Will the Fed Cut Rates in December?

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 10,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

We follow rate cut decisions because short-term interest rates are a big driver of stock prices. To wit, the SPX topped out on Oct 29, the exact date that Powell dashed hopes for the Dec rate cut. It stands to reason that a rate cut would spark the next leg of the rally.

Since Powell’s speech, various Fed members have publicly announced their own preferences for a cut or hold. This manner of “walking back” Powell’s statements is how the Fed guides the markets regarding future rate decisions. So we need to pay attention.

By our estimates, 7 out of 12 members are in favor of a cut. This includes NY Fed President John Williams, who holds a lot of sway on the board:

“I still see room for a further adjustment in the near term to the target range for the federal-funds rate to move the stance of policy closer to the range of neutral…”

-NY Fed Pres John Williams, Nov 21

Combine this with a rising unemployment rate (as discussed earlier) and a 6-week government shutdown that hurt GDP by approx. 1.5%, we think there’s a decent case to be made that Dec will be a cut. In spite of what Powell would have us believe. However, further cuts in 2026 will be uncertain and that marks a shift from the easy glidepath that we were on just a month ago.

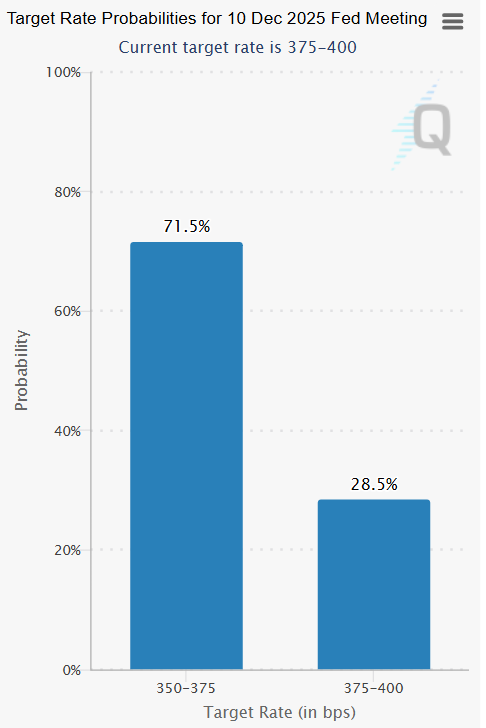

Market odds for the Dec cut have been volatile. They were nearly 100% heading into the prior FOMC meeting, until Powell spoke and odds fell to just 30%. But since Fed members have spoken in favor of a cut, the odds have shot back up to 72%:

But let’s not forget the bigger picture. The Fed’s quantitative tightening (QT) ends on Dec 1, and the large accumulation of liquidity (due to government shutdown) is about to be dispersed. This should turn a liquidity headwind into a tailwind for the remainder of the year.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!