CoreWeave Is Cracking

Submitted by QTR's Fringe Finance

When I first wrote about CoreWeave in July, in One Tech Stock I’m Hell Bent on Avoiding, I said the business had the odd, unmistakable feel of a company being held upright by the very firms it depended on.

What somehow became a hot AI-infrastructure IPO started as a deal rushed out the door only because Nvidia stepped in with a last-minute nine-figure purchase to prevent an embarrassing failure. It didn’t make sense the stock would have a bid approaching $200 when it needed at bailout to IPO at $40.

The closer people looked, the more that saw CoreWeave appeared to operate in a closed loop of mutual dependency—Nvidia, Microsoft, OpenAI, and CoreWeave each serving as the other’s customer, supplier, lender, and investor.

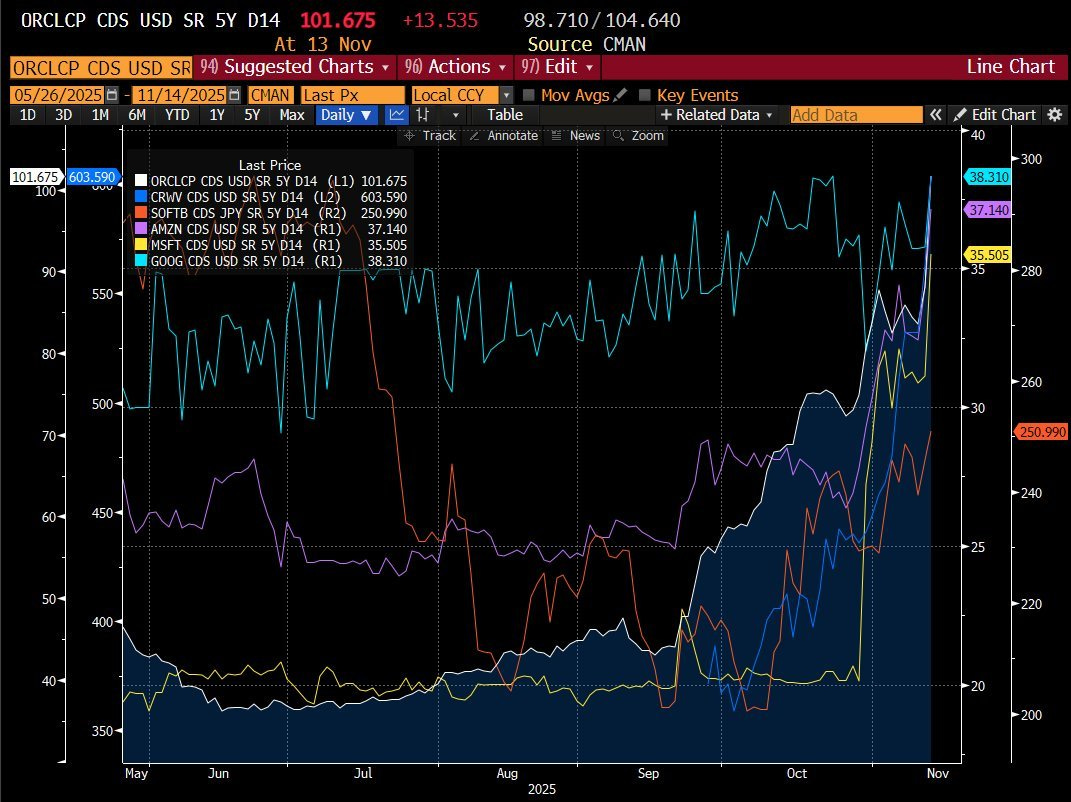

Then, last week, I pointed out that CoreWeave’s 5 year credit default swaps had quietly begun to blow out. What had been a 250–300 bps name earlier in the year ballooned to around 360 bps in early October, then to roughly 510 bps—meaning investors suddenly demanded over a five percent annual premium just to insure against a default within five years. For a recently IPO’d company propped up by its own supplier, that was an unmistakable sign of rising fear.

And now things have worsened...(READ THIS FULL PIECE HERE).