Sikh And Destroy

The Decline of Disinterestedness

From “A Government of Laws” to “Who? Whom?”

In his 2013 essay The Decline of Disinterestedness, Steve Sailer recalled how, in 1991, federal agents deported a housekeeper employed illegally by the Bush family—while George H.W. Bush was still President. “John Adams, who called for ‘a government of laws, not of men,’ would have been proud,” Sailer wrote. Back then, even the president’s son wasn’t exempt from the law.

"Today", he observed, such impartial enforcement—what older Americans once called disinterestedness—is treated as a “tiresome WASP hang-up.” Civic virtue has given way to the logic of Who? Whom?: which tribe benefits, which tribe pays.

Dhillon’s Statement and the New Hierarchy of Concern

That decline was on full display last week in a statement by Assistant Attorney General Harmeet Dhillon. Dhillon condemned California’s decision to issue commercial driver’s licenses to illegal immigrants—after two deadly crashes involving unqualified drivers—then pivoted to warn against “attacks” on Sikh and Indian-origin truckers.

Many of you have probably seen the news in the last few months of two illegal aliens causing horrific tragedies on American roadways while behind the wheel of large commercial trucks.

— AAGHarmeetDhillon (@AAGDhillon) October 27, 2025

These individuals obtained commercial driver’s licenses in California due to the State’s…

“Many of these law-abiding Sikhs and Indian-origin Americans are hard-working and patriotic,” she wrote, adding that the DOJ’s Civil Rights Division “will aggressively prosecute” any discrimination against them.

It was a familiar rhetorical pattern: lead with outrage over a policy failure, close with reassurance that your own in-group deserves protection. In the age of Who? Whom?, even appeals to law and order apparently must genuflect to ethnic solidarity.

“Principle Ends Where the Tribe Begins”

Several commenters on X noticed. Mystery Grove called it “totally inappropriate that theoretical discrimination against Sikhs is given more time in this than the real-world deaths.”

Shylock Holmes noted that “the only groups willing to make a principled argument against their group self-interest are North-West Europeans.”

Fugitive Caesar was blunter: “White American employees are getting laid off by Indian managers by the hundreds of thousands… can you please do your job and investigate racial discrimination against American workers?”

And Matt Forney argued that Indian hiring networks amount to “ethnic nepotism,” displacing Americans from both trucking and tech.

Harmeet, with all due respect, nobody is "attack[ing] law-abiding Sikhs and Indian-origin drivers" out of malice or blind prejudice.

— Matt Forney (@realmattforney) October 28, 2025

We criticize them because they are disproportionately unqualified for their positions, hired solely to undercut truckers on wages, and are… https://t.co/PLOU9WrLZW

Forney closed with a plea to the Assistant AG:

I ask you to put Americans first. And that means ALL Americans, including the ones who have been discriminated against by Indians or the corporations where they hold positions of power.

The Data Behind the Backlash

Those claims might sound exaggerated—until you look at the numbers.

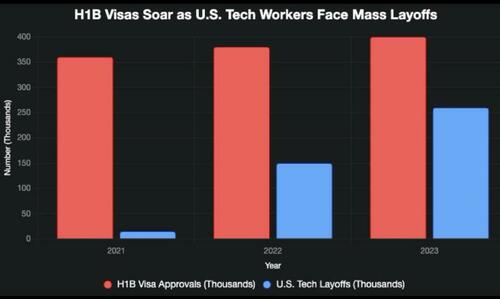

While U.S. tech layoffs have surged, H-1B approvals have continued to rise, replacing one workforce with another. The same dynamic appears in housing.

In New York, 32 percent of public-housing residents and 44 percent of rent-stabilized tenants were born outside the U.S.. As Anna Khachiyan’s thread illustrated, politicians such as Zohran Mamdani have redefined “affordability” as redistribution—away from the whiter neighborhoods and toward foreign-born constituencies.

https://t.co/Ho7K1jQuD5 pic.twitter.com/XkSQF8I9lZ

— Anna Khachiyan (@annakhachiyan) October 27, 2025

Zohran Mamdani would accelerate current trends already moving in that direction.

32% of NYC public housing is occupied by people born outside of the US.

— Geiger Capital (@Geiger_Capital) October 20, 2025

44% of rent stabilized units.

Almost half!

Some of this is nationalized citizens, but the point remains. American-born citizens are subsidizing the foreign-born to live here and drive up home/apt prices. pic.twitter.com/MCI6QhA6CX

The racial (re)distribution is even more tilted.

NYC public housing https://t.co/HtccrNmhek pic.twitter.com/A9zLx344m4

— Zarathustra (@zarathustra5150) October 20, 2025

From Disinterested Law to Patronage Politics

This is not disinterested governance; it’s a new form of patronage.

The old civic ethos—one law for everyone, regardless of family or faction—has been replaced by a patchwork of group exemptions and competing moral claims. Dhillon’s statement, well-intentioned as it was, reflected that change: every appeal to justice must now be balanced by a nod to one’s own tribe.

Sailer’s closing line from 2013 now reads as prophecy. What was once a “WASP hang-up” has become a relic of a vanished republic—a society that still believed in laws, not men.

A Word From Our Sponsor

One of my fellow contributors is offering a 75% off discount to his Substack. I'm not. In fact, if our November OpEx exits are as good as our October ones were, I'm probably going to raise my prices. Our first exit exits this week continued that trend:

Options

Put spread on Sofi Technologies (SOFI 2.60%↑). Entered at a net credit of $0.75, as part of a 3-leg combo on 10/21/2025; exited at a net debit of $0.15 on 10/28/2025. Profit: 80%.1

Four-leg combo on Advanced Micro Devices (AMD 0.32%↑). Entered at a net credit of $3.65 on 8/12/2025; exited the call spread at a net credit of $4 on 10/16/2025; exited the put spread at a net debit of $0.20 on 10/28/2025. Profit: 204%.2

Four-leg combo on Celestica (CLS -0.43%↓). Entered at a net credit of $2.75 on 8/25/2025; exited the call spread at a net credit of $8 on 10/24/2025; exited the put spread at a net debit of $0.25 on 10/27/2025. Profit: 382%.3

Four-leg combo on Cameco (CCJ 9.30%↑). Entered at a net credit of $1.05 on 8/19/2025; exited the call spread at a net credit of $4 and the put spread at a net debit of $0.20 on 10/28/2025. Profit: 462%.4

On premium collected; ROI on max risk = 34%

On premium collected; ROI on max risk = 117%

On premium collected; ROI on max risk = 140%

On premium collected; ROI on max risk = 120%

That was our third profitable exit in Celestica this year--and our highest profit on it yet.

If you want to see today's trades, you can sign up as a free subscriber below, and then take advantage of the free trial or whatever the feature is that let's you see below the paywall.

You can also subscribe to the Top Names feature on the Portfolio Armor iPhone app, before I raise the prices on that.