Consumer Spending is Cautious

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Consumer Spending

As the largest retailer in the country, Walmart’s earnings give us insight into consumer spending patterns. Entering the event, investors were nervous about the health of the consumer, in particular lower income households. We touched on this in last week’s letter. Walmart’s customer base skews low income, so they make a good barometer.

Their earnings were strong, with the stock ending the day 6.5% higher. Consumers are buying more frequently and making larger purchases per visit. But this is not necessarily good news, as it indicates a trade-down effect, where people switch to lower priced alternatives. Management called out inflation and wage disparities that continue to put the pinch on low-income households.

Separately, Home Depot (the largest home improvement retailer) reported disastrous earnings and a guidance cut. There continues to be ongoing challenges in the US housing market as transactions are stagnant. This has dampened discretionary spending on home renovation projects. The consumer remains cautious as high borrowing costs and credit uncertainty forces people to cut back.

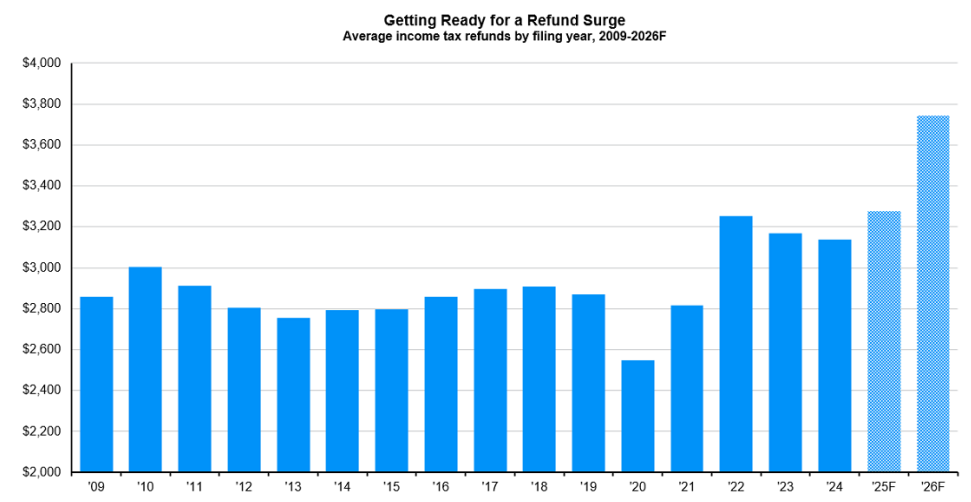

Looking ahead, the One Big Beautiful Bill Act (OBBBA) is giving consumers a $100B tax rebate in the coming year. Most of this will be paid out between Feb and Apr 2026. This is a significant amount of discretionary dollars in the pockets of consumers, some of which will make its way into the stock market. There is strong statistical correlation between tax refund timing and monthly stock market performance.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!