TD's Ghali: "Silversqueeze" Done, Platinum Pump Next

Setting Up for the Big (Platinum) Squeeze

Summary/Observations

Platinum & Palladium emerge as structurally underpriced due to durable automotive demand, delayed scrap supply, and persistent underinvestment in mining, with upside potential materially above consensus estimates into 2026.

Silver bears the most contemplation here as it shifts from squeeze conditions toward inventory saturation according to Ghali, with volatility driven by liquidity distortions and prices expected to normalize into the mid-$40s. Ghali is the first we know of to take this position.

If the shorts are comfortable paying monthly backwardation costs for a while, they could wait this out despite our own biases. But if they are not able to, (if China and Indian buyers do not remain patient) Ghali may be early in his call of the Silver squeeze demise. Finally, the market knows there is a Silver deficit now. It does not seem to be looking at the aforementioned PGM risk. So Ghali’s points are well taken. Platinum may be where the puck goes to next borrowing Wayne Gretzky’s analogy. but after LBMA proves it is solvent again beyond its self-inflicted damage.

Gold remains the primary beneficiary of monetary stress, fiscal deterioration, and institutional diversification, with a projected trading regime centered near $4,400/oz in early 2026.

Platinum & Palladium: Structural Deficits Beneath Consensus Pessimism

“Small changes in vehicle density can result in immense changes in auto sales and associated PGM demand.”

— Dan Ghali, TD Securities

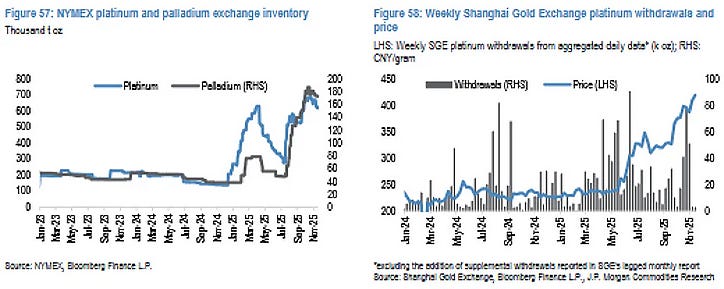

TD’s most contrarian thesis centers on platinum and palladium. Prevailing market consensus assumes structural erosion of internal-combustion vehicle demand, affordability constraints linked to tariffs, and accelerated scrap recovery will narrow current deficits toward market balance or even surplus. TD’s proprietary modeling offers a differing outlook.

Vehicle-density surveys indicate sustained growth in North American household fleet ownership driven by de-urbanization trends. Small variations in density assumptions produce large shifts in automotive demand, with TD estimates suggesting that a two-percentage-point annual variation can swing platinum demand by over 400,000 ounces and palladium demand by approximately 1.7 million ounces.

Interestingly, JPMorgan concurs on Platinum on both squeeze risk and fundamentals, but does not think Palladium upside risk will be long-lived.

JPM Says "Platinum, Higher for Longer"

Platinum prices are high enough to begin to turn the gears of supply rebalancing but this will take time and, in the interim, we still see a deficit market and a further rally in gold supporting platinum prices to average $1,670/oz in 2026.

In the near-term, tariff risk is most acute in palladium, which will continue to drive upside to prices in the coming months. Beyond this, however, we still see a palladium market where structurally weaker demand growth is expected to bring the market back towards balance by 2027, pressuring palladium prices back towards $1,150/oz by the end of 2026.

So in summary: JPM likes Palladium over Platinum for a squeeze, but likes Platinum over Palladium for longevity of a rally

TD projects rising U.S. vehicle density and highlights persistently low dealer inventories as indicators of strengthening auto production. Global growth forecasts support continued ex-U.S. demand stability.

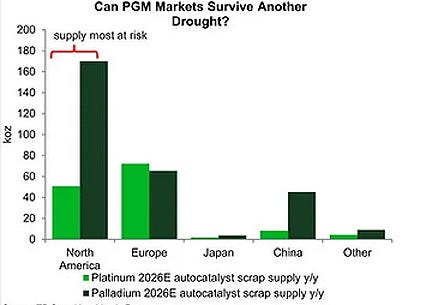

On the supply side, TD disputes prevailing scrap-boom expectations. Rather than rapid secondary-supply growth, TD expects scrap recovery to remain delayed until at least 2027. Regional scrap flows from North America are projected to remain broadly unchanged, diverging from consensus estimates for sizeable increases in platinum and palladium recycling volumes. Combined with structural underinvestment in mine supply, this outlook supports persistent market deficits extending into the later years of the decade.

Trade policy introduces asymmetric upside risk. TD notes that Section 232 investigations could place PGMs within the tariff review framework. Even if negotiated exemptions follow, a deferred implementation window could encourage speculative stockpiling cycles similar to earlier silver dynamics. Palladium is identified as particularly underappreciated within this risk profile.

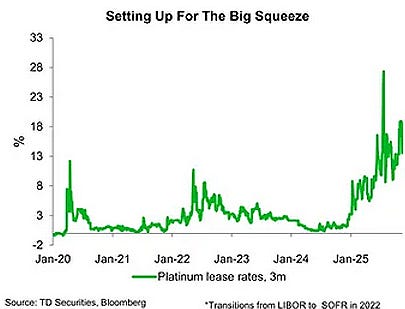

TD designates platinum and palladium as top commodity selections for 2026, with price forecasts approximately 20% above prevailing market consensus. Tighter forward curves and higher lease rates are expected to accompany structurally constrained supply conditions.

Is The LBMA Fit for Purpose? pic.twitter.com/Y8gawTRPyr

— VBL’s Ghost (@Sorenthek) December 9, 2025

Silver: From Scarcity Premium to Inventory Overhang

“Heading into 2026, an epic-scaled #silverflood has resulted in the single largest wave of repletion in LBMA free-floating inventories on record.”

— Dan Ghali, TD Securities

TD assesses that silver’s market structure has shifted materially over the past year. What began as a developing physical squeeze has transitioned into the largest inventory replenishment event observed in modern precious-metals trading. More than 212 million ounces of silver are now estimated to be freely available within LBMA vaults, effectively reversing over a year of cumulative drawdowns. At prevailing price levels, supply from private-vault liquidation and scrap recovery has returned to the market.

Despite this replenishment, prices have remained near historical highs. TD attributes this resilience to distorted liquidity conditions rather than renewed physical tightening.

Continues here

Free Posts To Your Mailbox