US Overtakes China in Africa Metals With Trump-2019 Program

Authored by GoldFix

The United States has overtaken China as Africa’s largest foreign investor for the first time in over a decade, marking a significant shift in global competition for control of critical minerals that underpin modern technology, defense, and clean energy systems.

According to BBC reporting by Egon Cossou, citing the China Africa Research Initiative at Johns Hopkins University, U.S. foreign direct investment in Africa reached $7.8 billion in 2023, surpassing China’s $4 billion. The reversal, last seen in 2012, reflects Washington’s intensified focus on securing supply chains for materials like lithium, cobalt, rare earths, and tungsten—resources vital to electric vehicles, AI infrastructure, and advanced weapons manufacturing.

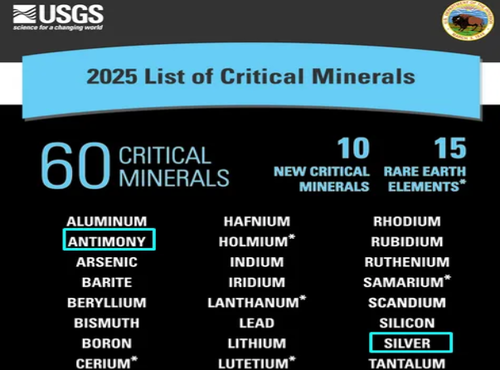

*Silver Officially Added As Critical Mineral

The United States has expanded its official list of critical minerals to include copper, silver, and uranium, signaling an intensified focus by the Trump administration on domestic resource security and supply chain independence.

“The U.S. government has been very supportive of what we’ve been doing, to look at bringing that supply chain directly to the United States,” said Shawn McCormick, chairman of Rwanda’s Trinity Metals, which received a $3.9 million grant from the U.S. International Development Finance Corporation (DFC).

Formed in 2019 under President Trump, the DFC’s mandate explicitly aims to “counter China’s presence in strategic regions.” Its investment in Rwandan mining operations now channels African tin and tungsten to U.S. smelters in Pennsylvania, deepening commercial ties and supply security.

Economist Sepo Haihambo urged African nations to be “clear on what outcomes they want,” emphasizing that partnerships with the U.S. must prioritize equity stakes, joint ventures, and domestic value creation over simple resource-for-cash deals.

“Africa really needs to prepare itself for these engagements.”

US Overtakes China in Africa Metals Investing.https://t.co/S7xa0aKD5O

— VBL’s Ghost (@Sorenthek) November 10, 2025

Meanwhile, American firms such as ReElement Africa are investing directly in on-continent refining facilities, signaling a potential evolution from extraction-based partnerships to industrial cooperation. “You could actually capture more value, upskill labor, and lay the foundation for industrial development,” said CEO Ben Kincaid.

However, experts warn the U.S. advantage may be temporary. Prof. Lee Branstetter of Carnegie Mellon University argues that Trump-era tariffs on African exports have weakened Washington’s appeal. “Had the current administration not indiscriminately slapped tariffs on large numbers of African countries, the U.S. would probably have been in a better position,” he said.