how-much-gold

Gold’s recent sprint isn’t just about glitter—it’s a hedge for countries tired of playing vassal to the U.S. empire, whose bankers have been waging “democracy wars” for decades while quietly grabbing natural resources. For skeptics in the West, the U.S. Treasury’s latest $20 billion bailout of Argentina should be a wake-up call: Donald Copperfield’s “Make America Great Again” seems more like “Print Dollars for Everyone Else.” The Treasury promised “exceptional measures” to stabilize markets (translation: panic politely) and even bought Argentine pesos—because nothing says geopolitical finesse like bailing out a bankrupt foreign currency with your own printing press. So much for “America First”; apparently it’s now “Argentina First, courtesy of Uncle Sam.”

The “Seesawer-in-Chief” of Buenos Aires may have campaigned on “Making Argentina Great Again,” even pioneering with a Doge-meme economy — something arguably more credible than what’s brewing in the Washington swamp. But much like Donald Copperfield, he seems to have caught the same globalist flu, dutifully playing his role in the grand puppet show of empire, where every leader ends up dancing to the same hidden orchestra to ‘Sata-Nyahou’ who is dreaming about a world ruled by ‘Pax Judaica’. .

Since gold typically rises when the dollar falls, it’s no surprise that the USD’s share of central bank reserves has slid to around 43% in the first half of 2025. Meanwhile, key antagonists to the U.S., like China (6.8% of reserves in gold) and Russia (37.1%), have been ramping up their gold hoards. Russia, for example, bought 274 tonnes in 2018, funding the spree largely by selling off its U.S. Treasuries. Until 2022, when the Bank of Russia paused its purchases, it was one of the world’s most aggressive gold-accumulating central banks.

https://www.gold.org/goldhub/data/gold-reserves-by-country#from-login=1

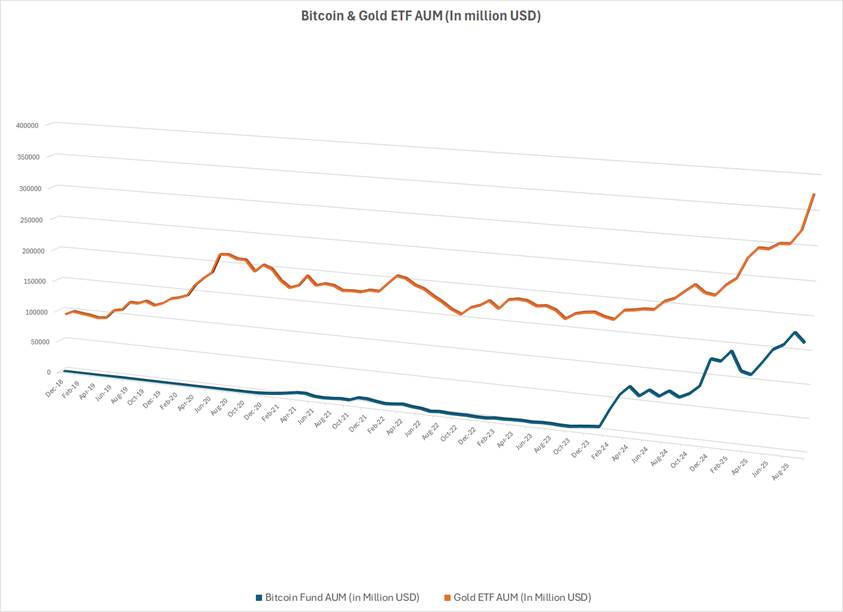

The de-dollarization narrative has also given the ‘Crypto Fadas’ of this crazy world a boost, as both retail and institutional investors hunt for a digital “liquid and decentralized” escape from cash and Treasuries. A weaker USD, for instance, drove record spot inflows into gold and Bitcoin ETFs, pushing total net flows to $5 bn and $4.7 bn in June alone. Cryptocurrencies have broadly rallied since Donald Copperfield’s election, fueled largely by bets that the U.S. administration will lean toward broader crypto adoption.

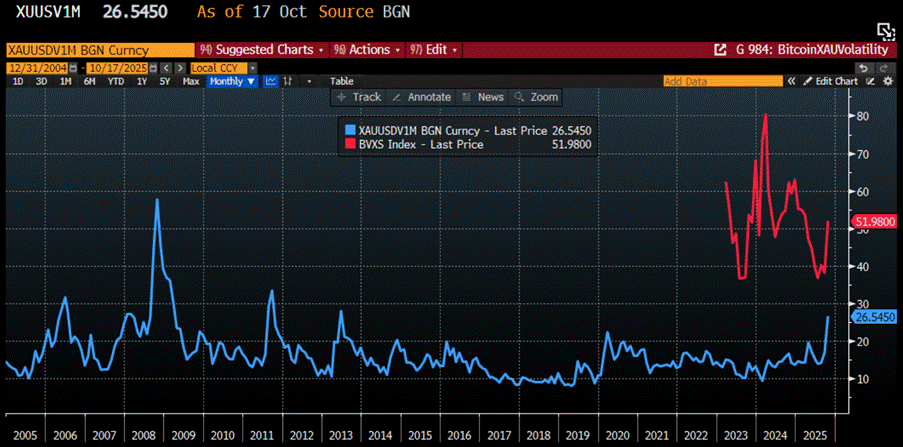

Both gold and Bitcoin can give you whiplash with their wild price swings, but only one actually keeps your portfolio from going full rollercoaster. Bitcoin jumps around based on tweets, memes, and regulatory whispers, turning a calm mix of stocks and bonds into a nail-biting ride. Gold, on the other hand, has been surviving crises, wars, and bankers’ antics for centuries—basically the seasoned grandparent of safe assets. Scarce, universally recognized, and free of counterparty drama, gold is the true antifragile hero: it calms your portfolio when chaos hits, while Bitcoin… well, it’s still auditioning for the role of “digital drama queen.”

Gold 1-Month Volatility (blue line); Bitcoin 1-Month Volatility (red line).

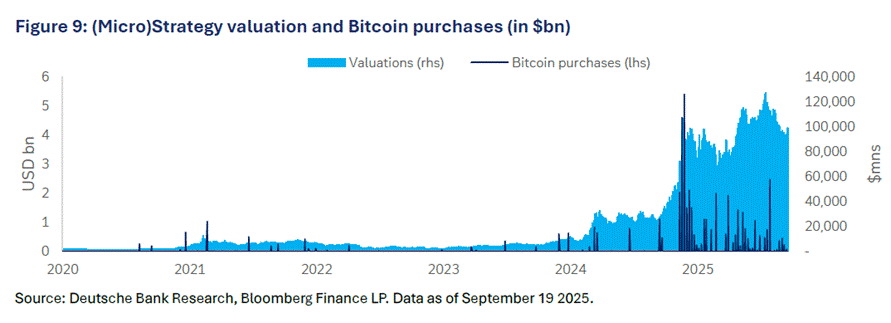

Bitcoin has often been dubbed “Digital Gold”—a label it arguably doesn’t deserve—because, unlike gold, it has not proven that it offers scarcity and durability, supposedly shielding against market chaos. Corporates, however, have jumped on the Bitcoin bandwagon faster than most central banks, from the usual suspects like Tesla, Strategy (formerly MicroStrategy), Square, and Stone Ridge, to more unexpected players like U.S. meat and seafood company Beck & Bulow, Japanese hotel service Metaplanet, and consumer brand DDC Enterprise operating in China and the U.S. That said, most of these companies aren’t exactly hoarding Bitcoin out of principled defiance of fiat—they’re mostly chasing bigger market caps or trying to squeeze extra returns from business models which are more fragile than a cup of porcelaine in the middle of a battle field.

On top of that, Bitcoin, tokenization and Blockchains have become the shiny toys of the Washington plutocracy, turning nepotism into a full-fledged governing philosophy and proudly marching toward its digital gulag. So, naturally, the next chapter of “freedom” would be penned in blockchain code. Enter Token 49 in the “Lion City” of Singapore, where young Zach Witkoff—dutiful heir to U.S. special envoy Steve Witkoff—teamed up with Donald Copperfield Jr. to unveil their grand vision: tokenizing the 47 family’s sprawling real estate empire. Because nothing says cutting-edge liberty like turning dynastic property into tradable digital playthings.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/bitcoin-the-gold-of-digital-fools

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.