AI Boom or Bust: Prosperity Through Balance—or Turmoil Through Greed?

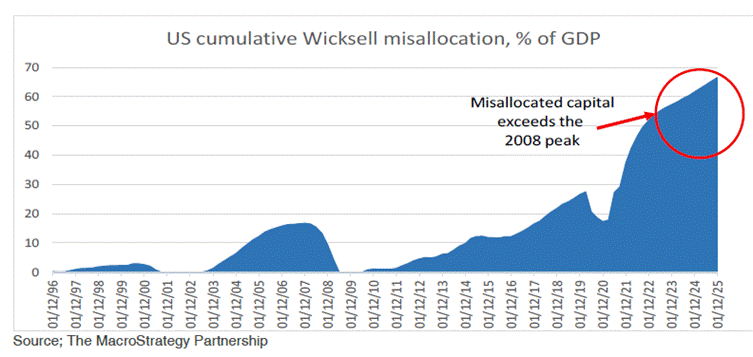

Historians will no doubt gush over this Jubilee Year of AI, dutifully parroting how the machines “reshaped financial markets,” while ignoring the minor detail that the whole sector has been one long carnival of exuberant fantasy. Let’s be clear: this isn’t just another bubble — it coul be the mother of all bubbles. The U.S. misallocation of capital (AI, housing, VC, crypto — pick your poison) is now 17x the Dotcom insanity and 4x the 2008 real-estate fever dream. When this thing finally deflates, it won’t just deliver a nasty economic hangover; it may well blow up the entire globalist economic order built since Thatcher, Reagan, the Berlin Wall’s swan dive, and China’s WTO debut. A LLM bust will shape the next macro era just as the S&L crisis turbocharged U.S. reflation in the early ’90s and lifted Asia — except this time the train is barreling downhill without brakes. Expect reflation, inflation, a rising Indian middle class, and AI crashing back to earth to define the late 2020s.

And what lit the fuse? As always, debased currency — with a bonus twist: a slow-burn fiscal sugar rush that kept the mania simmering long enough to go nuclear.

The Wicksell spread is the gap between the market interest rate (usually a short-term policy rate) and the natural rate of interest — the theoretical rate at which the economy can grow without sparking inflation. Rooted in Knut Wicksell’s work, it’s a simple gauge of monetary stance: when the market rate sits below the natural rate, money is effectively loose, fueling credit growth, rising asset prices, and potential overheating; when it’s above, policy is tight, credit slows, and deflationary pressures build. Because the natural rate is unobservable and must be estimated, the Wicksell spread isn’t a precise instrument, but it remains a powerful lens for understanding how central banks influence economic cycles, financial instability, and the broader transmission of interest-rate policy.

The pandemic stimulus — roughly 15% of GDP in both 2020 and 2021 — was so massive it basically screamed, “Go forth and speculate!” And speculate we did. Inflation erupted (shocking?), forcing the Fed to slam on the brakes in 2022. Yet by late that year, the system was still sloshing with leftover liquidity: households were sitting on excess savings, the reverse-repo pool held a casual US$2.2 trillion waiting to gush into markets, the TGA could cough up another US$500 billion when the debt ceiling drama peaked, and corporations — especially the Mag7 — were hoarding record cash. Naturally, all this loose liquidity decided to cosplay as “innovation” and piled into LLM AI (with a side quest in crypto).

How big is the bubble? Let’s just say “misallocated capital” is one of those polite economic phrases that sounds mildly unfortunate, like losing your umbrella — except it actually means sabotaging two centuries of human progress. Prosperity depends on capital flowing to productive work, not to GPU bonfires and cartoon dog tokens. Misallocate capital on a colossal scale and you derail the entire train of social and economic advancement. That’s not just bad economics; it’s bad ethics.

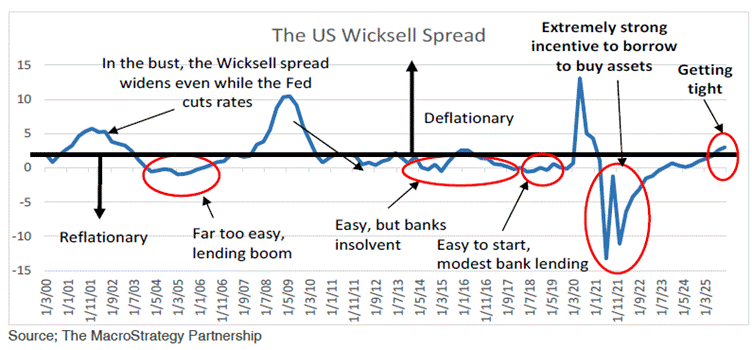

To size this mess, a look at the Wicksell spread. Wicksell argued that an economy stays on track when the average corporate borrowing cost sits about two percentage points above nominal growth — a sensible buffer since governments earn nothing, businesses earn more, and investors prefer volatility in theory, not in their portfolios. When that spread collapses, capital stops being allocated wisely and starts being misallocated spectacularly — exactly what we’ve been watching in real time.

Set rates and liquidity at sane levels, keep the Wicksell spread around 2%, and—assuming you’re not running a monopoly—capitalism actually works: productive firms borrow to grow, unproductive ones quietly fade away. That’s how societies progress, wealth compounds, and civilisation moves forward. It’s not just economics; it’s a moral act. Now, enter Powell’s 2021 masterclass in financial distortion: QE infinity and zero rates while the economy was growing 11% nominally. That’s like handing out free champagne at a fireworks factory—everyone borrows, everyone buys, and prices soar to “perfection.” Then, inevitably, the music stops: growth slows, rates rise, spreads widen, and suddenly all those “perfect” assets start looking like overpriced regrets.

The result? The potential greatest misallocation of capital in history—17 times the Dotcom bubble, four times the housing bubble. Not just a policy mistake; it’s monetary malpractice on an epic scale.

Capital misallocation is the fuel that turns ordinary market optimism into full-blown bubbles. When monatery policies provide cheap abd abundant liquidity, it stops flowing toward productive, high-return activities and starts chasing whatever is shiny, fashionable, or conveniently hype-driven. Instead of funding innovation, efficiency, and real economic growth, capital floods into speculative assets, pushing their prices far beyond any rational valuation. As investors, corporations, and even consumers pile in—emboldened by easy credit and rising paper wealth—prices feed on themselves, creating a self-reinforcing loop of exuberance. The trouble is that misallocated capital builds fragile structures: when conditions normalize, cash dries up, or sentiment turns, the inflated assets can’t support their own valuations. The bubble bursts, leaving behind debt, losses, and years of stalled progress that could have been avoided had capital been allowed to flow where it actually creates value.

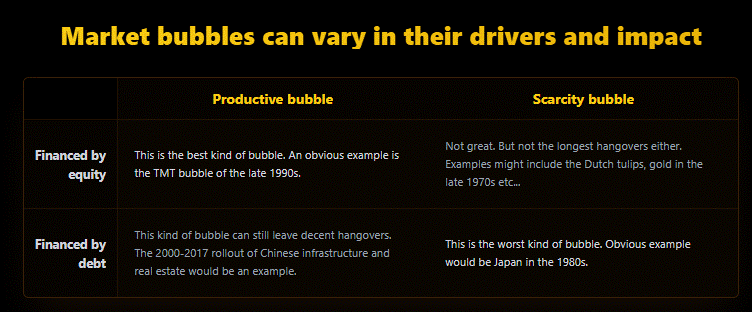

Not all bubbles are created equal: some leave a mess, others leave a legacy. Productive bubbles—like railways in the 1800s, electrification, or the early internet—misallocated plenty of capital, but at least they built real infrastructure that later powered decades of growth. They were inefficient, yes, but the waste came with long-term dividends. Unproductive bubbles, by contrast, burn money without building much of anything: think housing speculation in 2008, meme coins. These bubbles inflate prices, distort incentives, and leave nothing but debt, empty office parks, and disillusioned investors when they pop. The difference is simple: productive bubbles overshoot in pursuit of progress; unproductive bubbles overshoot in pursuit of narratives. Only one leaves society better off when the dust settles.

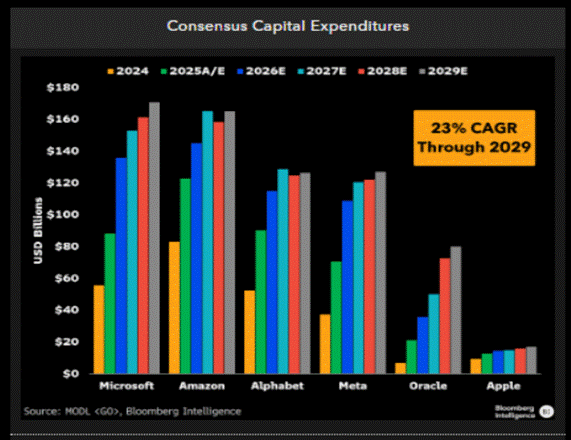

Why bring this up again? Well, because the AI hype machine is now so loud it could probably drown out a jet engine. According to JP Morgan, AI-related capital spending in just the first half of this year added a whopping 1.1% to US GDP — meaning robots and server farms are now doing more heavy lifting than the American consumer. The same report noted that ever since ChatGPT burst onto the scene in late 2022, a hand-picked squad of 41 AI-themed stocks has been responsible for 75% of the S&P 500’s gains. In other words, the entire market is basically riding shotgun in a self-driving car and hoping the battery doesn’t die.

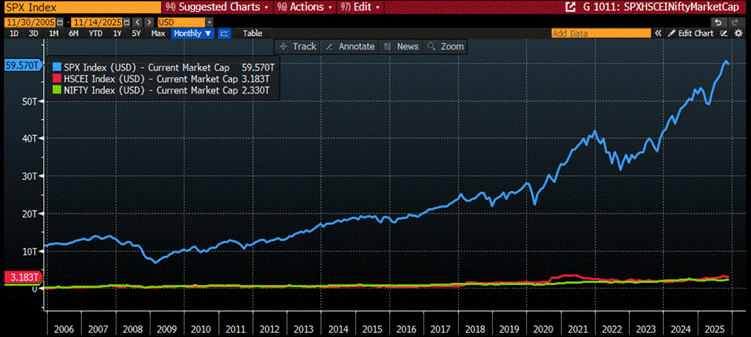

Market capitalization in USD of the S&P 500 index (blue line); Hang Seng Composite Equity Index (red line); Nifty 50 Index (green line) in trillions of USD.

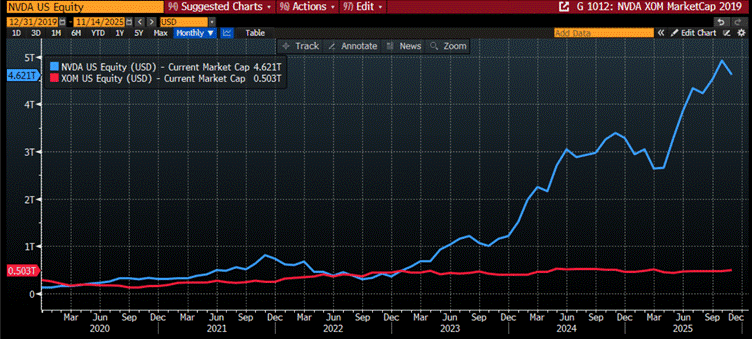

Nvidia alone has magically conjured over US$4 trillion in market cap since ChatGPT showed up — a feat that, in the grand saga of capitalism, ranks somewhere between “unbelievable” and “did we all just agree to suspend reality?” It’s one of the fastest wealth-creation episodes ever recorded, which naturally leads to a few polite questions… like: is this brilliance, luck, or just another episode of Market Madness: GPU Edition?

Market Capitalization of Nvidia (blue line); Exxon Mobil (red line) since December 2019.

Post-pandemic liquidity fueled a binge on housing, crypto, NFTs, VCs, and the Magnificent Seven, with the Wicksell spread now back above 2%—perfect timing to watch the hangover unfold. While recuperating from open-heart surgery, bubbles aren’t just about liquidity—they’re about power. Welcome to the “New Digital State,” where monopoly is king, quality and price elasticity are jokes, and CEOs are chosen for their talent at spinning hype, not running a competitive business.

So is the AI craze a bubble?

Well, if it looks like a duck, swims like a duck, and quacks like a duck… odds are it’s not a unicorn. By that logic, the AI boom has all the classic bubble symptoms: gigantic spending plans with foggy future returns, cozy insider dealings, and valuations stretched so thin they’re practically transparent. In other words, yes — this duck is waddling suspiciously close to Bubble Pond.

If the AI craze is a bubble, what kind of bubble is AI?

Everyone’s betting that pouring mountains of money into giant language models will magically boost productivity everywhere. But if that doesn’t happen, we’ll be left with lots of very expensive data centers and Nvidia chips that age faster than avocados. Sure, maybe this is like the 1990s broadband boom that accidentally gave us Netflix, outsourcing, and dirt-cheap international calls. Maybe something great will emerge. Or maybe not. The problem: AI hardware becomes obsolete practically overnight. So unless AI starts paying for itself in the next couple of years, all these shiny new data centers might look pretty sad by 2028.

Third question is how the AI capital spending funded?

The AI capital spending so far has not really been funded by debt. Microsoft, Alphabet, Meta, etc.—have mostly been paying for their AI shopping sprees with actual cash flow. But as the price tags keep ballooning (looking at you, Oracle), the big question is when this goes from “paid in cash” to “put it on the credit card.”

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/ai-boom-or-bust-prosperity-through

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.