Jeff Currie: Gold as The Currency of Last Resort

The Currency of Last Resort

October 28, 2025

Submitted by GoldFix; Authored By Jeff Currie for Carlyle

By nearly every known valuation metric for gold prices – inverse of real rates, the US dollar and marginal costs – gold and precious metals have disconnected from fundamentals to the upside. Yet most analysts, including us, continue to recommend an overweight allocation in gold and precious metals. Why? Gold is a direct alternative to fiat currencies in times of policy-induced currency debasement and systemic risk; hence, we call it the currency of last resort. A position it has held for three millennia versus 16 years for cryptocurrencies. Gold can survive nearly anything and its position on the periodic table gives it an infinite half-life, making it the ultimate monetary refuge in times of distress.

We believe gold is being driven by three factors – Debasement concerns, De-dollarization and portfolio Diversification. Each is becoming increasingly important for investors to consider when making asset allocation decisions. For example, gold reversed a sell off last week on news of fresh, yet more aggressive sanctions on Russia that threatened secondary sanctions on anyone dealing with Russian oil companies. Such secondary sanctions could be very disruptive to global payment systems, reinforcing further de-dollarization demand for gold.

Currency Debasement Is Not Only the Result of Price Inflation

During the Global Financial Crisis (GFC) confusion peaked over what was driving gold prices. Commentators attributed gold’s rise to inflationary and deflationary concerns. Clearly, it can’t be both at the same time, so was gold really an inflation hedge which was the prevailing view at the time? No. Debasement can occur with or without CPI-style inflation; what matters is the decline in real rates. Before the GFC, falling real rates were invariably associated with CPI-style, or what we like to call physical inflation. What we now know is that the dollar was being debased against inflation in financial assets like stock and bond prices, not physical inflation.

The Ultimate Gold-Market Primer

This piece is the most thorough and candid discussion on gold we’ve seen consolidated in one place. Its clear aim is to re-educate sophisticated clients who have little direct experience with gold but now find themselves needing a textbook to catch up. The writing is accessible without being pedantic, making it an ideal entry level analysis.

Goldman’s analysis is the natural continuation of this trend: the re-emergence of gold as both a hedge against risk and a check on policy weakness. It is also notable that Lina Thomas has held firm to her “physical demand over Keynesian correlations” view, even as other banks pushed back.

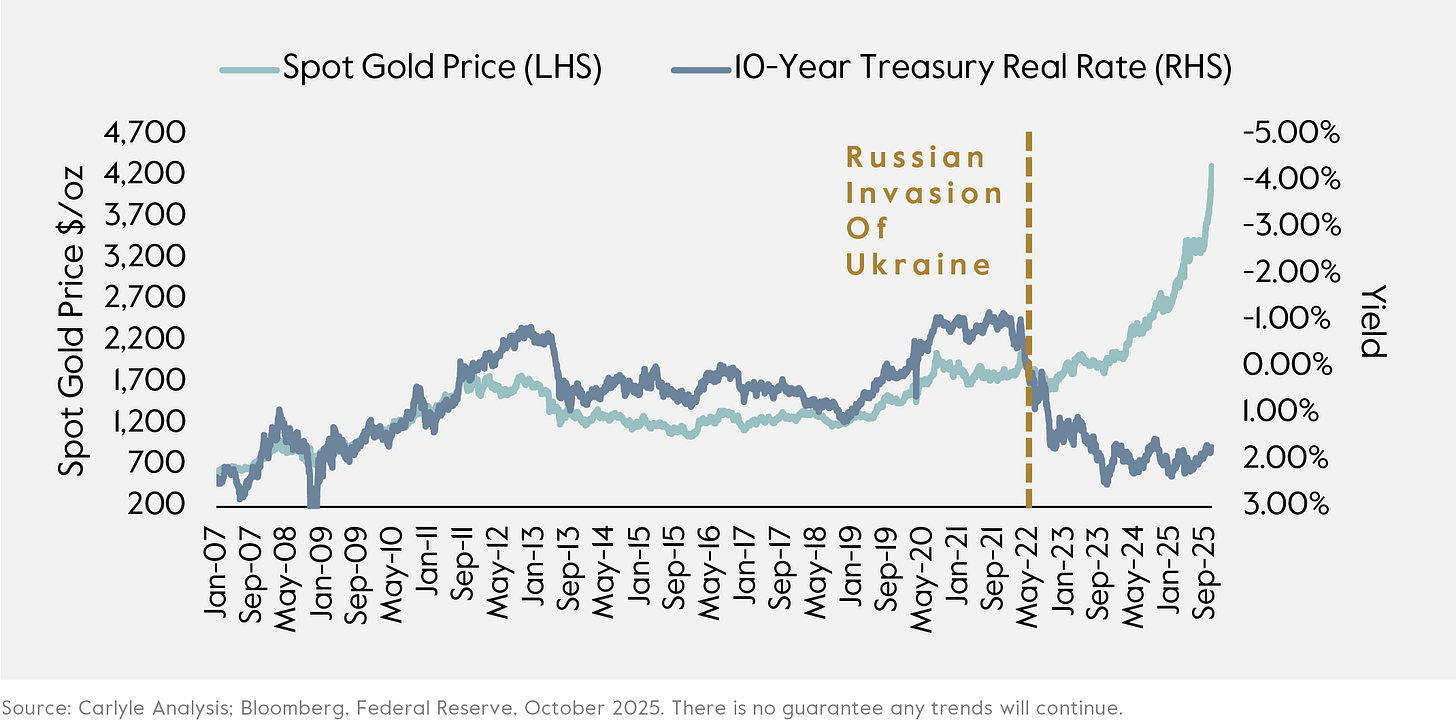

This characterization of gold worked well even through Covid when currency debasement was driven by both financial and physical inflation. This debasement reason for holding gold is typically captured in declining real rates and a weaker US dollar (see Exhibit 1). In fact, the term debasement comes from when the Romans would mix ‘base’ metals like copper into precious metals like gold, to ‘debase’ their gold coins. This characterization of gold worked extremely well until 2022 when gold sharply disconnected from real rates, driven by a new force: de-dollarization.

Exhibit 1: Decoupling Between Gold Prices and Real Rates Coincided with Sanctions Imposed on the Russian Federation in Response to the Invasion of Ukraine

In 2022, gold prices sharply disconnected from US real rates when the Western powers froze around $300 billion of the c.$600 billion in Russian central bank’s assets. Although the communication was very clear in 2022 that the West would respect international law and not touch the assets, very few emerging markets (EM) central banks believed Western policymakers and began to sell US treasuries reallocating to gold to hedge themselves. Clearly, that decision proved prescient with German Chancellor Merz recently advocating to use frozen Russian central bank assets to back financial aid for Ukraine. Historically, countries whose central bank assets are frozen —such as Iran, Venezuela, North Korea, Afghanistan and Libya —rarely recover economically. Only Iraq, following an absolute regime change, has re-emerged from this in the post-war era, though fragility remains. In other words, it must be avoided at all costs. “Fool me twice, shame on me.”

BBG Analyst: Gold As The Last Safe Collateral

Gold has recouped all it’s losses Friday in a historic 3 day period. The sell-off was so short lived and the buying so vociferous today with no new news, one has to ask “What is going on?”

The answer may be that Gold is the last collateral standing and that price may be completely secondary to having atoms of the precious metal in your possession.

This shift led to a simultaneous surge in central bank gold holdings and a reduction in US Treasuries. In early September of this year at $3,500/toz, gold surpassed US Treasuries, and today at $4,200/toz price gold has a 27% share of central bank reserves compared to US treasuries at 23%. To put this in perspective, in 1970 before the Nixon Shock, when Nixon took the US dollar off the gold standard, gold’s share was 40%, suggesting further room to run.

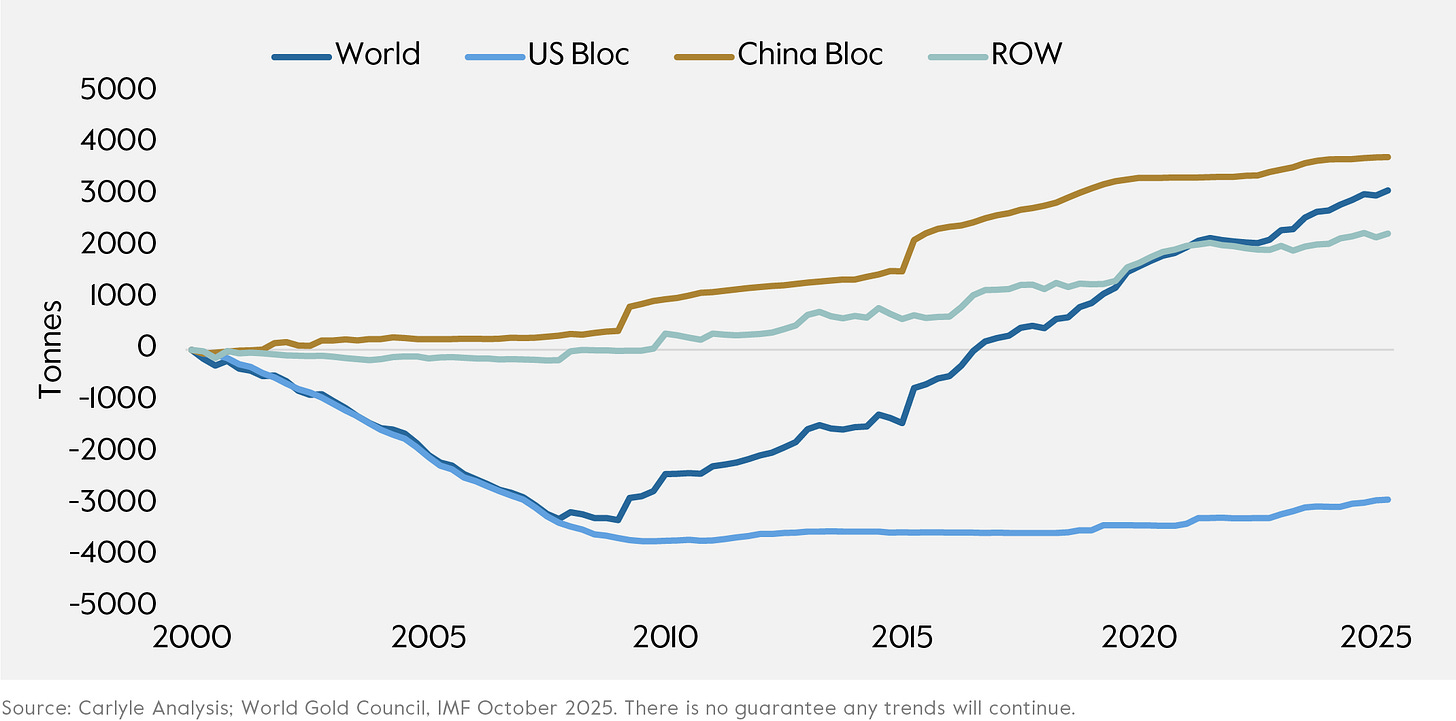

But as you can see in Exhibit 2, the rise in EM central bank demand for gold started well before 2022, which highlights why US administration recently only threatened secondary sanctions on those who transact with Russian oil companies. This current de-dollarization trend initially started in 2018 when Trump 1.0 imposed secondary sanctions on Rusal, the Russian aluminium producer, for Russian tampering over US political elections. Russia responded by aggressively starting the de-dollarization process by selling nearly $100 billion in US Treasuries and replacing them with gold and physical greenback currency.

Exhibit 2: Cumulative Change in Central Bank Gold Holdings

The ‘Search for Diversification’ Is Accelerating Gold Demand

Thus far, we haven’t discussed investment demand which is also a big driver. As we argued in January, ‘search for yield’ was the key investment theme from 2002 to 2022 due to low rates and inflation. Today, with higher rates and inflation, that theme has been reversed. Accordingly, the 60/40 portfolio is no longer “naturally” diversified, as the correlation between bonds and equities has flipped positive. This creates the need for investors to find new diversifiers of which hard commodities, particularly gold, are the natural choice going back to antiquity.

Continues here