Changing Technical Signals

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com in improving your portfolio returns.

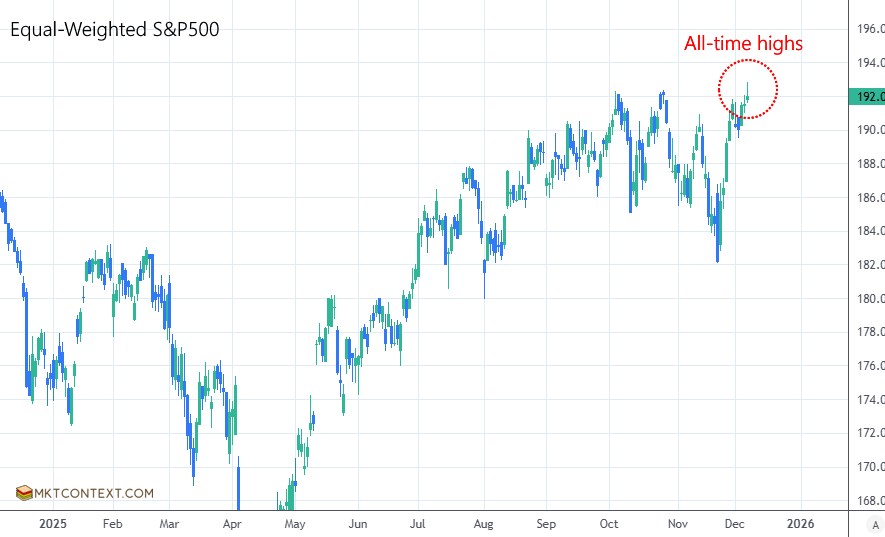

These last two weeks we’ve seen a stunning breadth improvement in the market. Driven by a drop in jobless claims, small cap stocks started squeezing to the upside while equal-weighted indexes reach all-time highs. The market is sniffing out our economic reacceleration thesis and bidding up riskier, cyclical stocks as a result. This means the market rally is broadening out to all companies and no longer concentrated in just the top 7 tech stocks.

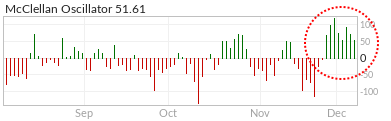

Breadth indicators are telling the same story — more stocks are going up than down. Recall that we had a near-breadth thrust the prior Tues, which sets the stage for continued gains. We’ve been waiting for these confirmation to occur. Can this continue? Only if the economic data continues to surprise positively.

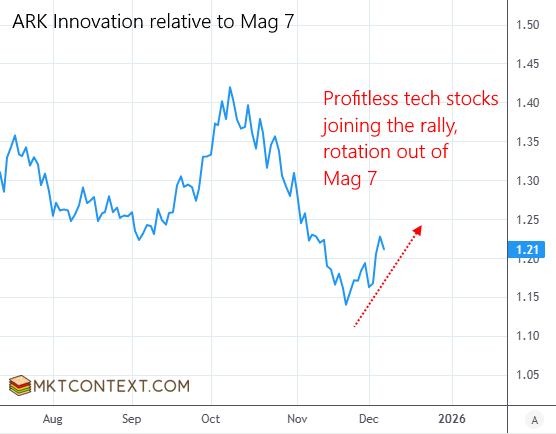

A rotation is underway as investors leave the safety of Mag 7 megacap tech stocks and back into the parts of the market that were hit hardest during the recent pullback. This includes “junk” stocks tied to the core themes of AI infrastructure, re-industrialization, and domestic energy capacity. We said last week that junk tech stocks would soon follow the rally, and they did.

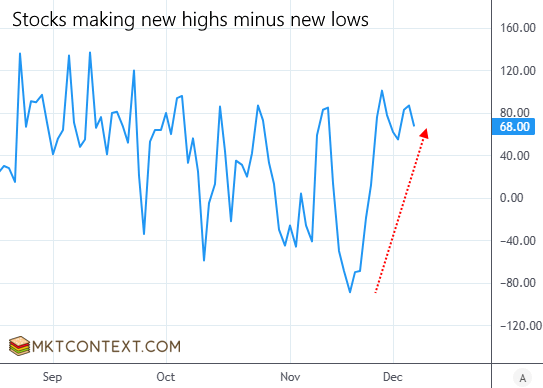

Broader participation also showed up in the rising ratio of stocks making new highs, versus stocks making new lows:

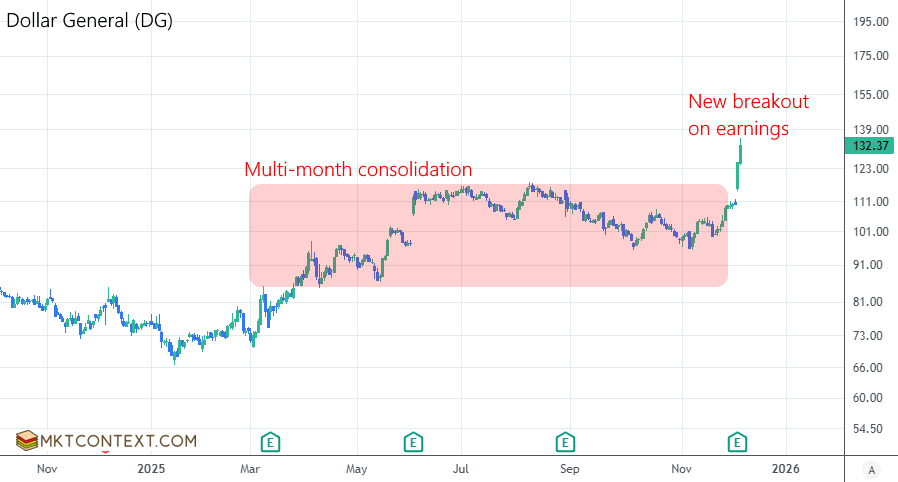

For once, retailer stocks are rising as Kohl’s, Ulta, American Eagle, Abercrombie, Dollar General, and Victoria’s Secret delivered strong earnings. These consumer-focused stocks have been consolidating for months as consumer sentiment soured. But that has run its course now as the stocks are breaking out:

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!