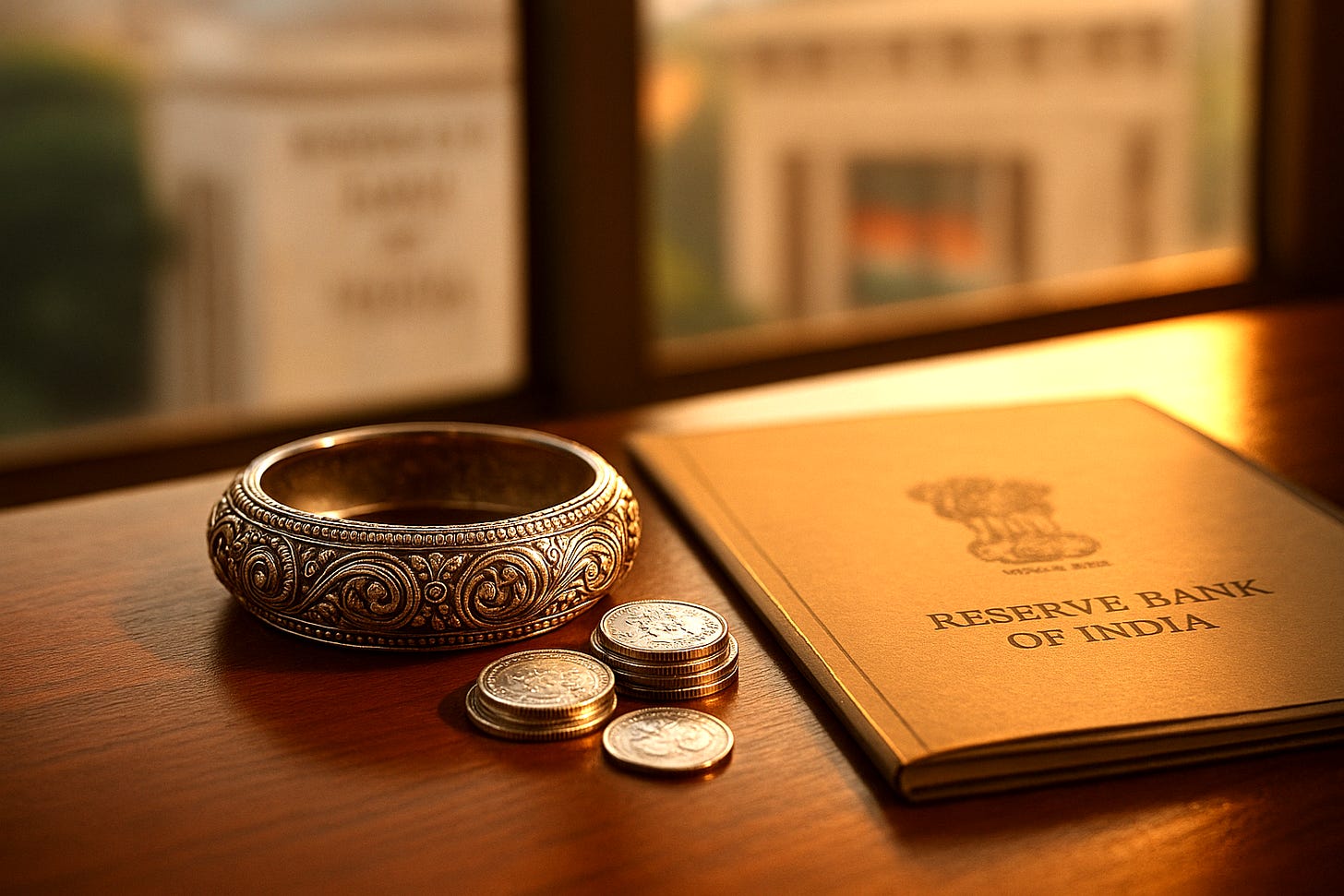

India Monetizes Silver's Buying Power

India Unlocks Silver's Collateral Buying Power

GFN – MUMBAI: The Reserve Bank of India (RBI) will allow banks and non-bank financial institutions to extend loans against pledged silver jewellery and coins beginning April 1, 2026, formally expanding collateralized household credit beyond gold for the first time under a unified regulatory framework.

The measure is contained in the Reserve Bank of India (Gold and Silver Loans) Directions, 2025, which the central bank said are designed to improve oversight, uniformity, and transparency across the precious-metal lending market. The new rules apply to commercial banks, small finance and regional rural banks, cooperative banks, NBFCs, and housing finance companies, and are sourced from reporting by The New Indian Express. As the RBI clarified in the guidelines, “loans can be given only on silver or gold kept in the form of jewellery or coins,” with lending against bullion ingots or financial products such as ETFs and mutual fund units explicitly prohibited.

Collateral limits have been capped at 1 kg for gold jewellery and 10 kg for silver jewellery, and 50 grams for gold coins and 500 grams for silver coins. Loan-to-value ratios will mirror gold-loan structures, set at up to 85% for loans up to ₹2.5 lakh, 80% for ₹2.5–5 lakh, and 75% for loans above ₹5 lakh. “This means that if you have silver worth ₹1 lakh, you can get a maximum loan of up to ₹85,000 on it,” the guidance notes. Price determination for both metals will be based on the lower of the 30-day average closing price or the previous day’s closing price using rates published by the India Bullion and Jewellers Association (IBJA) or any recognized commodity exchange; any value attributable to stones or non-precious components in jewellery is excluded from collateral calculations.

The RBI further mandated strict timelines on collateral release, stating that pledged jewellery must be returned within seven working days after full settlement of the loan. In cases of lender-caused delays, customers must be compensated at ₹5,000 per day, reinforcing consumer protections alongside the expansion of household access to secured credit.

India Unlocks Silver's Buying Power pic.twitter.com/NORN6eVRUx

— VBL’s Ghost (@Sorenthek) December 8, 2025

Continues here