When Math Kicks Bitcoin "HODLers" In The Nuts

Submitted by QTR's Fringe Finance

These lessons go for pretty much any asset class, but where I’ve noticed the largest concentration of inane theories, economic non-sequiturs and general outright confusion is among the most hubris-laden speculators in the market, the Bitcoin crowd. I own some Bitcoin and would love it just as much as the next guy if the price went to $1 million or $1 trillion or whatever Michael Saylor’s made up price target is today. But that doesn’t give me a hall pass to disconnect an otherwise well-functioning brain from all financial reality as we’ve ever known it.

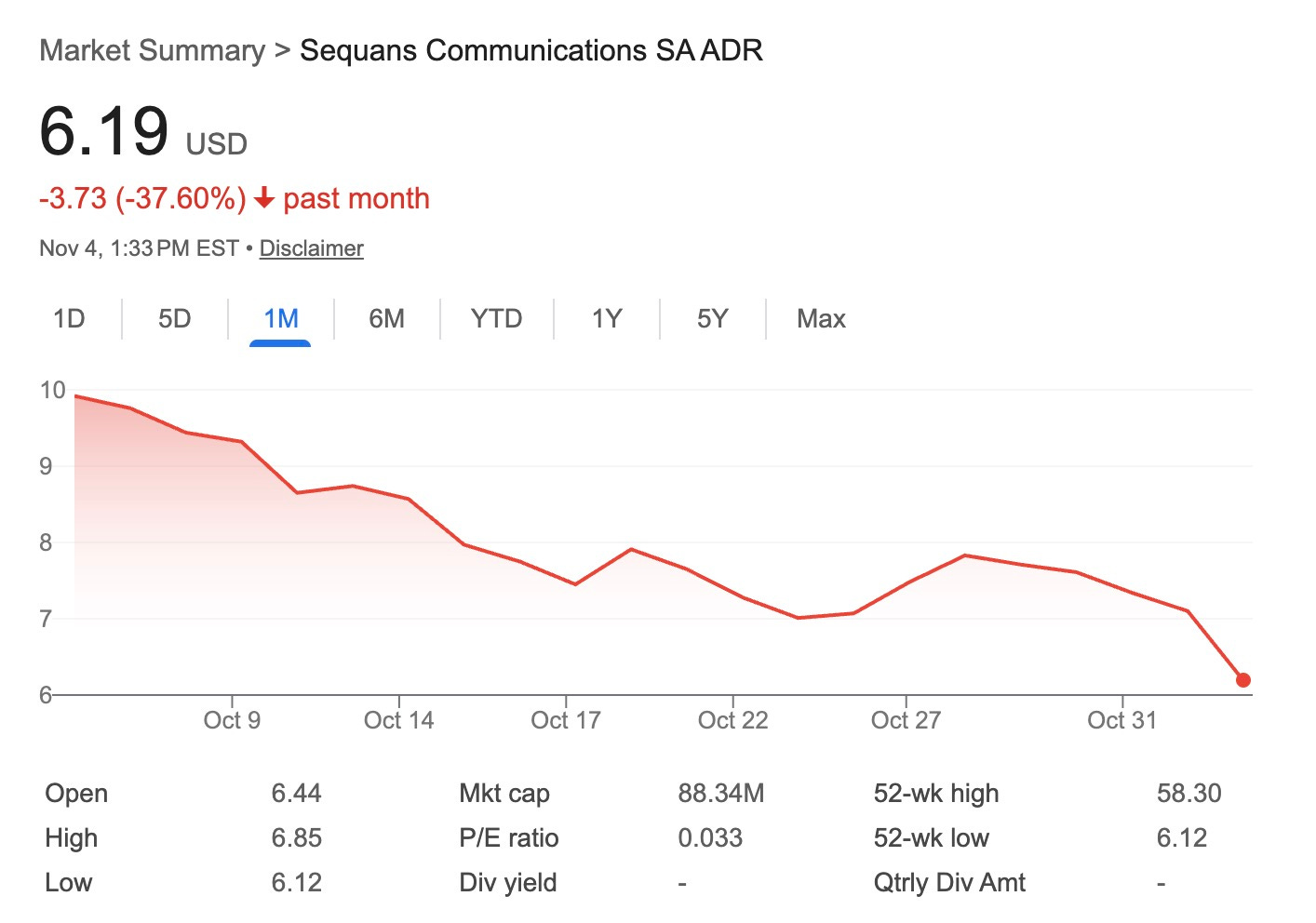

Bitcoin loyalists often repeat that holders (or HODLers) never sell, that conviction alone is enough to withstand any downturn. But as seen in the example of Sequans Communications that CoinDesk wrote about this week, even the most outspoken converts to the “BTC treasury strategy” eventually face a moment where reality overtakes belief. Sequans, which pivoted aggressively into Bitcoin earlier this year, just unloaded 970 BTC because its debt burden became too large. Go figure.

The company insisted this sale was merely tactical, yet its stock remains crushed, and its once-promoted strategy now hinges on less leverage and fewer promises.

This is not an isolated corporate event, but a preview of what happens when enthusiasm collides with the reality of financial obligations.

Bitcoin has grown into a financialized asset at every level: corporate treasuries, retail holders borrowing against their stacks, institutions using futures and leverage to enhance returns. During market strength, these decisions feel brilliant — I mean, just look at the scores of assholes who don’t know the difference between a market cap and an enterprise value bragging on social media daily about their financial acumen — and the conviction looks unshakeable. But when liquidity thins or macro stress arrives, as I predict it will in four different spots of the market, even believers discover that math is a stronger force than ideology.

The Eye Of The (Shit) Storm

There is a persistent narrative that Bitcoin supply is locked up by long-term holders who will never sell regardless of the price. But that’s not quite the truth.

In good times, that produces an illusion of invincibility. In downturns, it creates thin markets and a new vulnerability: when someone is forced to sell, there may not be many willing buyers on the other side.

Sequans didn’t exit the trade because it lost faith in Bitcoin. It sold because debt left it no choice. In a deeper decline, more corporations could follow the same path, not as a judgment on the asset, but as a condition for survival.

MicroStrategy, the highest-profile corporate buyer of Bitcoin, reflects...(READ THIS FULL COLUMN HERE).