Tucker Carlson Says USD is Doomed, Starts Gold Company

Tucker Carlson Says USD is Doomed, Starts Gold Company

GFN – NEW YORK: Carlson’s move, as detailed in the Wall Street Journal, is framed as a response to what he sees as the decline of trust in central banks and the fading reliability of post-war monetary structures. As one report put it, “the dollar is doomed, collapse is a matter of time,” capturing the tone of Carlson’s argument that traditional currencies are entering a long cycle of debasement. He contends that central banks have abandoned their stabilizing role, turning into institutions that undermine the very confidence they were built to maintain. Gold, in this narrative, regains importance as both symbol and store of value.

Analysts note that Carlson’s entry into the metals business is uniquely amplified by his vast communication reach. After leaving Fox News, he built an independent media platform with millions of viewers. This creates a feedback dynamic in which public commentary and commercial activity reinforce each other. As one observer noted, “his platform transforms opinion into market influence.” Even indirect references to systemic risk can boost retail demand for gold or silver, a mechanism that operates alongside his company’s commercial interests.

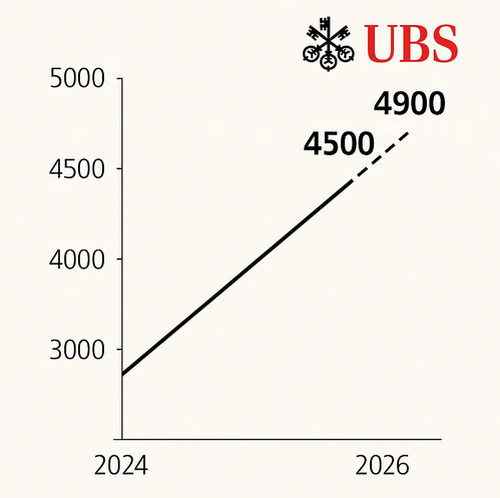

UBS Raises Gold to $4500-$4900 for 2026-27

UBS analysts Wayne Gordon, Giovanni Staunovo, and Dominic Schnider report that gold has held above 4000 dollars per ounce following a dramatic appreciation in 2025. They reiterate their claims of less than a month ago when they said in Gold’s Pause Before the Next Advance “The recent pullback has not altered the long-term narrative”. But in this update, they raise their price targets for both 2026 and 2027.

Economists view Carlson’s positioning as a textbook expression of flight-to-quality behavior. In periods of monetary uncertainty, investors shift away from risk assets and seek stores of value that operate outside inflationary decay. The difference in Carlson’s case is the communication overlay. His statements, delivered from a highly influential platform, may shape expectations directly and accelerate the very behavior he is describing. That raises questions about conflicts of interest, since he now holds a financial stake in an asset class he is simultaneously encouraging his audience to consider. Analysts warn that such dual roles can distort perception and drive demand that does not originate from neutral analysis.

Over the past 25 years, since January 2000, the price of gold has nearly doubled the S&P average. Why don’t most people know that? There’s a reason, says Chris Olson, one of the country’s biggest gold wholesalers. This is an amazing story.

— Tucker Carlson (@TuckerCarlson) November 24, 2025

(0:00) Introduction

(4:49) How Has… pic.twitter.com/qnjxWXNgGg

The broader trend, however, extends beyond Carlson’s audience. Global demand for precious metals is rising as inflation, uncertain policy cycles, and institutional distrust reshape investor psychology. Gold purchases now function as an implicit vote against the existing system rather than a technical trade alone. Investors are increasingly turning to gold, cryptocurrencies [EDIT- Crypto really?], and alternative assets as a hedge against monetary unpredictability.

About Carlson's Company

Tucker Carlson has launched Battalion Metals, a precious-metals dealer offering gold, silver, and platinum products, including “precious metals IRAs” and storage inside its proprietary “Battalion Bunker.”

According to Forbes, Carlson co-founded the company with North Dakota bullion dealer Christopher Olson. The firm markets physical metals for home storage or bunker storage and pitches metal-backed IRAs as protection against inflation, banking stress, and currency instability.

Market Rundown | Sovereigns Print Fiat to Buy Gold Now. pic.twitter.com/TlqTpIAo6P

— VBL’s Ghost (@Sorenthek) November 24, 2025

In an interview cited by Forbes, Carlson repeated his claim that the U.S. dollar is “doomed” and that the world is approaching “the end of the postwar order.” He also alleged that major gold advertisers on cable networks sell products to elderly viewers with “massive markups,” saying Battalion Metals intends to avoid that model.

Gold prices hit record highs above four thousand dollars per ounce this year before pulling back. Carlson’s launch follows several post-Fox ventures, including a streaming network and a nicotine-pouch brand.

end//////////////

Free Posts To Your Mailbox