Did The Bull Market Finally Just Crack?

Submitted by QTR's Fringe Finance

Another week near “all-time highs” on Wall Street, another week of reality quietly cracking underneath. As of last check, my 25 Stocks I’m Watching For 2025 are beating the S&P by a little more than 45% this year still. And I’m already preparing my list of 26 names I’ll be watching for the upcoming year, to be published next month for paid subscribers.

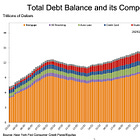

For subs this week, I went under the hood of the so-called “strong economy” with “Even ‘All Time Highs’ Feel Shitty.” While the S&P prints new highs, Americans are quietly setting their own records in credit-card delinquencies, subprime auto defaults, commercial real estate stress, and total household debt. The piece walks through the numbers and the narrative games: how “consumer strength” is really “people maxing out 25% APR cards to cover groceries,” and how Wall Street spins a leveraged, late-cycle mess as a victory lap. If you want to see the scoreboard the financial media won’t put on TV, this is it.

Even "All Time Highs" Feel Shitty

🔥 70% OFF, Forever: Use this coupon to get 70% off an annual subscription to Fringe Finance — this coupon expires after this weekend. The discount and price remains for as long as you remain a subscriber: Get 70% off forever

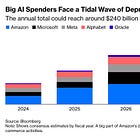

And in “AI and Late Stage Bubbles,” I connect Michael Burry’s criticism of hyperscaler accounting with emerging cracks in the credit market for AI infrastructure. The gist: what’s been sold as a self-funding, revolutionary profit engine is increasingly looking like an overleveraged, debt-financed late-cycle bubble. I walk through how depreciation games, bond issuance, and widening credit spreads are telling a very different story than the AI cheerleaders on financial TV. If you’re long the AI narrative, or just curious where the next real dislocation might come from, you may to read this one.

AI And Late Stage Bubbles

Just yesterday I wrote “I’ll Be Bullish On Stocks Again…Someday,” where I lay out why I’m not actually allergic to being bullish, why I turned aggressively long during COVID, and what conditions would need to exist before I stop mocking index-fund evangelists and start buying hand over fist again. Read it here and see what I’m watching heading into 2026.

I'll Be Bullish On Stocks Again...Someday

In “Breaking Burry,” I dig into Michael Burry’s decision to shut down his fund, Scion. This isn’t a story about a guy “losing it”; it’s about a market so warped by liquidity and passive flows that being early and right gets you steamrolled anyway. I walk through how short sellers used to be the real risk managers of the system, why that world is gone, and why Burry stepping aside feels like something you see near major tops, not healthy middles. You can read the full post and decide for yourself whether he’s wrong—or just refusing to play a broken game.

Breaking Burry

We also ran a guest essay, “The Social Costs of Inflation,” by Allen Mendenhall of The Heritage Foundation. It connects the dots between inflation, family breakdown, delayed marriage, collapsing fertility, and the quiet two-tier society forming under fiat money. If you’ve ever felt like something is off socially that CPI doesn’t capture, this piece helps explain why.

The Social Costs Of Inflation

If you’re not a paid subscriber yet, I’d love to have you on board. Hell, maybe someday you’ll be the first to find out I’ve turned bullish on markets again. Though, without a sharp crash soon, it may be a while…

Here’s what else is new on the blog:

Increases in the Money Supply, Not Corporate Profits, Drive Price Increases

Government Promised Healthcare for All. It Gave Us Waiting Lines

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.