FT Confirms China's Gold Secret

The FT work analyzed below vindicates our own and that of those who came before us like ZeroHedge (2022) and BBG (and before them Jim Rickards, Sinclair and more). This will only raise awareness of Gold’s ascendant importance in global trade.

INTRO

Authored by GoldFix

Our latest breakdown below is based on some reporting by the Financial Times, in particular Leslie Hook’s excellent work breaking down a SocGen piece titled “China’s secretive gold purchases help fuel record rally,” and organizes the FT’s findings and sourced views into a structured framework with our own past proprietary analysis embedded for understanding the scale and implications of these flows as we have warned multiple times over the last 3 years following the 2022 invasion of Ukraine and confiscation of Russian Wealth.

Incidentally, the next story worth covering is Soc Gen’s analysis and our breakdown of the fact that Russia’s Gold production stands at approximately 330 tonnes in 2025, none of which has been accounted for in sales or in CB holding increases yet. This we contend is all part of the same big picture development; That the BRICS are preparing to release Gold’s financing potential in HQLA Collateral fashion as direct competition for the global REPO market with US Treasuries.

But that is for another time1

1. Underreported Buying and China’s De-dollarization Objective

Official data from the People’s Bank of China (PBoC) suggests only modest monthly additions to reserves, with single digit tonnage increases reported for recent months. Analysts quoted by the FT argue that these figures dramatically understate reality. Société Générale estimates that total Chinese official purchases could reach roughly 250 tonnes this year, which would represent more than one third of global central-bank demand.

Goldman Shares a Gold Secret

The Bank openly discusses increased secretive buying of Gold in London being held for an unknown buyer embedded in a walkthrough of the LBMA marekt structure.

Our estimates of China’s institutional gold purchases in the London OTC market align with the PBoC reports, but tend to be higher, start earlier, and last longer (Exhibit 4). While the PBoC reported no additional purchases after April, our nowcast estimates 50 tonnes of institutional purchases from China on the London OTC market in May,Who is it? Although they do not conclude it, evidence points to China

The FT’s sources interpret this accumulation as a deliberate component of China’s strategy to diversify reserves away from the dollar. Jeff Currie, chief strategy officer of energy pathways at Carlyle, links the buying directly to this policy objective, noting that he does not attempt to pin down exact volumes because of the difficulty of tracking bullion movements:

“China is buying gold as part of their de-dollarisation strategy,” said Jeff Currie, chief strategy officer of energy pathways at Carlyle, who says he does not try to guess how much gold the People’s Bank of China is buying.

Unlike oil, where shipments can be observed via satellites and shipping data, physical gold is more easily moved and stored without leaving a transparent trail. This structural difference underpins the uncertainty around the precise size of China’s purchases and supports the argument that the official numbers are only a fraction of the true picture.

2. Central Bank Demand, Opacity, and Market Impact

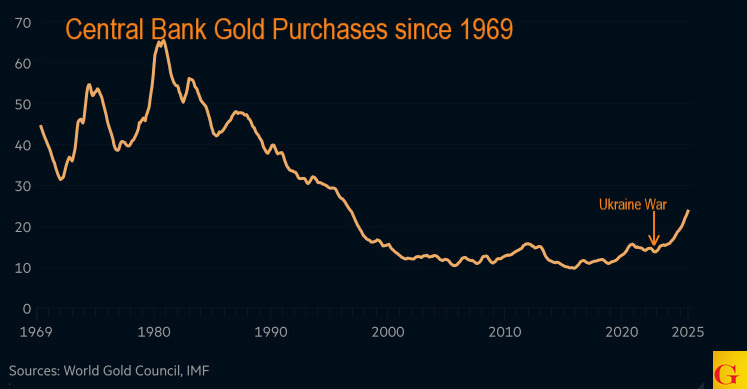

China’s behavior is taking place in a wider context of robust central-bank demand for gold. Over the past decade, the share of gold in global reserves outside the United States has increased from roughly one tenth to about one quarter, making gold the second-largest reserve asset after the dollar according to World Gold Council data, and coinciding with spot prices above 4,300 dollars per troy ounce.

However, the transparency of this central-bank activity has deteriorated. The FT cites estimates showing that only about one third of official gold purchases were reported to the IMF in the most recent quarter, compared with around 90 per cent four years ago. This means that a growing share of the marginal price-setting demand is hidden from straightforward statistical sources.

Several reasons for this secrecy are discussed. Some central banks may wish to avoid moving the market against themselves by signalling large purchases in advance. Others may be concerned about political repercussions, especially where bullion buying is interpreted as a hedge against the dollar at a time when relations with Washington are sensitive. Nicky Shiels, analyst at MKS Pamp, frames the calculus in those terms:

“It makes sense to just report the bare minimum, if need be, for fear of reprisal from the US administration,” said Nicky Shiels, analyst at Swiss refinery MKS Pamp. “Gold is seen as a pure USA hedge. In most emerging markets it is in central banks’ interest to not fully disclose purchases.”

The FT recalls the example of the United Kingdom’s gold sales under then chancellor Gordon Brown, where advance signalling coincided with depressed realized prices. That event is historically referred to as “Brown’s Bottom in Gold. That episode is cited as a case study of how transparency can work against the seller. In the current environment, the combination of political sensitivity and market impact gives central banks strong incentives to keep activity opaque.

Goldman: China "Secret" Gold buying Surprises Yet Again

Year-to-date, central bank demand nowcasts have averaged 88 tonnes per month—surpassing Goldman’s baseline forecast of 80 tonnes through mid-2026.China was again the largest identifiable buyer in April, accounting for 27 tonnes—nearly nine times the officially reported figure. This continues a pattern of quiet accumulation by the so-called “secret buyers” shaping flows behind the scenes. Read full story

Michael Haigh of Société Générale summarises the challenge for traders trying to interpret this environment:

Michael Haigh, an analyst at Société Générale, said this opacity makes the gold market “unique and tricky” compared with commodities such as oil, where Opec plays a role in regulating production.

Without reliable visibility on central-bank flows, price discovery for gold rests increasingly on models and proxies rather than direct reporting.

3. Reconstructing China’s True Purchases

Because China’s official figures are widely viewed as incomplete, analysts and market participants have developed a series of indirect methods to gauge actual demand.

One approach described in the FT is to monitor orders for freshly cast 400 ounce bars with consecutive serial numbers. These bars are typically refined in Switzerland or South Africa, routed through London, and then shipped on to China. Elevated activity in this specific bar segment is taken by traders as an indication of official or quasi official buying.

Market practitioners interviewed by the FT also place little weight on Beijing’s published reserve numbers. Bruce Ikemizu of the Japan Bullion Market Association estimates that China’s true gold holdings are already roughly double the official total:

“This year, people are really not believing the official figures, especially about China,” said Bruce Ikemizu, director of the Japan Bullion Market Association, who believes China’s current gold reserves are nearly 5,000 tonnes, double the level it publicly reports.

On the institutional side, the State Administration of Foreign Exchange (Safe), which is part of the PBoC, officially manages the reserve accumulation program and reportedly operates with one year and five year targets. Yet the FT notes ( as this publication’s author has broken down multiple times going back to 2017 in detail) that actual buying is conducted through multiple channels.

Continues here.

Free Posts To Your Mailbox