Silver Lease Rates Fall. But LBMA Elephant Remains

Silver Price & Lease Rate Fall From Peak, But Large Elephant Remains In The Room...

Submitted by GoldFix; Authored by Chris Marcus

Earlier this week Bloomberg reported on how the pressure in the silver market has eased. And while they didn’t specifically say this, the change in the price and the silver lease rate is the result of silver leaving the Comex and China, and presumably flowing to London and/or India.

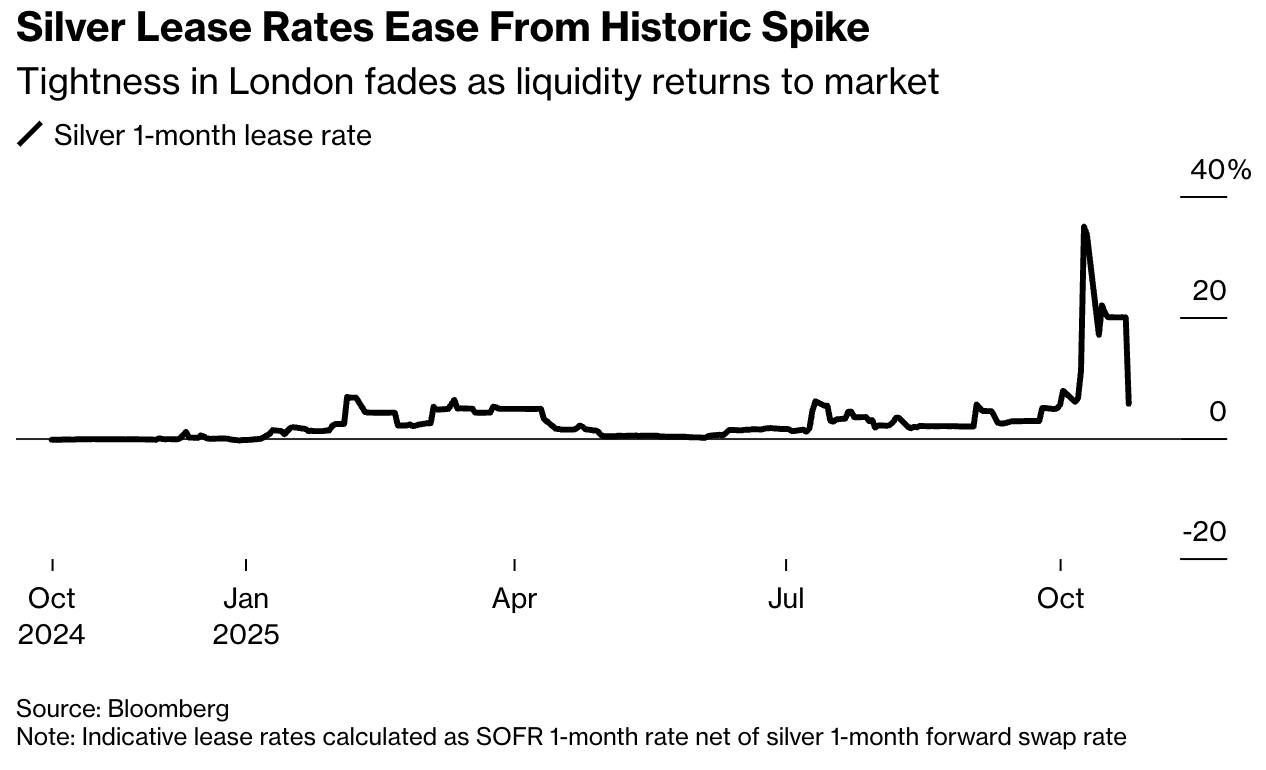

The cost of borrowing silver in London has retreated from a record high, a sign that greater liquidity has returned to the market and brought some relief from a squeeze earlier this month.

Silver lease rates – which represent the annualized cost of borrowing metal in the London market – fell to 5.6% on Monday after surging to an all-time peak of 34.9% on Oct. 9, data compiled by Bloomberg show.

I’ve been searching for any indication that silver has started to reach India and resolve their shortage, although it doesn’t appear that’s happened yet (and a Bloomberg article from a week and a half ago said that JP Morgan is telling clients that they’re not expecting any silver in India until November). But the Times of India confirms what I mentioned above about the silver shipments easing this current phase of the squeeze.

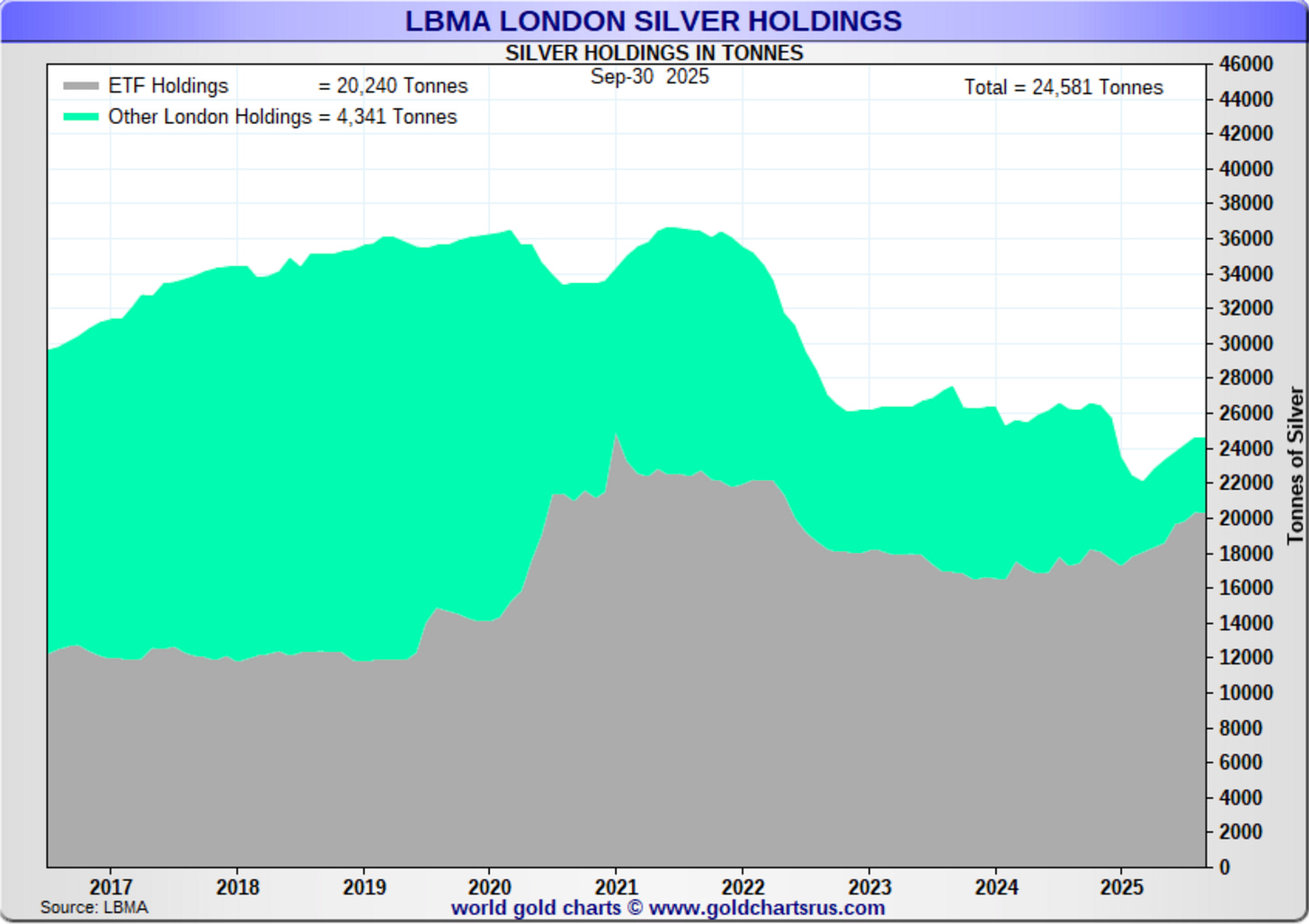

So that’s helped to resolve the London shortage, although what’s less clear is how permanent of a solution that actually is.

About 30 million ounces of silver have left the Comex vaults since the breakage in the market on October 9th. Although given that the average daily turnover at the LBMA is about 250 million ounces, and the free float is currently at 153 million ounces, is 30-40 million ounces going to resolve the situation, or just buy a little more time?

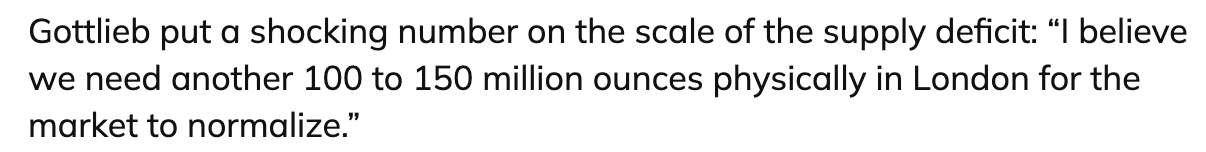

Former JP Morgan Precious Metals Managing Director Robert Gottlieb was on KITCO last week, and he said that he thinks 100-150 million ounces would be needed to normalize the silver market.

Reuters noted that 100-150 tons have come from China, which comes out to 3.2-4.8 million ounces, so that’s not exactly going to bridge the gap either.

Given how the lease rates have dropped back down, which is perhaps one of the best true indicators of how tight or fragile the London market is, it’s not surprising to see the price fall, especially given how gold was getting clobbered at the same time too.

Although for a better understanding of why it seems like the gold and silver prices will almost have to rise over the longer term, I think it would be worthwhile to watch this video about how the thinking regarding gold in Washington is likely changing as we speak.

Even despite the volatile sell-off over the past two weeks, silver is still above $48, while gold is back over $4,000. And especially on the silver side, until there’s some sort of more sustainable longer-term solution (which given the underlying dynamics is somewhat difficult to see happening), there’s a high probability that we haven’t seen the end of this yet.

Sincerely,

Chris Marcus