Repo Market's Warning Light Is Flickering

After several years of calm, stress is again building in the hidden plumbing of the US financial system — the short-term funding markets that move trillions of dollars in overnight cash and securities each day. These markets, particularly the repurchase (“repo”) market and its benchmark Secured Overnight Financing Rate (SOFR), are critical to the smooth functioning of the financial system. When they seize up, the consequences ripple outward into Treasury trading, bank liquidity management, and even the implementation of monetary policy.

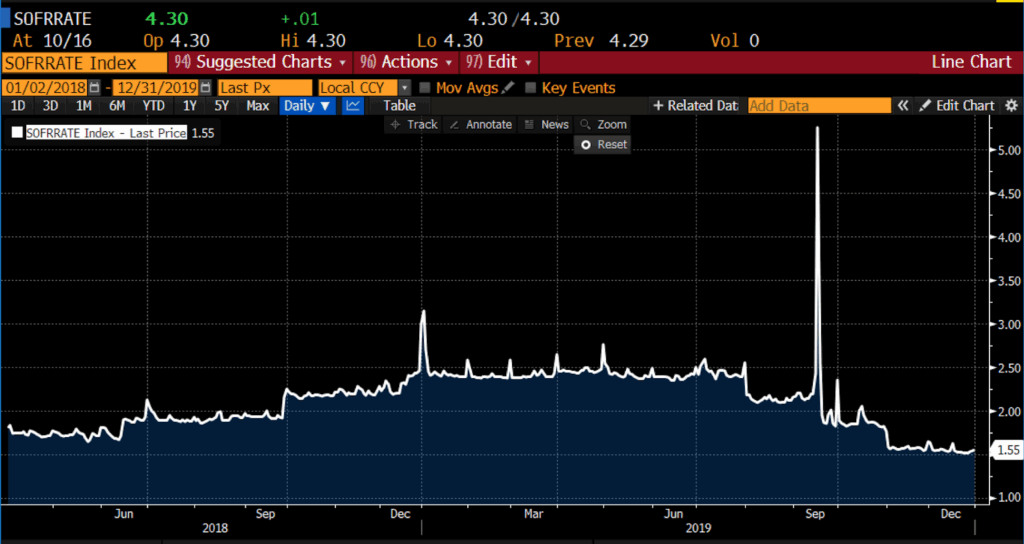

The last time the repo market buckled, in September 2019, it happened suddenly and dramatically: overnight borrowing rates spiked from around two percent to more than eight percent, exposing how fragile the post-crisis liquidity framework had become. When corporate tax payments and the settlement of a large Treasury auction drained roughly $120 billion in cash from the system in a single day, major banks — constrained by liquidity coverage rules and post-Basel capital surcharges — hoarded their reserves. The result was a stunning jump in repo rates, a one-day surge in SOFR to 5.25 percent, and a near-immediate intervention by the New York Fed, which pumped up to $100 billion per day into the market to restore order. In other words, a sudden cash drain caused the usual lenders in overnight markets to step back all at once, leaving borrowers scrambling for funds and driving rates sharply higher — a classic liquidity squeeze rather than a credit panic. The episode taught regulators a humbling lesson: in a world of regulatory liquidity floors, “ample reserves” can prove illusory when those reserves become unevenly distributed.

Secured Overnight Financing Rate, 2018 – 2020

(Source: Bloomberg Finance, LP)

A simple chart of daily SOFR from 2018 through 2020 captures the point clearly. The September 2019 spike (see above) appears as a sharp vertical wall — an almost instantaneous loss of equilibrium — while the more recent uptick of late 2025 looks tame but unmistakably directional. In both cases, seemingly minor reserve drains exposed just how nonlinear the system becomes near its lower comfort limit.

Fast-forward six years, and some familiar symptoms are re-emerging. Signs of renewed short-term funding stress have begun to surface across US money markets. Nothing approaching the 2019 spike has yet occurred, but the tremors are unmistakable. In mid-September 2025, the Federal Reserve’s Standing Repo Facility (SRF) was tapped for roughly $18.5 billion in a single day — its largest draw since inception — suggesting that banks were again leaning on official backstops for liquidity. Around the same time, SOFR rose to about 4.42 percent, and related secured funding benchmarks such as the Tri-Party General Collateral Rate (TGCR) climbed in tandem. By October 16, SOFR remained elevated near 4.3 percent, underscoring lingering tension despite some easing.

Recent news of souring debt on bank balance sheets, along with the sudden failures of both First Brands Group and Tricolor Holdings, are likely key drivers of the abrupt rise in risk aversion across bespoke lending markets. The tightness may, additionally, be attributable to familiar quarter-end forces that periodically drain liquidity: tax deadlines, Treasury settlement flows, and a surge in short-term debt issuance that competes for cash.

Analysts at the Dallas Fed observed that...(READ THIS WHOLE ARTICLE 100% FREE HERE).