Gold’s Ignored Message to the Fed

When Gold Speaks Lately, the Fed Falls Silent

Authored by GoldFix

The Fed is ignoring Gold as a signal for problems now as it is focused on suppressing signals in Bond volatility and stock prices signalling their inability to unload a bubble-balance sheet of securities it has held since Covid started, and as far back as the 2009 GFC. Steven Blitz does the math on this and we break it down.

1. Setting the Stage

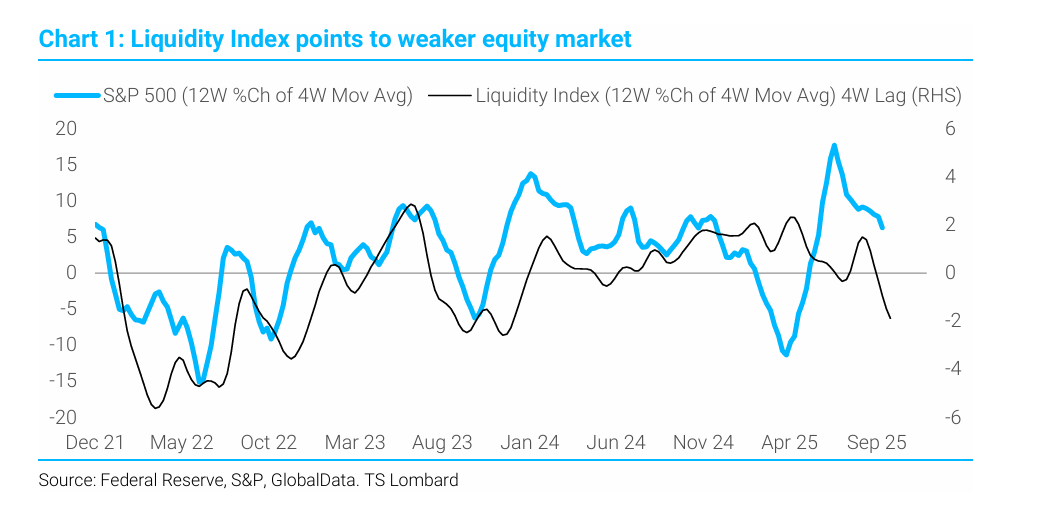

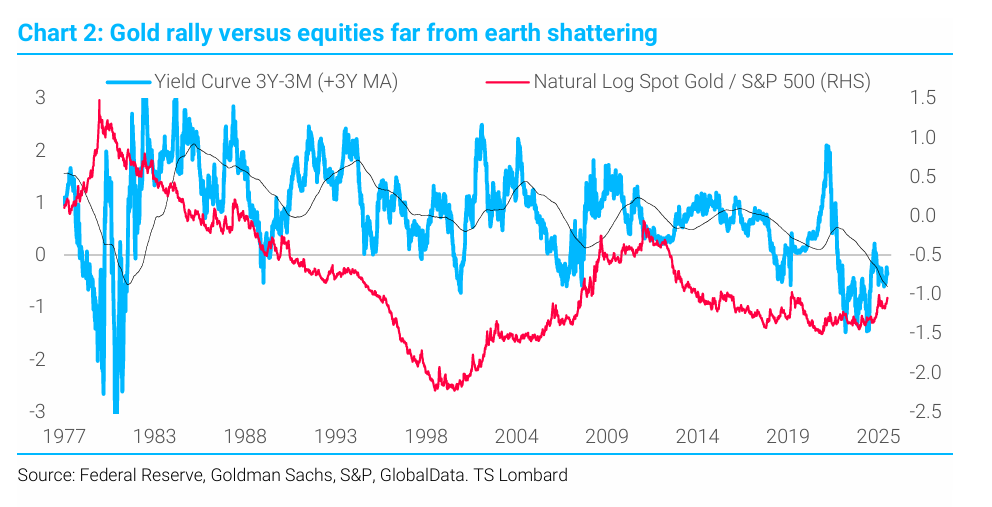

Market liquidity is retreating, and equities are feeling it. Gold has reached record nominal highs, yet when measured against U.S. equities it remains far from extreme valuations. Its rise instead signals that markets expect a steeper short-end yield curve while the Federal Reserve continues to dampen natural price discovery.

When scaled to the S&P 500, gold’s current rally barely registers by historical standards. Yet its direction matters.

- Steven Blitz, TS Lombard

Reporter: “Greenspan saw gold as an inflation gauge. How do you read today’s rally?”

— VBL’s Ghost (@Sorenthek) October 17, 2025

Powell: “No comment on any particular asset price — including that one.”

(Likely he’s too busy distorting the yield curve killing QT) pic.twitter.com/MRjOy4MkZr

Analyst Steven Blitz, Managing Director for Global Macro & Strategy at TS Lombard, argues that the present cycle still sits in “misdemeanor territory.” U.S. data show uneven strength: tariff-related spending masks softening employment, and inflation remains subdued. The October Fed Beige Book turned negative (–1 from +4 in August), and liquidity contraction warns of further equity weakness. Quantitative Tightening may end soon—perhaps over dissent from Bowman, Waller, or Miran—but only as a tactical reprieve. Beyond year-end, the misery index points higher, implying equities may cheapen relative to the real economy.

2. A Changing Mean

Complacency around mean reversion misses a key point: the mean itself has changed. Blitz writes that the U.S. economy is evolving toward a structure unlike prior cycles. Between here and that endpoint, sub-par real growth is most probable, kept out of recession by residual liquidity. Inflation risk matters over time but is likely overstated for the coming year.

“The mean has changed to something still in formation.”

3. Gold’s Message to the Fed

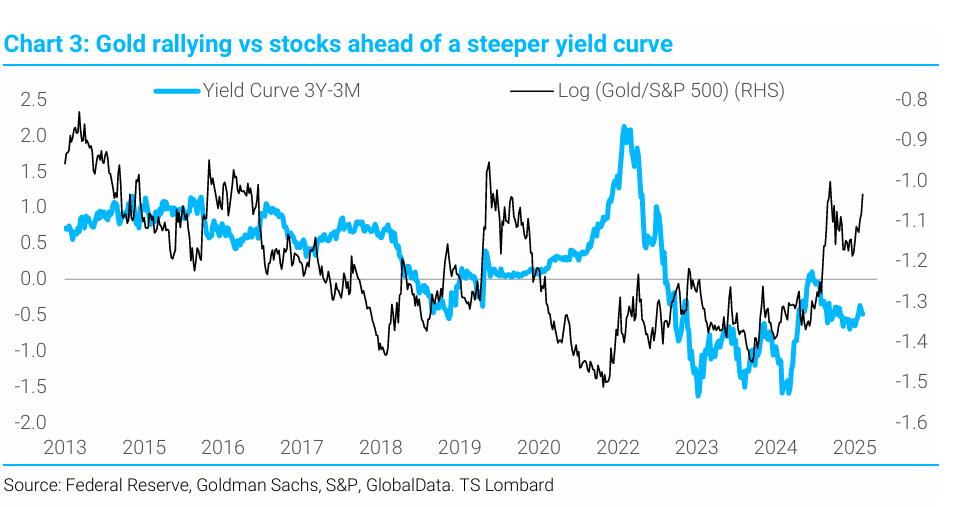

When scaled to the S&P 500, gold’s current rally barely registers by historical standards. Yet its direction matters. The metal’s rise reflects market disbelief in the Fed’s short-term yield curve signaling. Investors interpret the negative 3-month/3-year curve as a policy distortion rather than evidence of low inflation ahead.

“The gold market sees the negative yield curve at the short end as nonsensical guidance.”

Historically, gold-to-equity ratios correlate with the 3M–3Y curve. Flattening corresponded with disinflation from 1982 to 1998 and 2009 to the present. Today, however, policy rates are driven more by bank-reserve management than real-world funding conditions. In that sense, gold now measures what the curve once did: true market conviction about inflation and Fed credibility.

Gold’s message is straightforward: inflation will not allow the Fed to achieve its stated path. In earlier cycles the curve would already have turned positive. Both the metal’s ascent and the subtle steepening at the short end reveal that policy lags reality. The balance sheet suppresses yields, but gold cannot be suppressed—it front-runs the curve

Continues here.