Tether Holds More Gold Than Some Central Banks

INTRO:

Authored by GoldFix

(Part 1 of 2) Tether has accumulated 116 tonnes of gold, making it the largest non-sovereign buyer and a meaningful force in short-term supply. Jefferies, (two months after raising their target, saying “Gold should rise to $6,571” (link below) notes Tether’s rapid purchases, regulatory limits, and rising XAUt issuance point to a broader strategy: pushing tokenized physical gold as an emerging settlement and value-storage instrument.

Also recall just weeks ago we reported Tether hired senior traders from HSBC. Now Jefferies explores exactly how much gold Tether controls. Tomorrow we will break down what it implies in the big picture.

I. Overview of Jefferies’ Core Findings

Jefferies’ research examines the scale, pace, and strategic intent behind Tether’s recent accumulation of physical gold. The firm concludes that Tether has become a buyer large enough to affect short-term supply and sentiment in the global gold market. The report also evaluates why Tether is accumulating bullion despite regulatory constraints that prevent its use as a reserve asset for forthcoming stablecoin products.

“Tether is the largest holder of gold outside central banks" - Jefferies

II. Size of Tether’s Gold Reserves

Jefferies identifies approximately 116 tonnes of gold in Tether’s end-September attestation. The assessment places Tether’s bullion position on par with several smaller sovereign reserves.

“The vault is now roughly equal to smaller central banks, such as Korea, Hungary, and Greece.”

This tonnage establishes Tether as a material participant in the physical market. However, according to Jefferies, size alone is not the critical factor. The pace of accumulation is what matters.

III. Pace of Buying and Market Impact

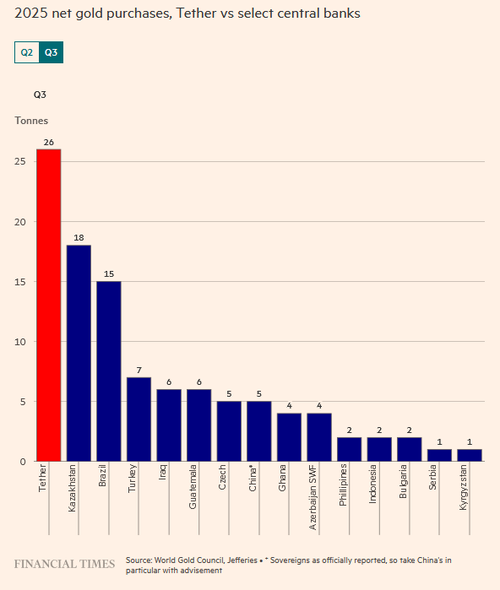

Tether’s physical gold purchases in the most recent quarter represented:

• Nearly 2 percent of total global gold demand

• Roughly 12 percent of central bank purchases during the same period

Jefferies categorizes this as incremental demand that did not previously exist. The firm attributes recent tightness in near-term supply conditions and changes in investor sentiment partly to Tether’s activity.

“Aggressive buying by Tether over the past two months is likely to have tightened supply in the short-term and influenced sentiment.”- Jefferies

Jefferies also cites discussions with investors indicating that Tether plans to acquire approximately 100 tonnes of gold in 2025. The firm notes that strong stablecoin profitability makes this target attainable.

IV. Regulatory Constraints and the Genius Act

Jefferies notes a contradiction between Tether’s gold accumulation and its product roadmap. The US Genius Act restricts stablecoin issuers from using gold as a reserve asset. This means Tether cannot back the planned USAT token with its bullion position.

The report frames this as a structural limitation that forces Tether to differentiate between:

• Gold held as a balance sheet asset

• Reserves qualifying under US regulatory standards

This contradiction becomes central to Jefferies’ interpretation of Tether’s strategic intent.

V. Jefferies’ Interpretation: A Bet on Tokenized Physical Gold

Jefferies argues that Tether is positioning itself to catalyze broader adoption of tokenized bullion. The firm states that physical gold ownership remains operationally difficult for most retail investors due to:

• Storage and insurance expenses

• Minimum size constraints for ETFs

• T plus one settlement limitations for exchange traded products

• Roll costs for futures contracts

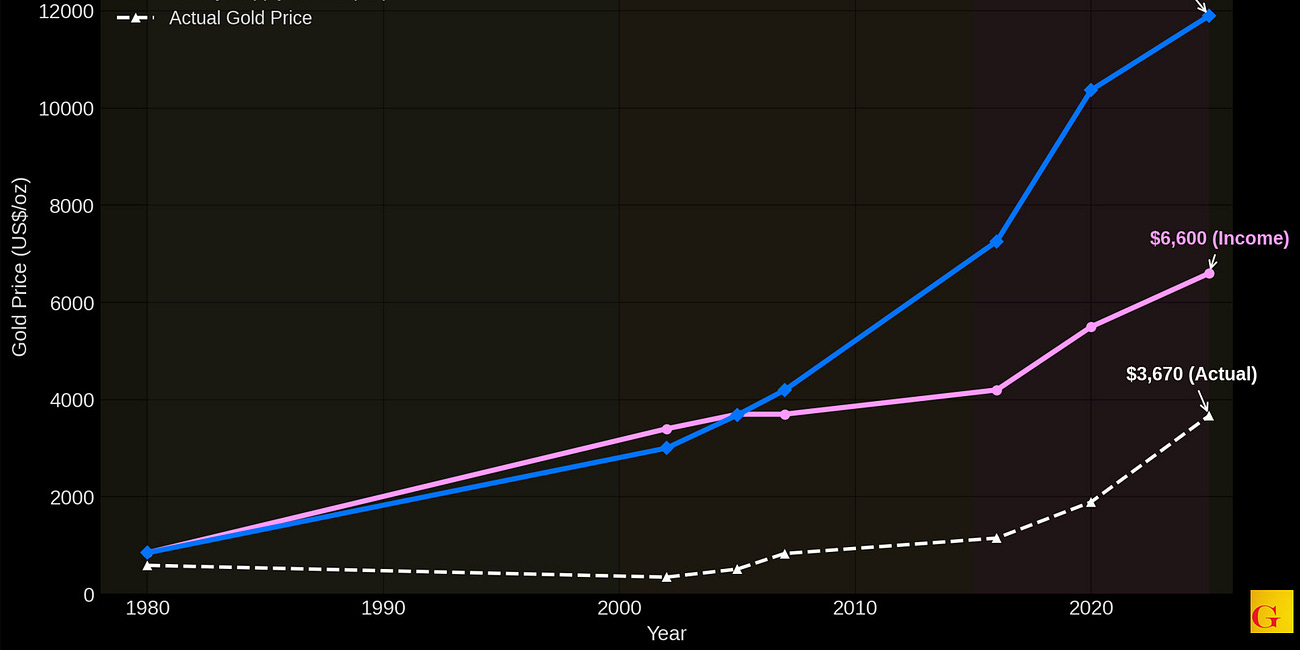

Jefferies Raises Target, Says "Gold should rise to $6,571” in New Report

Considering less than two months ago, the firm called for Gold's price normalizing above $6,000 as a proxy for US households adding gold to their porfolio, tokenization might be what they had in mind sense. In a note to clients on September 18th titled India deepening and gold targets, Chris Wood of Jefferies updated investors on the firm’s dollar model as it relates to Gold price. We break that down and then some

Tokenized gold, in Jefferies’ view, offers a cost-reduced and continuously tradable alternative.

VI. The XAUt Token and Patterns in Issuance

The XAUt token, introduced in 2020, represents one troy ounce of gold per unit. Tokens in circulation have approximately doubled over the past six months. Jefferies notes that issuance has occurred in large increments rather than incremental flows.

Jefferies’ blockchain analysis suggests Tether has added more than 275,000 ounces of gold worth roughly 1.1 billion USD to XAUt reserves since early August.

The firm observes that:

• Large issuance blocks create tracking error potential

• Physical purchases associated with these batches must occur in sizeable lots

• These lots, while symbolically large, are small relative to a physical market that clears about 60 billion USD monthly

VII. Internal Tokenization and Block-Trade Inefficiencies

Jefferies states that not every new XAUt token requires Tether to purchase fresh gold. Some tokens may represent gold already held within Tether’s ecosystem, such as bullion associated with USDt reserves.

“An inefficient and expensive block-trade strategy would look a lot like the chart above.”

Even with internal reuse, Jefferies notes that Tether’s batch-style issuance resembles an inefficient block-trade strategy when observed on-chain. No doubt the traders they jsut hired are there to reduce this inefficiency

VIII. Strategic Outlook Identified by Jefferies

Jefferies comes to four conclusions:

- Tether’s gold buying has contributed to short-term tightness and improved sentiment in the gold market.

- The company’s long-term ambition may involve promoting a gold-backed crypto medium of exchange.

Concludes here. with Part 2 titled What Tether Buying Really Means published Friday