Technicals Are Looking Up Again

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 10,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

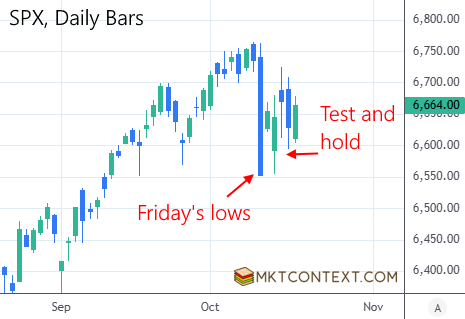

After last Friday’s shock selloff, markets briefly re-tested the lows and rebounded this week. Even with the bank fraud, SPX still remained supported above the 50-day moving average.

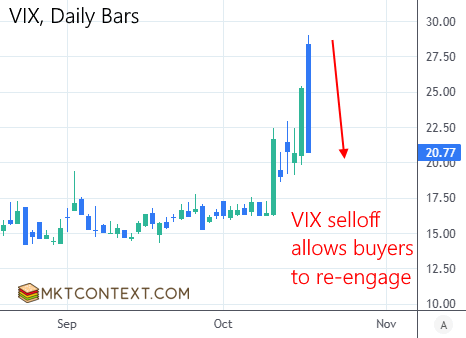

The VIX sold off heavily which invites volatility-control buyers to step back into the market. These buyers employ leverage based on the prevailing level of volatility in the market. Recall we wrote last week that instances where VIX spikes more than 30% in a day are usually followed by a quick fall.

The SPX rebound shows how little conviction underpinned the prior selloff. This is characteristic of a market that remains flush with money supply. As soon as the tariff shock was resolved (with Trump & Co. walking it back) demand for risky assets came roaring back.

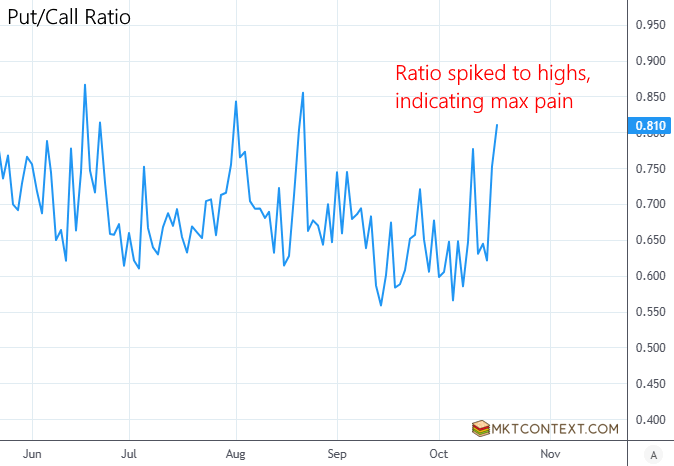

From a technical perspective, the Put/Call Ratio (our favorite bottoming indicator) reached peak levels, indicating capitulatory behavior. When people scramble for downside hedges, including put contracts, it spikes the P/C ratio and often signals the market bottom.

Similarly, market breadth has deteriorated sharply, indicating oversold conditions. It did not make sense to us that an isolated case involving a few small banks would drag down the rest of the SPX.

At the end of the day, we remain in a supportive macro environment with accelerating economic growth, the Fed cutting interest rates, easing trade tensions, and AI exuberance. Our research suggests that positioning is above average but not stretched yet, meaning there is still some room for buyers to join the rally.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!