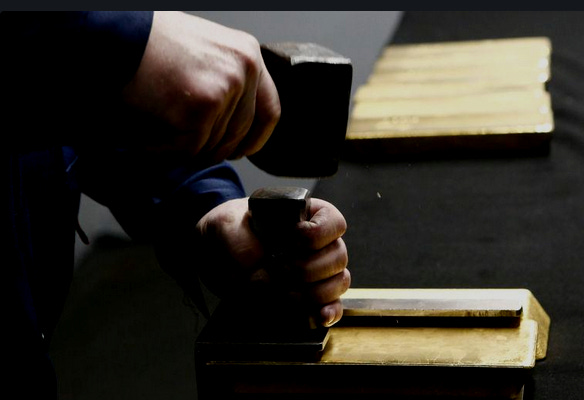

Putin Steps Up Deals, Cites Rising Gold Liquidity

In a story by Reuters, the Bank of Russia said its purchases and sales of gold for the National Wealth Fund have “been increasing in recent years” as domestic market liquidity improves. The central bank noted that Western sanctions, which froze its dollar and euro assets, accelerated the pivot toward what it described as the fund’s two remaining liquid assets: “yuan and gold are liquid assets of the NWF.”

Meanwhile.. Russia has simultaneously stopped selling its gold abroad

Why Has Russia Stopped Selling Gold?

The withheld Russian supply may represent the initial stock underpinning a new market architecture. If realized, gold would re-enter the international monetary system not as a reserve of last resort but as an operational funding instrument. The SocGen data describe a change in trade behavior; the GoldFix framework identifies the system it may feed into. Together, they outline a potential transition from Western Treasury-based liquidity to a Eurasian structure centered on gold.

The transition began in 2023 when Russia removed the dollar, euro, and other Western currencies from the reserve structure. Fiscal reserves are now split between gold and China’s yuan, with explicit targets of 40 percent and 60 percent. According to Reuters, the central bank said the process of converting yuan or gold into roubles requires it to execute matching operations inside the domestic market.

Officials added that the rally in global gold prices has boosted local turnover, which in turn enables “the central bank to intensify its transactions in gold.” Reuters reported that the bank did not disclose when transaction volumes started to rise.

“Due to the rally in global gold prices, the turnover of gold in the domestic market has grown.”

The central bank cannot source metal internationally because of sanctions [Yet Russia has sold none in 2025 thus far] Although Russia is the world’s second-largest gold producer, the domestic market historically lacked enough depth for large-scale official operations. That has changed. “Since the liquidity of the domestic gold market has increased in recent years,” the bank said, it now executes part of its operations directly through buying and selling metal rather than relying solely on yuan-rouble transactions.

Related:

As of November 1, liquid NWF assets in yuan and gold totaled 51.6 billion dollars, equal to 1.9 percent of projected GDP. These assets may be deployed to cover deficits as needed.

Russia’s NWF continues to receive roubles from excess oil revenues, while the central bank executes all currency and gold operations for the fund. Reuters noted the bank has been selling gold and foreign exchange on a net basis through 2025.

“The share of gold at over 41 percent.”

The foreign currency and gold held on behalf of the NWF are counted within Russia’s 720-billion-dollar official reserves, which include frozen assets abroad. The share of gold in these reserves now exceeds 41 percent, reflecting both valuation gains and increased domestic turnover.

Putin Steps Up Deals, Cites Rising Gold Liquidity

— VBL’s Ghost (@Sorenthek) November 19, 2025

[Unlocked]https://t.co/QU1tw6OzxA

Continues here.