AI And Very Very Late Stage Bubbles

Submitted by QTR's Fringe Finance

Two new warning flags in the world of AI surfaced this week — both worth pointing out and connecting with each other, as well as with my previous skepticism.

First, Michael Burry, the contrarian investor immortalized in The Big Short, has turned his sights on the artificial intelligence boom.

In a recent post, Burry accused major U.S. tech “hyperscalers” of using aggressive accounting tactics to inflate profits. That skepticism found an unexpected echo in a new note from Barclays, which highlights growing unease over how sustainable AI-related capital expenditures truly are.

Together, Burry’s critique and Barclays’ analysis hint at a growing chorus of caution amid the euphoria surrounding AI-driven profits.

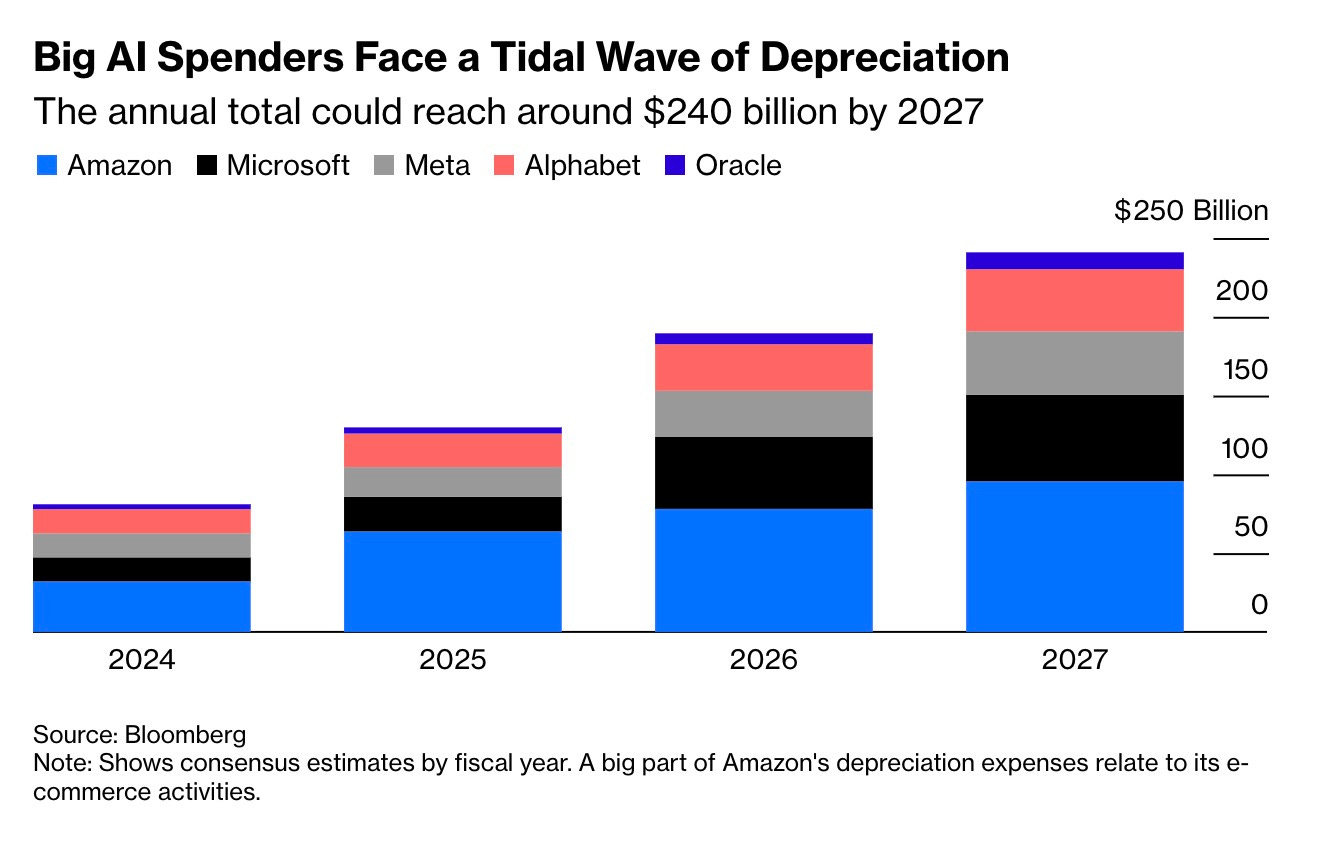

Burry claims hyperscaler companies are artificially extending the estimated lifespan of expensive AI hardware such as Nvidia chips and servers, allowing them to report lower yearly depreciation costs and therefore higher earnings, according to Bloomberg.

He argues that this practice inflates profits across the sector by billions of dollars, predicting nearly $176 billion of understated depreciation between 2026 and 2028. He singled out Oracle and Meta as examples, estimating their earnings may be overstated by 27% and 21%, respectively, by 2028.

While the accusation is serious, experts note it may be difficult to prove, as accounting standards give companies flexibility in how they estimate asset lifespans.

Putting Burry’s notes down and then reading Zero Hedge this morning I came across another note that lands almost exactly in the overlap of Burry’s take — and the arguments I made in “Credit Crash in AI Names” and “Limbo.”

The strains I described in the credit of multiple AI names appear to be heading from anecdotal to part of the mainstream credit narrative.

In “Credit Crash in AI Names,” I argued that widening CDS spreads in both CoreWeave and Oracle were early warnings that the...(READ THIS FULL COLUMN HERE).