The $329 Billion Tailwind No One’s Talking About

The $329 Billion Tailwind No One’s Talking About

- Congress quietly passed the Invest America Act earlier this year.

- Every newborn receives $1,000 invested in the S&P 500.

- Families can contribute $5,000 annually, compounding tax-free until age 18.

While the media hunts for cracks in the rally, Congress quietly poured concrete under the market’s foundation…

After a shaky start to the year, U.S. stocks have roared back to life. Since the April low, the S&P 500 Index has surged 37%, lifting its year-to-date gain to 16.3%. October alone delivered eight new closing highs, bringing the 2025 total to 36. Momentum is strong, breadth is improving, and yet—financial media keeps playing the same tired tune.

Every time the market rallies, the naysayers get louder. Outlets like Bloomberg and CNBC scramble for reasons why stocks are about to crash. They treat new highs like warning signs, not milestones. So, they spotlight the negatives, hoping fear will drive clicks. But in doing so, they’re missing the real story: the catalysts that could push stocks even higher.

Take earnings. Heading into Q3 results, the consensus was cautious. Analysts expected growth to slow, and the media echoed that view. But Wall Street has a habit of underestimating upside. So far, earnings are up 9.2% year-over-year, well ahead of the 7.9% forecast. That’s not a slowdown. That’s acceleration.

And there’s another tailwind the media barely noticed. Earlier this year, Congress quietly passed a bipartisan bill with broad support from business leaders like Altimeter’s Brad Gerstner and Nvidia’s Jensen Huang. It’s called the Invest America Act. Starting next year, it opens up new investment accounts for more than 65 million Americans. If the numbers live up to their potential, this legislation could act like rocket fuel for the S&P 500.

But don’t take my word for it, let’s look at what the data’s telling us…

The Invest America Act is a deceptively simple piece of legislation with outsized implications. Starting January 1, 2026, every child born in the U.S. will be eligible for a government-seeded investment account—$1,000 deposited at birth, tax-exempt, and invested exclusively in low-cost S&P 500 index funds. These accounts are structured as trusts, professionally managed, and locked until age 18. The goal isn’t just financial—it’s behavioral. Give a child a stake in the market, and you give them a reason to care about growth, compounding, and ownership.

Parents, relatives, and employers can contribute up to $5,000 per year per child. That’s after-tax money, with no income phaseouts or itemized deductions required. Employers can add up to $2,500 annually without affecting taxable income. The accounts are simple by design: no stock-picking, no rebalancing, no trading. Just passive exposure to the broad market, with the compounding engine running quietly in the background.

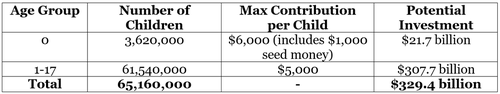

Let’s run the numbers. The average number of children born in the U.S. each year is just over 3.6 million. Multiply that by the $1,000 government seed, and you get $3.6 billion in new capital flowing into S&P 500 exchange trade funds (“ETFs”) annually. It’s a structural bid—small in any given year, but relentless over time. And that’s before a single private dollar is added.

Now let’s scale it. If every family maxed out the $5,000 annual contribution limit, and we assume a flat age distribution across 18 cohorts, that’s 65.1 million children eligible for accounts. Multiply that by $5,000, and you get a theoretical ceiling of $329.4 billion in annual investments.

That’s not a forecast, it’s a boundary condition. But even modest uptake would be meaningful. If families contribute $2,000 per year, that’s still $132 billion in sticky, long-duration capital.

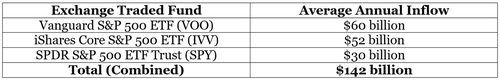

Let’s put that in perspective. From 2019-2024, the three largest S&P 500 ETFs accounted for roughly 20% of all passive fund investments. The following table lays out the average annual net inflows based on number from fund data provider ETF.com…

Based on those numbers, maximum contributions to Invest America accounts next year would more than double the average annual total that’s flowed into S&P 500 ETFs over the past five years. It would eclipse the record $237 billion from 2024—and the $210 billion invested so far this year.

The accounts are nonforfeitable, professionally managed, and restricted to S&P 500 ETFs. That means no style drift, no speculative allocation, and no behavioral leakage. The money is locked until age 18, except for qualified rollovers. Withdrawals are taxed at favorable rates if used for education, housing, or entrepreneurship. Otherwise, ordinary income rules apply. But the real value isn’t in the tax treatment, it’s in the habit formation.

For financial institutions and Registered Investment Advisors, this opens new terrain. Custodial onboarding, contribution matching, and financial literacy programming are all in play. So is the opportunity to build long-term relationships with families who now have a tangible reason to engage early. The accounts are simple, but the implications are profound: a new generation of investors, growing up with equity exposure from day one.

Bottom line: this isn’t just a savings plan. It’s a structural shift in how we think about opportunity, ownership, and the investing landscape. The Invest America Act turns compounding into policy, gives every child a front-row seat to the American growth story, and creates a steady tailwind for the S&P 500.

If you'd like to receive more commentary like this to your inbox daily or see how I'd invest for any type of market, click here.