Above 3,200 dollars, the tariff rate is 10 percent to 15 percent. …dore, nuggets, ingots, or cast bars will face the highest levy, making foreign finished goods more expensive

Authored by GoldFix for Scottsdale

JAKARTA- Indonesia will introduce a new export duty on gold products by the end of next year, marking a major policy shift for one of the world’s top producers as the government pushes to expand domestic refining and processing capacity. The announcement triggered immediate declines in gold-linked equities.

According to Nikkei Asia, Febrio Nathan Kacaribu, director general of fiscal economic strategy at the Ministry of Finance, told lawmakers that the policy is in its “final stage.” He said the duty will vary by product type. When gold trades between 2,800 and 3,200 dollars per ounce, duties will range from 7.5 percent to 12.5 percent. If the price exceeds 3,200 dollars, the rate increases to 10 percent to 15 percent. Febrio noted that “dore, nuggets, ingots, or cast bars” will face the highest levy, while minted bars will face the lowest.

Shares of domestic miners fell as investors assessed the margin impact. Archi Indonesia dropped 5.9 percent, and Merdeka Gold Resources declined 3.5 percent.

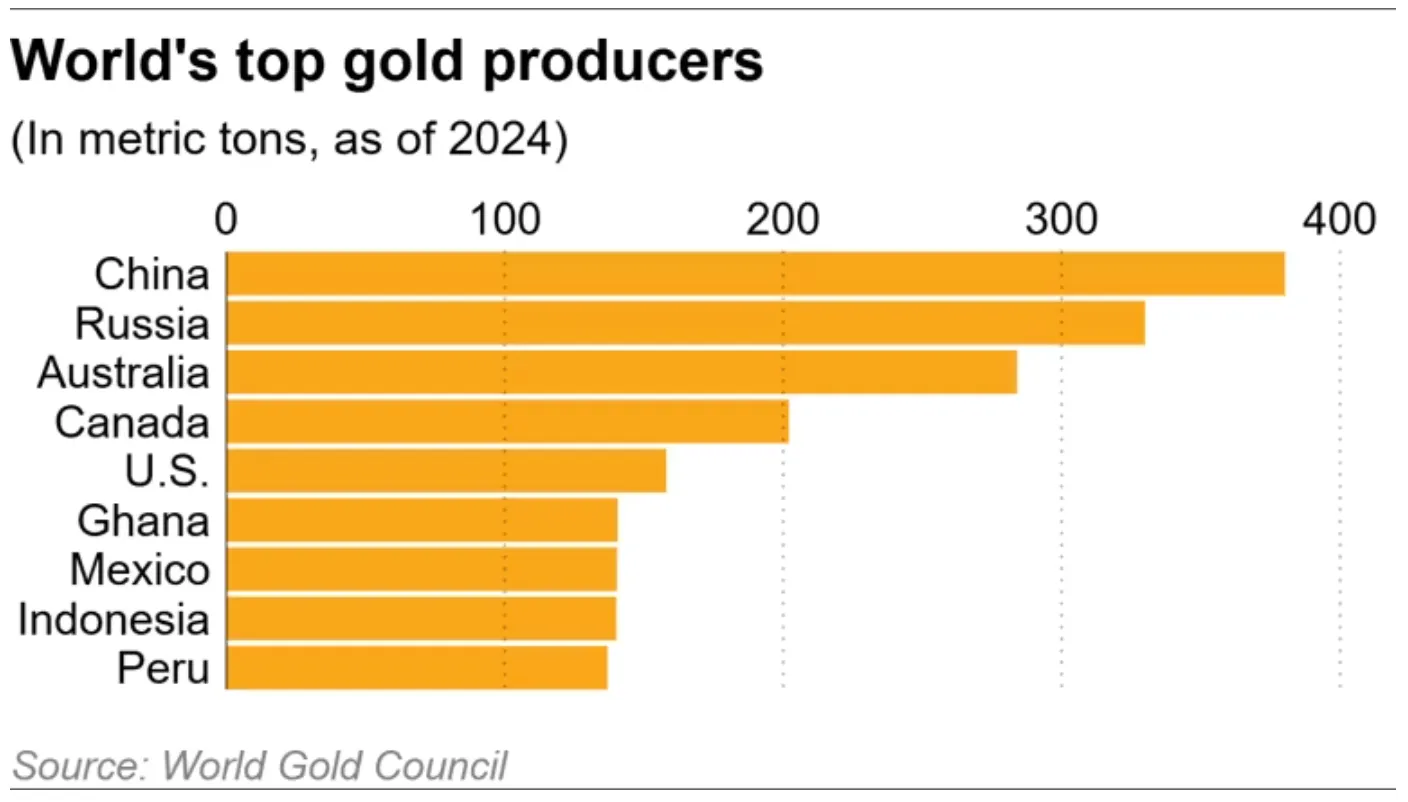

Gold has surged from 2,565 dollars per ounce last year to a record near 4,400 dollars before a recent pullback. Indonesia, the eighth-largest gold producer globally, has experienced rising investment and market activity around the metal. In July, the Indonesia Stock Exchange confirmed plans for a gold ETF launch. In September, Merdeka Gold Resources raised 4.66 trillion rupiah in the largest gold IPO of the year, which was 4.6 times oversubscribed. The company has since opened the Pani Gold Mine, targeting 7 million metric tons of ore per year.

At Aneka Tambang, the nation’s largest bullion producer, retail gold prices recently jumped 27,000 rupiah in one day to 2,287,000 rupiah, roughly ten times the usual daily move.

Rizal Kasli, chairman of the Indonesian Mining Experts Association, said the export duty is “reasonable” because local demand is rising faster than supply. He said Indonesia imports more than 40 metric tons per year despite producing more than 150 tons.

Industry groups expressed concern over the policy’s impact on higher-grade products. Hendra Sinadia, chairman of the Indonesian Mining Association, said refined bullion “should not be banned from export, nor should it be subject to export duties.”

Economist Josua Pardede of Permata Bank said the policy could “improve the trade balance by shifting exports toward higher value products,” but warned that higher duties cut into upstream revenues and “could weaken investment, delay new projects, and eventually reduce production.”

Febrio also noted the government plans to reinstate export duties on coal, reversing a 2006 abolition. He said the move aligns with Indonesia’s broader “downstreaming” strategy to expand domestic processing and value-added production.

Indonesia is doing a "Soft Nationalization" of their Gold. Imposing new Taxes on all kinds of Gold leaving the country. Nearly 4% of the global mine production of Gold is now STUCK in Indonesia.

— Josh Philip Phair (@JoshPhilipPhair) November 17, 2025

This is not very well understood yet...https://t.co/4DFSivekcO