It's Official: Silver Added As Critical Mineral

*Silver Officially Added As Critical Mineral

Authored by GoldFix

The United States has expanded its official list of critical minerals to include copper, silver, and uranium, signaling an intensified focus by the Trump administration on domestic resource security and supply chain independence.

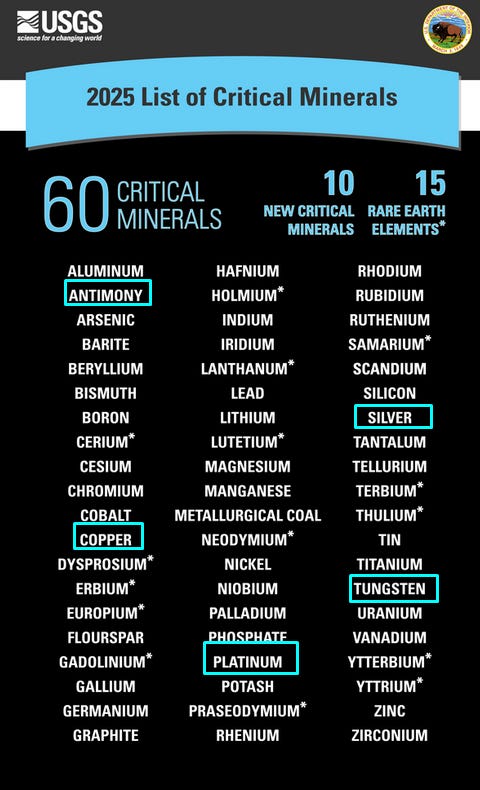

First reported here in August; The updated and finalized U.S. Geological Survey (USGS) list now totals 60 materials, adding ten new entries such as metallurgical coal, potash, silicon, rhenium, and lead. The list, which also retains 15 rare earth elements, guides federal policy for mining investments, tax incentives, and potential trade restrictions under ongoing Section 232 investigations into processed critical minerals and derivative products.

Are You Ready for $144 Silver and $9.00 Copper?

The recent decision to add silver to the U.S. critical minerals list marks an important shift in how policymakers view the metal. The designation signals that silver is no longer treated as a simple commodity but as an asset tied to industrial capacity, technological development, and national security. Analysts and policymakers alike emphasize that this recognition places silver in the same category of strategic concern as lithium, uranium, and rare earths.

“Designation of a mineral as critical is bullish because it highlights essential demand, reveals insecure supply, and creates a government-backed floor for consumption.”

Lessons from Lithium and Uranium

The lithium market provides a clear and very favorable example of how critical designation can lead to higher prices. After the U.S. listed lithium in 2018, automakers and investors rushed to secure access. Supply did increase, but the lag time for new mines allowed demand to run ahead, driving prices from under $10,000 per ton in 2020 to over $70,000 per ton by 2022.2

President Trump has framed the expansion as a national security measure, citing over-reliance on foreign suppliers as a strategic vulnerability for sectors spanning infrastructure, technology, and defense. The USGS list is expected to shape tariff policy and resource-development priorities.

Copper’s inclusion follows lobbying from U.S. producers who argue it underpins electrification and defense applications. The U.S. currently imports nearly half its copper, primarily from Chile, Peru, and Canada, with refining dominated by China. Potash, also newly listed, is largely imported from Canada, which supplies about 80% of U.S. demand.

Silver’s addition marks a particularly sensitive move for metals traders and manufacturers. The U.S. depends heavily on imported silver for electronics, solar panels, and medical equipment. Any tariff action could tighten supply chains and introduce volatility into precious-metals markets already strained by industrial demand.

Rare earth elements remain central to the White House’s industrial-policy agenda after Beijing threatened export curbs. The new list further broadens that focus to encompass base and precious metals critical to both energy transition and defense production

The US added uranium, copper and silver to a government list of critical minerals. The updated US Geological Survey list also adds metallurgical coal, potash, rhenium, silicon and lead, according to the list posted to the US government sitehttps://t.co/isMTFPHRfY

— zerohedge (@zerohedge) November 6, 2025

Sources: Bloomberg News, U.S. Geological Survey