AI Bubble Is Not Stopping

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 10,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

As the AI bubble keeps accelerating, more and more analysts are chiming in, calling the top:

Investors often compare the AI bubble to the dot-com bubble and assume it will collapse the same way. But the two differ in important ways. When internet companies in the ‘90s installed massive amounts of fiber optic cables in anticipation of soaring traffic, much of it was never used. Hence it became known as “dark fiber” because it was never “lit”, even as demand was rising. By the time the bubble burst in 2000 and demand collapsed, supposedly only about 5% to 10% of fiber was ever “lit”.

In contrast, current evidence shows that data center capacity is extremely tight, with utilization rates near highs and new capacity quickly absorbed as soon as it is built. Third-party data centers are constantly “sold out”. The 3 big cloud providers (Microsoft, Amazon, Google) repeatedly state they need more capacity to catch up to demand.

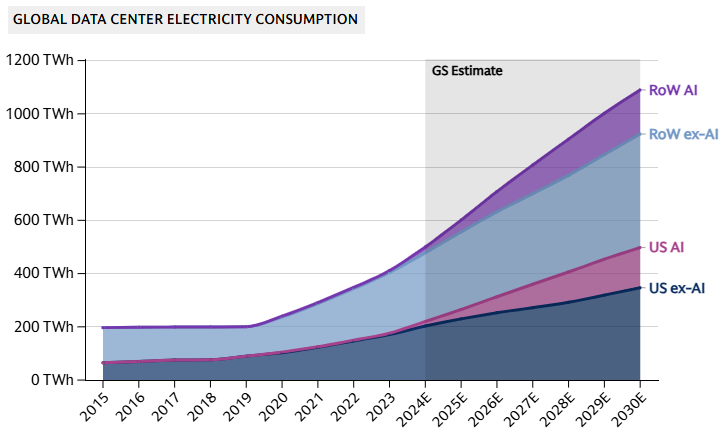

We can also see electricity consumption is growing exponentially — something that wouldn’t happen unless the data centers were turned on and being used at max capacity.

The AI bubble is not over yet because the true extent of AI capabilities has not yet been recognized. The endgame is AI-generated video, robotics, and mass automation; these things are nowhere near. We also theorized that cloud providers will enter an arms race of capex spending, with lots of room to borrow debt.

We do admit the circular money flows and off-balance-sheet financing arrangements (GPU-collateralized debt, sort of like asset-backed securities that harken back to the 2008 housing bubble) are a bit concerning. But they are a feature, not a bug. It sets up the preconditions necessary for the bubble to proliferate.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!