Italy's Gold Tax: Pay Now and Pay Later…

The first section below covers the straight news. The second section, “Pay Now and Pay Later…,” is our exclusive breakdown detailing broader implications. Those implications are deeply troubling.

1- Italy Floats Plan to Bring Private Gold Into Public Coffers

GFN – ROME

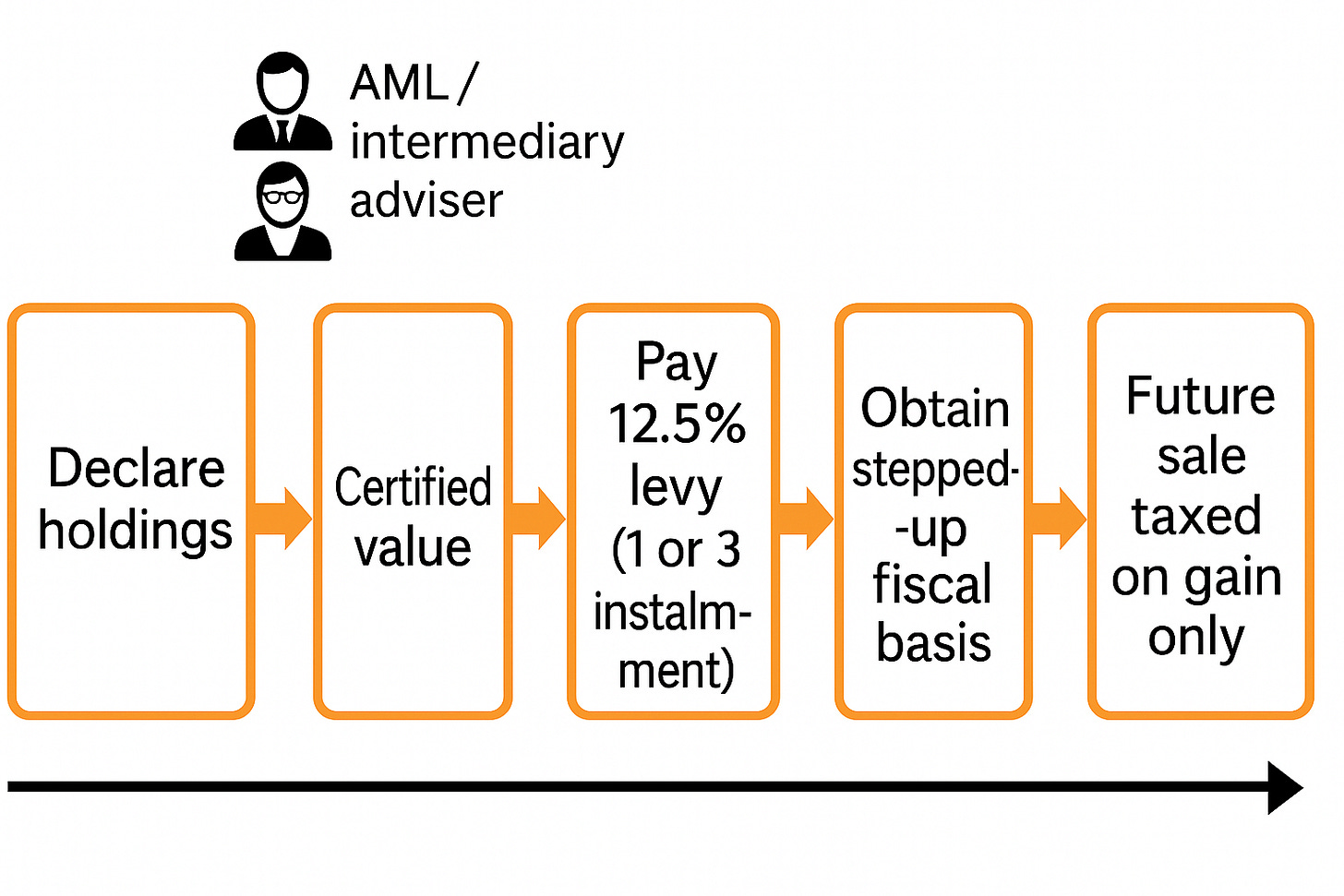

In a story by Reuters, Italy’s draft 2026 budget amendment outlines a 12.5 percent substitute levy that would allow households to formally declare bullion, jewellery and collectible coins lacking purchase records. According to the report, “the certification has to be done by June 2026,” placing a firm deadline on an initiative aimed at coaxing privately held gold into the system.

Lawmakers backing the plan argue that current rules are punitive. Under today’s regime, individuals who cannot prove a cost basis may face a 26 percent tax on the entire sale value. The amendment notes that this has “discouraged people from selling their inherited gold on the official market” and pushed activity toward informal channels. A stepped-up basis after certification would remove that barrier.

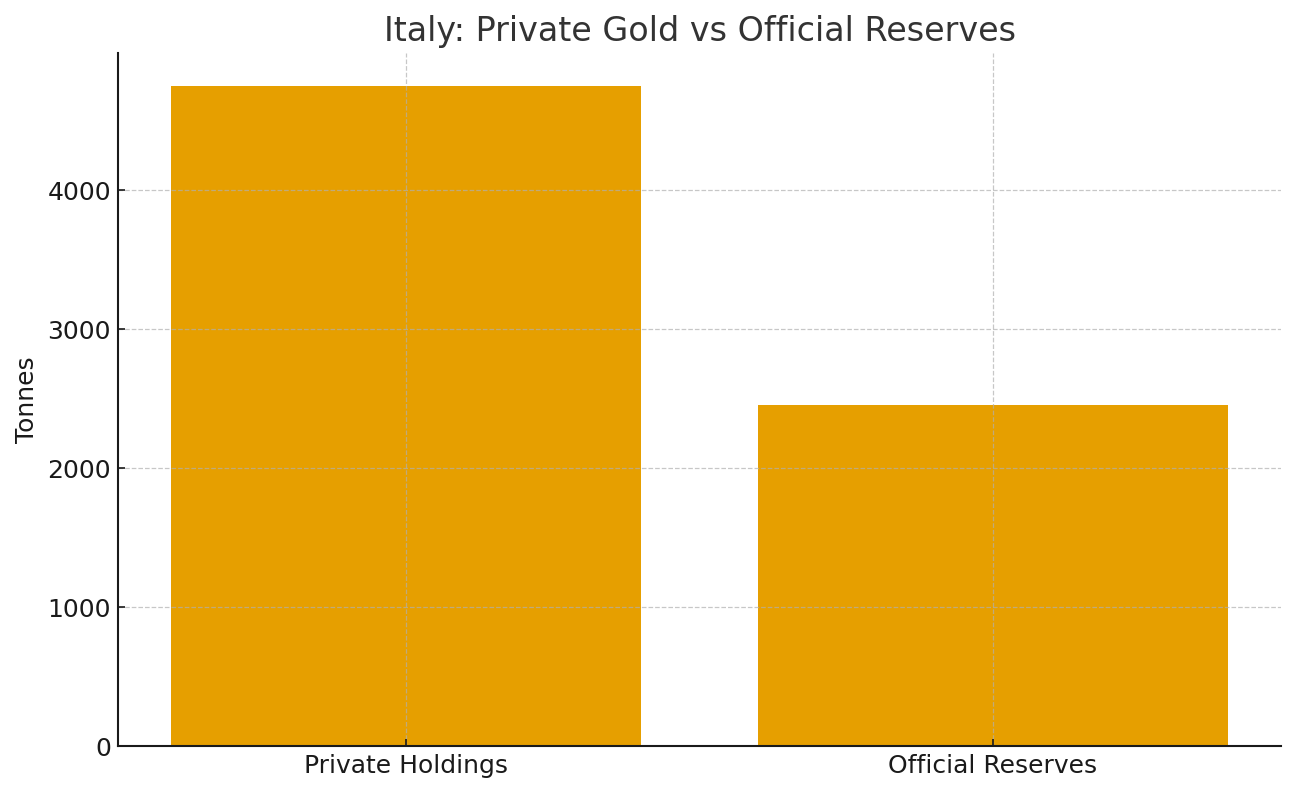

Estimates cited in the draft place Italy’s private gold hoard between 4,500 and 5,000 tonnes, worth roughly 500 billion euros at current prices. Based on an assumption that only 10 percent of investment-grade holdings participate, the Treasury could net as much as 2.08 billion euros in one-off revenue.

Italy’s expanding “Compro Oro” network has seen activity surge as prices hit records. Reuters notes that used-gold sales jumped roughly 25 percent in 2025, with more than 1.2 million transactions per month as households converted old jewellery and coins into cash.

If approved, the measure would allow taxpayers to pay the levy in one or three installments. Certified holdings would be granted a new fiscal value for future sales, and transactions would be conducted through authorized intermediaries under strict anti–money laundering checks.

Officials say the move would strengthen transparency in a market where off-book holdings remain substantial. The proposal must still clear parliamentary scrutiny and government vetting.

2- Analysis: Pay Now and Pay Later…

The measure described above is billed as a voluntary certification process, but its design forces households to choose between a smaller sanctioned loss today or a larger punitive tax later. The policy reflects a shift toward converting long-standing private stores of wealth into transparent, taxable, and fully trackable assets at a time when governments across advanced economies are searching for new sources of fiscal stability.

Italy’s proposed one-time levy on undeclared private gold is being presented as a routine fiscal measure, but the mechanics point to something far more consequential. The country is moving to convert a vast pool of private, off-book wealth into a fully documented asset class that can be taxed, monitored, and controlled. The policy is framed as optional. It is not. The structure forces private holders to choose between two forms of loss: a smaller sanctioned haircut today or a larger punitive one later.

A Forced Conversion of Private Wealth

At its core, the measure compels individuals to bring inherited or informally accumulated gold into the official system. A 12.5 percent levy serves as the price of legalization, while a 26 percent tax on future sales for those who decline creates a pressure mechanism. Individuals are being asked to surrender a portion of their accumulated savings in exchange for official recognition and a revised cost basis. The choice is engineered so that the lower loss today appears rational when compared with the higher loss tomorrow.

This is not a revenue measure alone. It is a structural attempt to reduce the size of an unmonetized, untracked store of value that has existed for generations. Italy’s private gold hoard, estimated between 4,500 and 5,000 tonnes, represents one of the largest concentrations of household bullion in the world. For a government dealing with persistent structural deficits, weak growth, and growing social expenditures, that is an irresistible pool of dormant capital.

The Transparency Penalty

The immediate cost is measurable. The deeper cost is structural.

Declaring one’s gold eliminates the anonymity premium that private holders have relied on for decades. Once disclosed, this wealth transitions from a private asset to a financial instrument captured inside the state’s data infrastructure. It becomes taxable in the future. It becomes traceable across generations. It becomes subject to policy shifts that respond to fiscal pressure rather than long-term planning.

Breaking: Italy's Gold-Tax Scheme is a Very Bad Sign.https://t.co/hFtuVTASj4

— VBL’s Ghost (@Sorenthek) November 20, 2025

Transparency converts optionality into obligation. Families that once had the ability to sell, transfer, or hold gold discreetly will now have a trail that cannot be severed without consequence. Individuals also expose themselves to the risk of future wealth taxes, inheritance recalculations, or new EU harmonization rules on personal assets.

For the owner, the loss is money and loss/end of discretion.

Free Posts To Your Mailbox