EU and India Bypass SWIFT-USD Payment Rails

Breaking: EU and India Bypass SWIFT

Authored by GoldFix

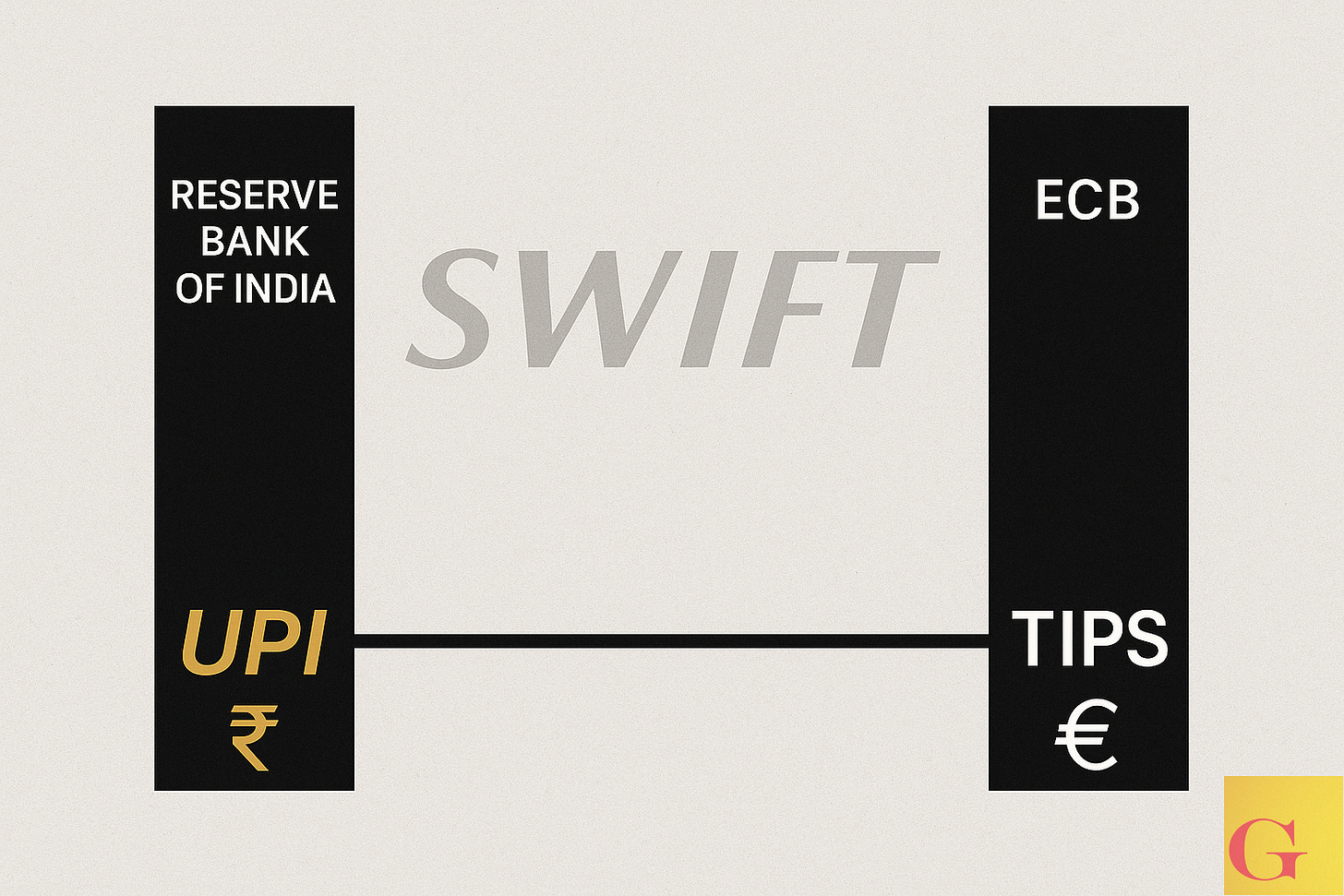

The European Central Bank has entered new territory by moving to link its TARGET Instant Payment Settlement system with India’s UPI network, marking the first time the EU’s instant-payments infrastructure has been directly connected with a BRICS nation

NEWS:

GFN--Mumbai: India and the Euro Area have agreed to begin formal work on linking the country’s Unified Payments Interface (UPI) with the Eurosystem’s TARGET Instant Payment Settlement (TIPS) rail, according to a statement released by the Reserve Bank of India. The move will create a direct cross border instant payment channel between INR and EUR retail systems once technical integration is completed.

ANALYSIS: Implications of the News.

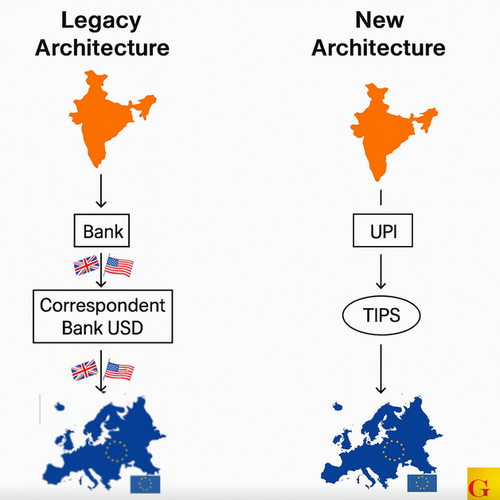

"The legacy path relied on SWIFT messaging and USD triangulation. The new path relies on sovereign retail rails that settle in local currency and bypass the U.S. banking system entirely. Once the geometry changes, the behavior often follows,"

The decision by the Reserve Bank of India and the European Central Bank to interlink UPI with TIPS is not a marginal development in global payments. It is a fully operational bridge between two sovereign instant-settlement systems, one belonging to a major emerging-market economy and the other belonging to the Euro Area.

The connection creates an alternative path for INR–EUR flows that operates without SWIFT messaging, without USD intermediated conversion, and without the historical dependence on correspondent banks concentrated in the United States. The significance does not come from the size of the flows that will immediately travel across the new corridor. The significance comes from the introduction of a usable, functional alternative. Once an alternative path exists, incentives change and behaviour follows.

A New Type of Linkage Between Two Major Payment Zones

The ECB has rarely extended the internal architecture of its instant-settlement systems to non-European jurisdictions. TIPS was designed as a pan-European retail rail that would reinforce SEPA Instant and improve the cohesion of the monetary union. The decision to connect TIPS to India’s UPI marks a departure from Europe’s traditional pattern of internal consolidation. It places India inside a technical perimeter that has been guarded carefully for institutional, liquidity, and supervisory reasons. This is not a political alliance, yet it is a structural alignment, and structural alignments matter in payment systems because they determine the channels through which money can move.

UPI and TIPS are both mature infrastructures. They do not require development. They only require interconnection. Once connected, a retail user in India can initiate a payment in INR that settles instantly inside the Euro Area’s sovereign infrastructure, and a retail user in Europe can do the same in reverse. That capability alone represents a reshaping of the global payments map.

How the New Rail Differs From the Old One

The legacy cross-border retail model relies heavily on SWIFT messaging and USD correspondent banking. When a sender in India transfers funds to a receiver in Europe, the historical path follows three conversion points: INR to USD, USD to EUR, and USD clearance through a correspondent bank in New York. Even when banks quote INR/EUR pairs directly, the price is derived through USD pairs because liquidity runs deeper through USD markets and because most banks maintain USD nostros rather than EUR nostros.

The UPI–TIPS corridor bypasses the entire structure. It performs the transfer without SWIFT, without USD, and without New York-based correspondents. The cost, friction, and settlement path are fundamentally different.

Market Rundown | SWIFT Gets Competitionhttps://t.co/0NFcYTEd1T

— VBL’s Ghost (@Sorenthek) November 25, 2025

Why Europe Is Building Options

Europe does not broadcast its geopolitical hedges. It engineers them. The past decade has shown the Euro Area the risks of dependency on single-point external systems, whether those were energy supply networks or global financial messaging networks. The U.S. use of extraterritorial sanctions, the Iran episode, and the broader conversation about strategic autonomy have encouraged Europe to diversify its financial plumbing discreetly. The UPI–TIPS linkage fits that pattern. It is a development that provides Europe with optionality rather than a public declaration of strategic divergence.