Fed Signals Coming Cuts

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Labor data continues to weaken gently, and should be enough to convince the Fed to cut more. Indeed that is the opinion we heard from individual Fed members this week. The market sensed this too, and reevaluated the odds of a cut from 30% back to 87%:

This next chart shows exactly how important interest rates and liquidity are in the repricing of assets. Powell came out on Oct 29 and nixed the rate cut, which marked the exact peak in equity and bitcoin prices. On Nov 21, New York Fed Pres John Williams said he sees room for a cut, and that marked the exact bottom in the correction:

Wall St. Journal reporter Nick Timiraos (a.k.a. Fed Whisperer) often gets inside leaks about what the next Fed action will be. He has been not-so-subtly dropping hints of a Fed cut. They do this to help steer market expectations. But it appears that we should expect a hawkish presser:

On the flip side, if Powell decides to pause the Dec cut (due to missing Nov jobs data, for instance) we expect him to signal his dovishness in the presser anyway.

So we now have three sources of liquidity flowing back into the financial system: 1) rate cuts, 2) end of Quantitative Tightening, and 3) government restart. This should provide the push that assets need to rebound into year end.

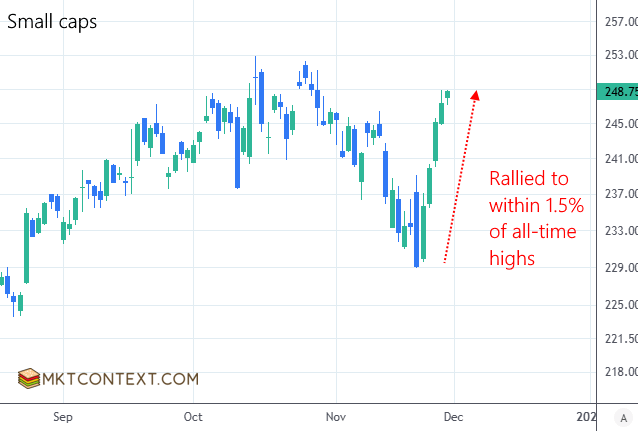

Evidence of this is in small caps (IWM) which have already started rallying aggressively. This index is sensitive to rate cuts and liquidity changes because it includes a lot of high-debt companies and banks. Junk tech stocks (e.g. ARKK, ARKQ) should follow suit to provide further confirmation.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!