BIS Sees Speculative Bubbles in Gold and US Stocks

“Gold has become much more of a speculative asset.” – BIS

Authored by GoldFix

GFN – BASEL: The Bank for International Settlements is warning that gold’s recent surge reflects a shift away from its traditional safe-haven function and toward speculative behavior as retail participation and momentum flows pushed bullion and equities higher simultaneously, a market pattern the BIS says has not occurred in more than 50 years.

“The price of gold rose along with other risky assets, deviating from the historic pattern of acting as a safe haven.”- Hyun Song Shin, BIS

According to both Bloomberg and Reuters the BIS said portfolio flow data show trend-chasing retail investors responding to media-driven momentum layered onto earlier institutional demand tied to hedging activity and concerns over stretched equity valuations. Gold has risen roughly 20% since early September and is up about 60% year-to-date, while equities have continued to rally on technology and artificial-intelligence optimism. Analysts at the BIS concluded that 2025 is the first period in at least five decades in which gold and the S&P 500 have entered what the institution calls a jointly “explosive” phase, raising the risk that both assets could correct together and leaving limited shelter for investors. ETF pricing has offered additional evidence of speculative intensity, with funds trading at persistent premiums to net asset value, which the BIS attributed to strong retail buying meeting reduced arbitrage capacity, even as central-bank purchases continued to provide a structural bid beneath prices.

“A bubble typically bursts with a sharp and swift correction.” – BIS

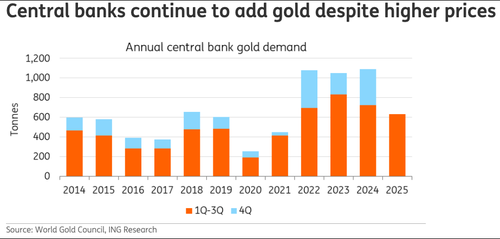

In 2025 Central Bank Buying Broadens at All Time Highs

Central bank purchases themselves resumed a stronger pace following two quarters of slowing activity according to ING Bank just yesterday.

“In Q3, central banks increased their buying pace following two consecutive quarters of slowing purchases. They bought an estimated 220 tonnes of gold in the quarter, 28% higher than the Q2 total and 6% above the five-year quarterly average.”

Kazakhstan was identified as the largest quarterly buyer, while Brazil returned to the gold market for the first time since 2021.Momentum continued into October. “In October, central banks added a net 53 tonnes to reserves – a 36% increase from September and the strongest monthly gain since November 2024.”

Year-to-date purchases reached 254 tonnes, a slower rate than the previous three years, which ING attributes to the dampening effect of record prices rather than shifting reserve policy. Poland remains the largest official-sector accumulator. After a five-month pause, the National Bank of Poland resumed purchases, adding 16 tonnes in October and increasing total holdings to 531 tonnes, representing approximately 26% of total reserves. China also continues sustained monthly additions.

“China’s central bank… has reported gold purchases for 13 months in a row, adding 30,000 ounces (0.93 tonnes) in November, lifting the total holdings to about 74.1 million ounces (2,305 tonnes), despite record high prices.” central-bank purchases continued to provide a structural bid beneath prices.

Beyond purchases, China is expanding its operational footprint within bullion markets. “China is also attempting to widen its presence in the bullion market by extending gold storage facilities to foreign banks.” Cambodia has already accepted participation in this initiative, which ING notes signals an effort to position gold beyond reserve storage toward broader financial involvement.

Central Bank Body Warns of Fragility

Beyond bullion, the central-bank body warned of broader “growing fragility” across risk markets as artificial-intelligence equities stretch valuations, cryptocurrencies post large drawdowns, and heavy sovereign issuance distorts historical spread relationships, drawing hedge funds into relative-value interest-rate trades. The BIS said that while economic activity has remained resilient so far, the unusual alignment of rising gold and equities historically precedes elevated cross-asset volatility and difficult adjustment phases whose timing remains uncertain.

“Gold has become much more of a speculative asset.” – Hyun Song Shin, BIS

Continues here