Silver Uncoils: The Drive to $65 Begins

Silver Uncoils Driving Towards $65/oz in 2026

Authored by GoldFix

Coiling is Over, Advancing Now

Silver prices have entered a consolidation phase near the USD 50/oz level following a historic upside run earlier in the year. Price momentum has cooled, but the broader macro framework supporting the move remains in place. Declining real interest rates, persistent sovereign deficit pressures, and structural questions around fiat purchasing power continue to underpin investor interest in precious metals. While silver’s speculative energy has moderated, the pause reflects digestion rather than exhaustion, with the medium-term trend still biased higher provided capital flows reaccelerate.

UBS Outlook and Price Targets

In the latest note from UBS, Dominic Schnider and Wayne Gordon raised their silver price forecasts by USD 5–8/oz, projecting average prices of USD 60/oz in 2026, with upside excursions toward USD 65/oz possible but unlikely to persist. UBS frames the outlook around the need for stronger investment demand to push prices decisively beyond prior highs, alongside expectations for renewed industrial demand growth into the second half of 2026. While the macro environment broadly remains supportive, the bank cautions that a future stabilization of U.S. interest rates near a neutral level of approximately 3% could temper investor urgency if growth conditions improve materially.

“We have increased our silver price forecasts by USD 5–8/oz and now expect the metal to trade at USD 60/oz in 2026with upside excursions toward USD 65/oz possible ”

- UBS

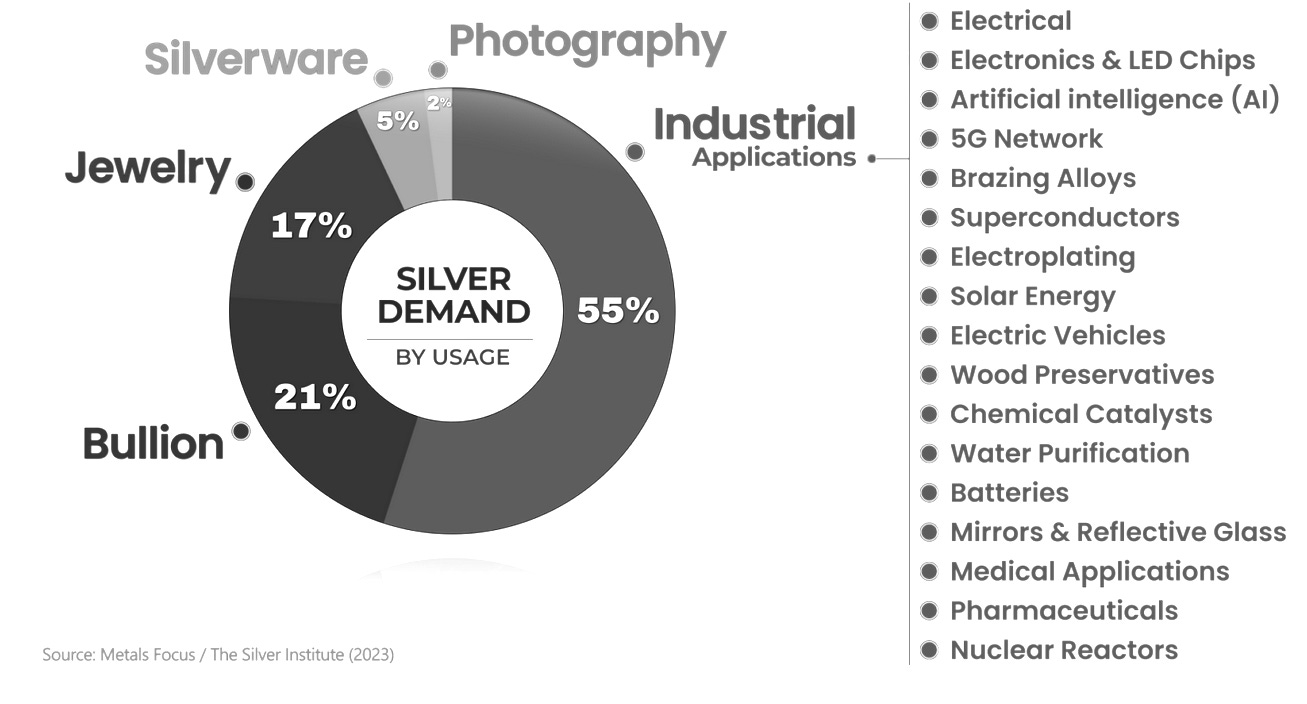

Demand Dynamics: Industrial Strength Meets Investment Dependence

UBS projects global silver demand to rise modestly to approximately 1.34 billion ounces in 2026 from 1.33 billion ounces this year. Incremental growth is concentrated in electrical and electronics applications, while photovoltaic demand is expected to remain stable near 190–195 million ounces annually. Additional tailwinds may emerge from expanding data-center construction driven by artificial intelligence infrastructure spending and from automotive electrification trends.

These increases are partially offset by weakness across discretionary segments. Jewelry demand is forecast to decline by 6% this year and a further 3% in 2026, while silverware consumption is expected to fall by 13% this year and another 9% next year due to persistent softness across India and broader international markets. Investment demand remains the primary swing factor. UBS estimates net physical and ETP inflows will grow to approximately 420 million ounces in 2026, up from roughly 400 million ounces this year.

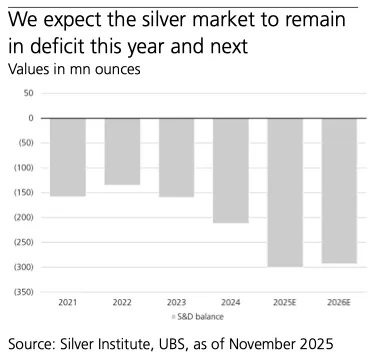

Supply Outlook: Marginal Growth, Structural Deficits

On the supply side, mine production is forecast to hold near 820 million ounces in 2025 before rising approximately 1.8% to 835 million ounces in 2026. Output gains in Mexico and Russia are expected to offset declines in Peru and Indonesia, leading to limited net expansion. Recycling supply should increase about 1% this year, reaching a 13-year high, driven by elevated scrap recovery from western silverware recycling flows.

Despite incremental supply growth, UBS expects the physical market to remain in structural deficit. The 2025 shortfall is estimated near 300 million ounces, narrowing only modestly to approximately 293 million ounces in 2026, a deficit profile that continues to underscore the tightness of the global silver balance.

Price Modeling: Gold Anchor and Ratio Path

UBS derives its silver price outlook from its gold target and gold-silver ratio assumptions. With gold projected to trade near USD 4,500/oz in 2026 and economic activity remaining firm enough to support risk appetite, the bank estimates an average gold-silver ratio near 75x, compared with roughly 78x currently. Periodic dips toward 70x are possible, echoing ratio compressions observed following the initial COVID shock in 2021.

At a 75x ratio, [The ratio is currently at 72 with a $4,200 gold price] silver prices model near USD 60/oz, consistent with the bank’s base-case forecast, while more aggressive, short-lived compressions could support price spikes toward USD 65/oz.