China Calls Gold Bluff, US Pushes Back

Introduction: Rules of a Managed Market

Authored by GoldFix

“Gold can go up, but not too fast.”

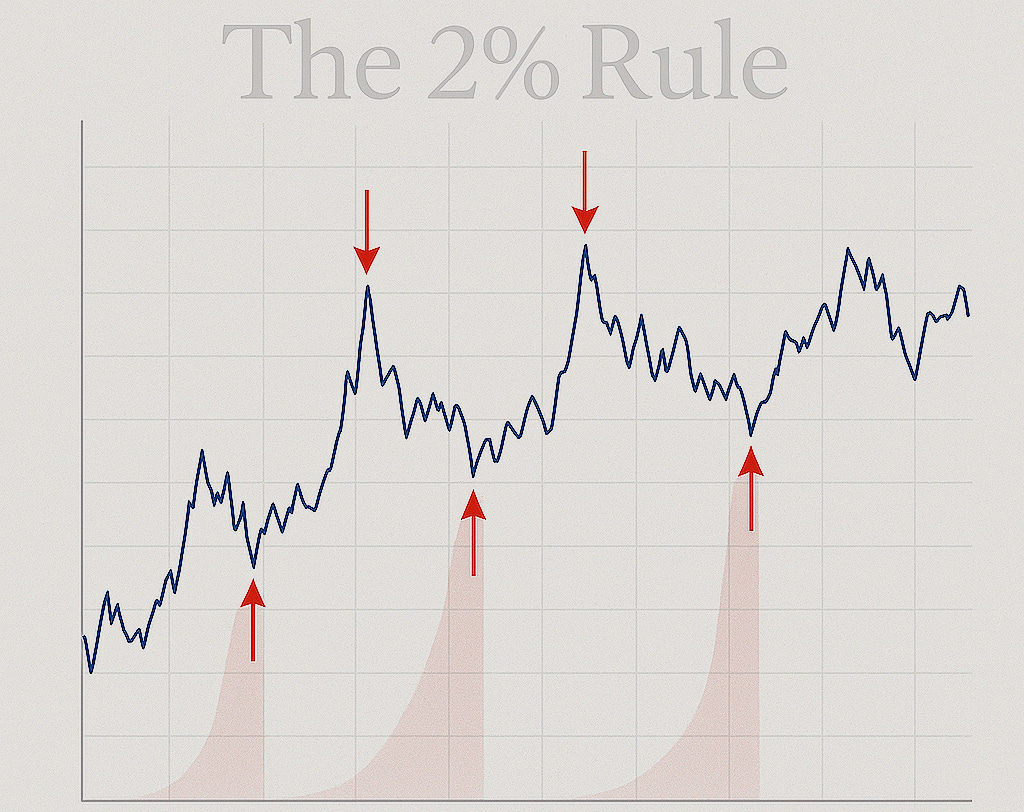

The first is the speed rule. Historically, whenever gold climbed more than twenty dollars in a day, the rally ended almost immediately. As the market matured and volatility increased, that evolved into a two-percent rule: any daily rise above two percent typically led to a decline of two to four percent within the following two weeks.

Narrative Control and the Fear of Headlines

The second rule concerns narrative, not price. Gold must never receive favorable sustained headlines. A rising gold price draws public attention to the dollar’s weakness. A quiet gold market, even at higher levels, preserves faith in the currency regime.

When such messaging reaches both institutional research and public conversation, it signals a loss of informational control. The United States now faces the same problem it confronted in the late 1960s: how to defend the appearance of stability when the market begins to doubt it.

China vs. US in Gold Stalemate. pic.twitter.com/tDbbW27ui8

— VBL’s Ghost (@Sorenthek) October 21, 2025

>

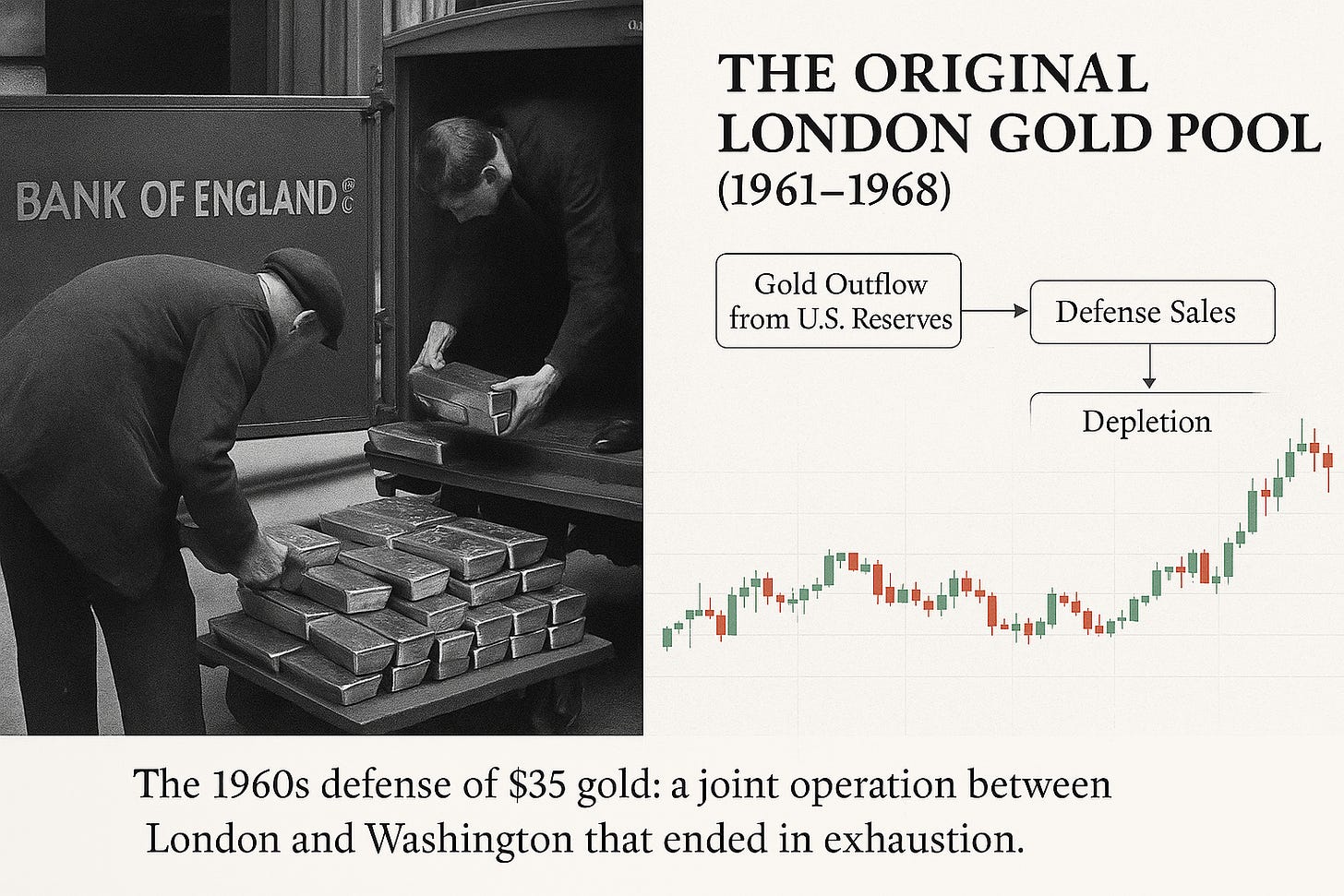

Historical Parallel: The London Gold Pool’s Final Stand

To understand the present, recall the London Gold Pool of 1961–1968.

Washington and London, joined by eight allies, sold physical gold into the market to keep the price fixed at $35 per ounce. For years, it worked…until confidence began to crack.

“They were selling gold to defend a price that no longer existed.”

By March 1968, the defense collapsed. The London market closed, the two-tier system emerged1, and the illusion of control ended. Within three years, convertibility was gone, and the gold standard with it.

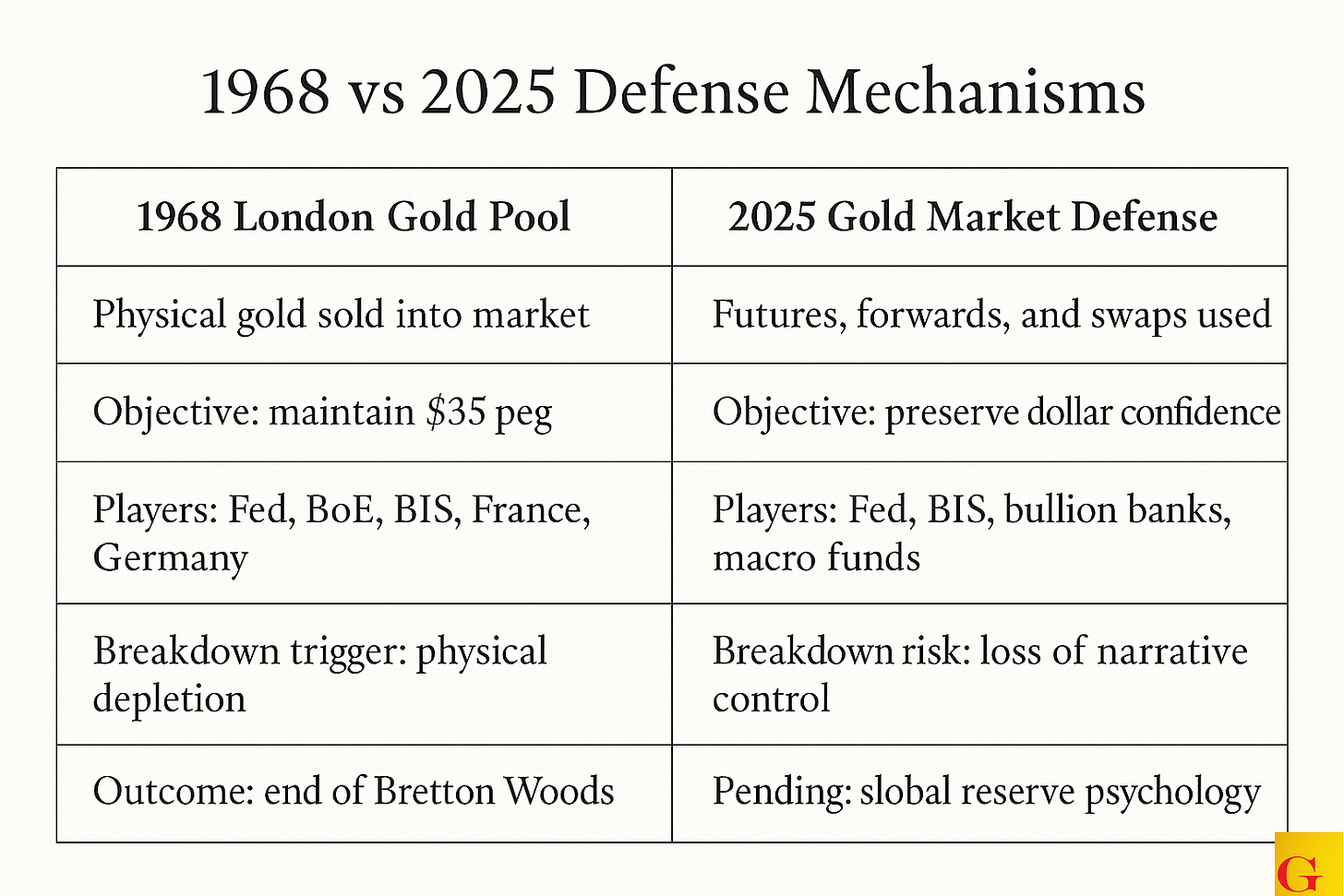

Physical Defense in Futures Form

Today’s structure looks different but feels the same.

Gold trades near $4,200, and each attempt to extend the rally is met with mechanical selling. Open interest remains flat, implying that as prices rise, large funds exit and bullion banks cover shorts—behavior consistent with official management rather than free price discovery.

Must Read: China is Going After The BiS Now

China is moving to host foreign central banks’ gold. This challenges London’s dominance and strengthens Beijing’s push to reduce reliance on the dollar, while cementing its ability to project global pricing power. Bloomberg reports the People’s Bank of China, through the Shanghai Gold Exchange International, is courting nations to buy and store bullion in China. Spot gold hit a record thirty-seven eighty-four on that news. Read full story

Repeated intraday reversals—up one day, slammed the next—create the appearance of coordination. It resembles a “hockey fight” in which all other players stop playing and wait for the other to finish the fight

The macro-discretionary funds, taking profits and stepping aside selling into Bullion banks covering shorts for losses likely. The combatants are official actors, likely including the Bank for International Settlements, executing what we call “cap and trade”: cap the market, let it sort things out in a range, then see how it reacts.

These function like margin raises, circuit breakers to slow the emotion and momentum. They historically work to cool bullish play. But seemingly not this time… at least not yet. Gold’s price fluctuations are on some level physical manifestations of two nations trying to out-print each other in a currency war