Dear FT: The LBMA is Dead. Let it Die

Authored by GoldFix

Intro: Yesterday the FT did a piece on the LBMA’s idea to create a futures exchange for Gold trading. That was broken down here in FT: LBMA Wants To Start a Futures Exchange. What follows is an analysis of the potential for such a venture.

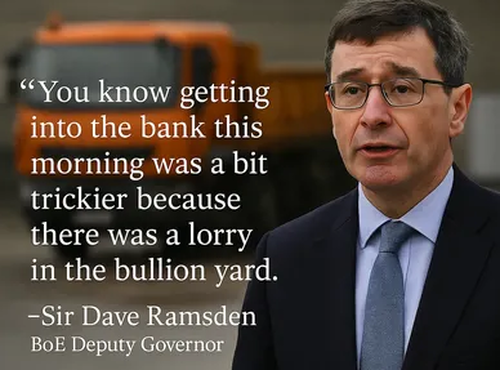

The London Bullion Market Association’s consideration of launching a futures contract reflects a strategic effort to restore relevance after years of declining influence in global gold pricing. Once the undisputed center of physical bullion trade, London’s role has been eroded by the decentralization of both supply and settlement.

BRICS Central Banks Cut LBMA Out

Central Banks Shift to Local Mines

This type of supply chain action will put the LBMA out of business or at least cripple Western access to physical gold going forward. We will have contextual implications for LBMA, The West, and how this is part of a much bigger strategy to secure all resource supply chains in a global mineral war. What the Brics are doing in Gold, they are doing in everything. Gold is the tip of the economic spear out of BRICS nations.

This shift has left the LBMA with supply infrastructure but diminishing transactional demand. Its earlier attempt to explore tokenized or blockchain-based gold represented a similar bid to reassert control. However, tokenized products resemble the old “pooled account” model, which has lost credibility amid recurring doubts over unallocated holdings and the timing of physical delivery.

A new futures exchange might appear a logical evolution, yet it underscores a deeper structural issue. The gold market’s future is multipolar. Vaulting capacity and clearing are spreading across Asia, the Middle East, and North America. Even Switzerland has examined shifting parts of its metals operations to the U.S.

Silver May Have Bottomed in Short Term. pic.twitter.com/KkA2QpjxRy

— VBL’s Ghost (@Sorenthek) October 23, 2025

Continues here.