Fed and Earnings. What to watch.

Subscribe on our website www.gmgresearch.com

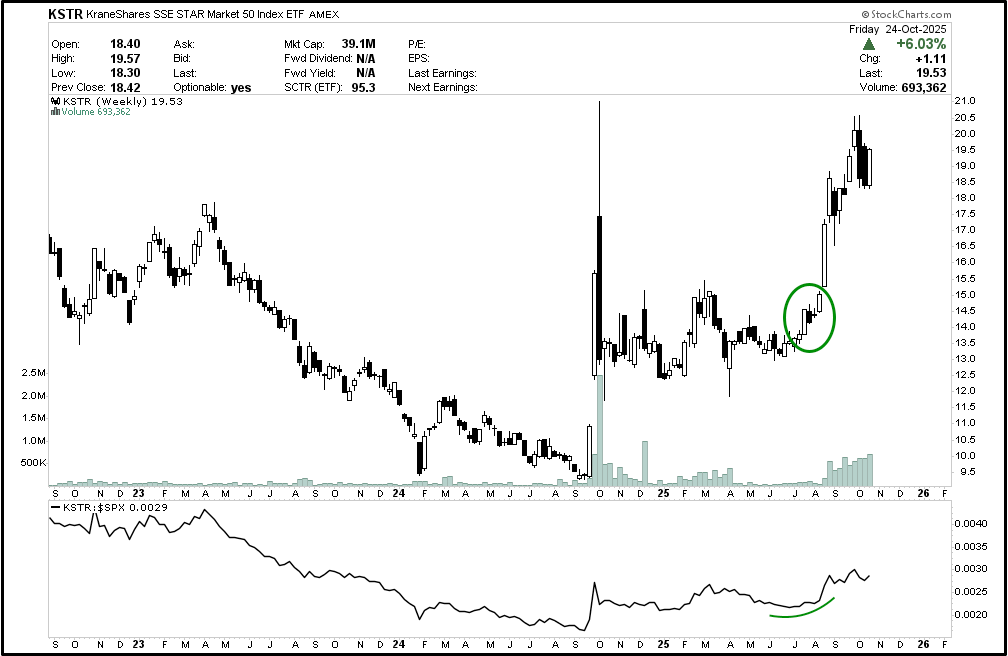

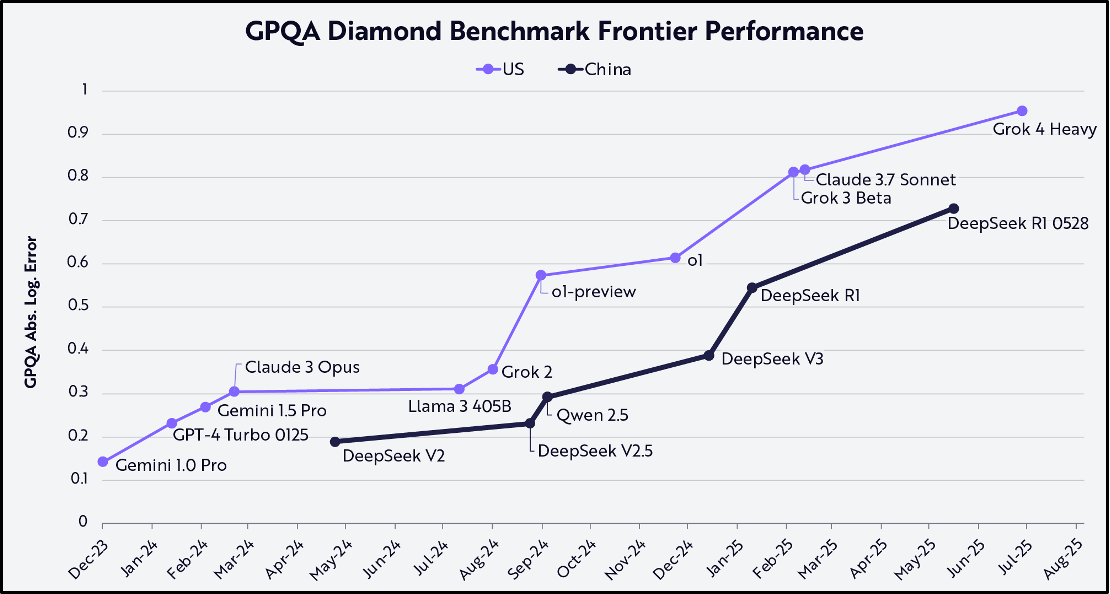

Markets rallied overnight on the hope of a US/China trade deal.

SOFR eased, and the Fed’s Standing Repo Facility saw zero demand, signaling that fear in the banking system has largely subsided.

This is a massive week for earnings — Microsoft, Meta, and Alphabet all report just two hours after the Fed’s rate decision.

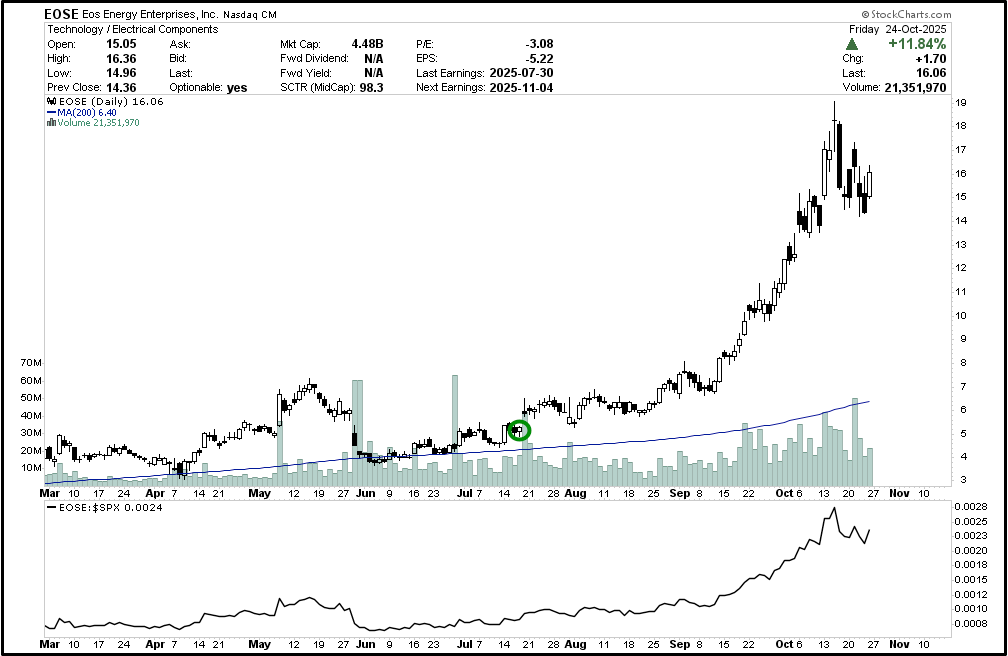

Do NOT chase the hype you see on social media. You are too late to names like IREN, APLD, ASTS, USAR, MP. We wrote about most of these in 2024 (+200% ago).

Gold is topping and will rotate into Bitcoin.

October is the best seasonal window for most sectors