Gold: LBMA Members Bullish in BRICS Back Yard

Pullback Inside a Larger Advance

Authored by GoldFix

A survey of 106 attendees projected prices near $4,980.30 by October 2026. LBMA respondents expect silver to reach $59.10 per ounce within a year and anticipate double digit gains for platinum and palladium.

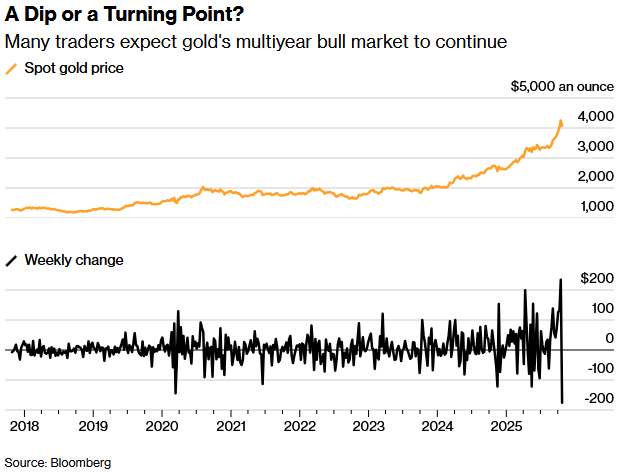

Gold’s sudden pullback has not erased confidence in its broader trajectory. Selling pressure arrived after a powerful surge in prices, yet demand signals remain firm across both institutional and retail channels. Forecasts from the sector continue to point toward higher prices as the market absorbs a rapid rise that left positioning stretched.

“Gold is the best investment,” a buyer in Bangkok told Bloomberg.

Dip Buying Surfaces Quickly

Gold has fallen from an all time high near $4,380 to around $3,900 to $4,100 in recent sessions. Technical unwinding occurred while demand for physical bars remained elevated. The metal is up about 50 percent year to date, supported by investors seeking protection from currency depreciation and large fiscal deficits. Pictures of queues at shops in Asia and the United States circulated widely as buyers rushed to secure bullion on the dip.

“We had a queue before opening with many more buyers than sellers,” a Singapore dealer said.

“Gold is the best investment,” a buyer in Bangkok told Bloomberg.

BRICS Central Banks Cut LBMA Out

This type of supply chain action will put the LBMA out of business or at least cripple Western access to physical gold going forward. We will have contextual implications for LBMA, The West, and how this is part of a much bigger strategy to secure all resource supply chains in a global mineral war. What the Brics are doing in Gold, they are doing in everything. Gold is the tip of the economic spear out of BRICS nations.

Central Banks Anchor the Strategic Bid

Central banks continue to play an important role. The Bank of Korea signaled interest in expanding its gold reserves for the first time in more than ten years. Purchases from monetary authorities across multiple regions remain a core driver of the two year rally. Commentary from the LBMA event reinforced that theme.

“The Bank of Korea plans to consider additional gold purchases from a medium to long term perspective,” an official said in Kyoto.

Market Needs Consolidation

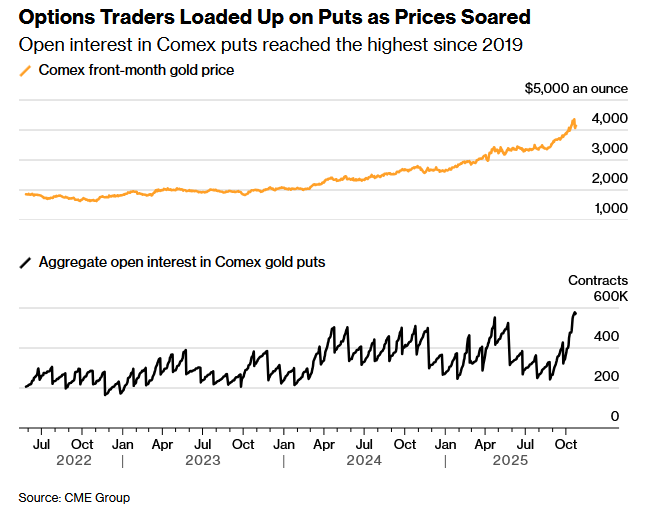

Analysts have pointed to a need for consolidation. Volatility has risen as leveraged traders booked profits. Pricing had become crowded and technically stretched. Some market participants discussed a possible retracement toward $3,500 as a level consistent with longer term strength and renewed inflows.

Bullish Outlook Remains Dominant

Forecasts remain constructive across the complex. LBMA respondents expect silver to reach $59.10 per ounce within a year and anticipate double digit gains for platinum and palladium. The strongest conviction continues to center on gold. JPMorgan views de risking episodes as temporary due to a base of physical buyers that continues to expand.

“Profit taking will be met by dip buying from other segments of demand including central banks,” JPMorgan wrote.

Free Posts To Your Mailbox