Authored by GoldFix for Scottsdale

We keep gold at Attractive and stay long the metal in our global asset

allocation, and believe it remains an effective portfolio hedge (even

at current levels)

UBS analysts Wayne Gordon, Giovanni Staunovo, and Dominic Schnider report that gold has held above 4000 dollars per ounce following a dramatic appreciation in 2025. They reiterate their claims of less than a month ago when they said in Gold’s Pause Before the Next Advance “The recent pullback has not altered the long-term narrative”. But in this update, they raise their price targets for both 2026 and 2027.

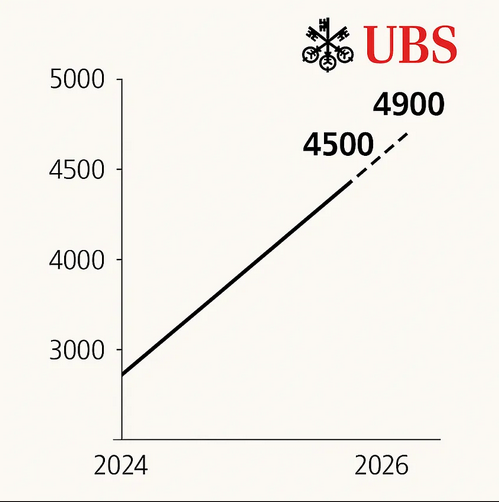

The metal has risen nearly sixty percent year to date, making it the strongest performing global asset. The team expects further strength through 2026 and has raised its mid-year price target to 4500 dollars per ounce, previously 4200 dollars.

“The gold price has stabilized above 4000 dollars per ounce after a phenomenal run in 2025.”

They point to the likelihood of additional Federal Reserve rate cuts, lower real yields, elevated geopolitical uncertainty, and election-related volatility as supportive factors. These conditions should underpin institutional and retail investment demand. UBS also anticipates a rebound in jewelry consumption during the second half of 2026.

This follows on recent upgrades by UBS for Platinum and even Palladium and less than a month which gave hint of deeper themes unfolding; Namely that the West was waking up to real money again

UBS Price Hikes Hint at Deeper Theme: America Is Buying

UBS analysts Giovanni Staunovo and Wayne Gordon, fresh on the heels of raising their Silver Price targets (and correctly calling for a new ATH) have now raised their price targets for both platinum and palladium for divergent reasons. The reports, released by the UBS Chief Investment Office on 30 October 2025, point to diverging drivers in the two markets: policy-driven tightness in platinum and sentiment-driven accumulation in palladium.

Gold remains rated Attractive within the bank’s global asset allocation. UBS maintains long exposure and presents the metal as a practical hedge within diversified portfolios. The year-end target is increased to 4900 dollars per ounce from 4700 dollars. The downside case remains 3700 dollars per ounce.

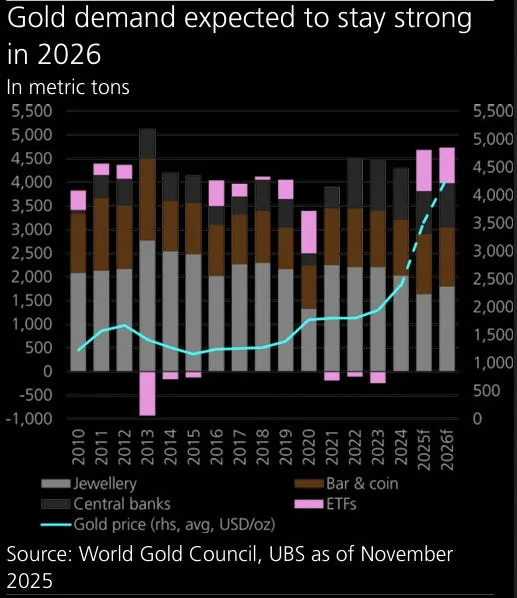

UBS expects total gold demand to expand next year. Anticipated Federal Reserve easing, lower real rates, and political uncertainty are expected to support the next phase of investment flows. The analysts highlight rising fiscal risks in the United States and note that deteriorating public finances can extend the preference for assets with no counterparty exposure.

“With the outlook for US public finances looking worse, this could extend the current buying trends of central banks and investors.”

ETF demand is expected to strengthen in 2026. Using historical relationships, UBS forecasts net inflows of roughly 750 metric tons. The figure is lower than the 870 metric tons projected for 2025 but still at least twice the annual average seen in the decade following 2010.

Central bank and sovereign wealth purchases are projected to remain robust. The strong structural bid that emerged after 2020 is expected to continue, although at a moderated pace relative to the extraordinarily heavy buying of 2023 and 2024. UBS estimates that reserve managers will still purchase more than 400 metric tons as the market heads into late 2026. This remains significantly above the long-term annual average of roughly 450 to 500 metric tons recorded between 2010 and 2021.

“Material unwind of the post-2020 environment is not expected.”

The analysts identify two primary risks to the outlook.

- A more forceful Federal Reserve stance could limit upside potential.

- Large surprise sales by any major central bank could also disrupt the structural bid.

UBS expects the market to consolidate near 4300 dollars per ounce during the political calendar of the fourth quarter of 2026. However, a rapid rise in political or financial stress could bring the upside scenario of 4900 dollars per ounce into view.

- Originally: UBS Raises Gold’s Roof Once Again

Continues here.

Free Posts To Your Mailbox