What Does a Hawkish Cut Mean?

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com in improving your portfolio returns.

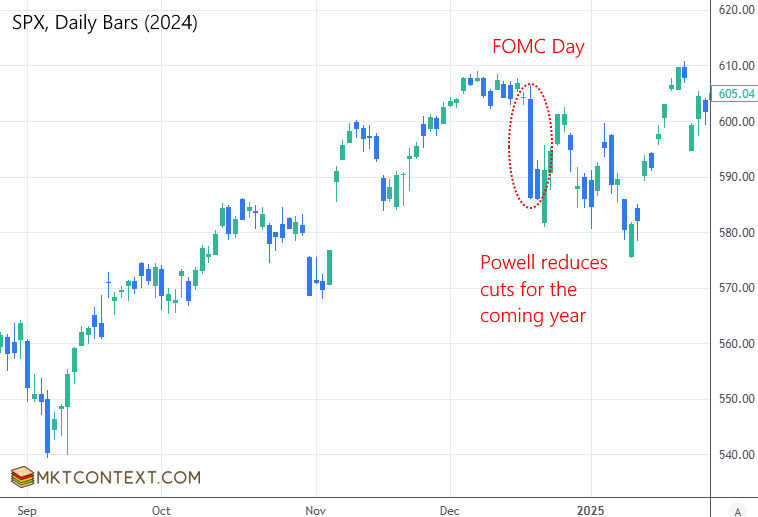

You might remember this massive intraday selloff on Dec 18, 2024, which was the Dec FOMC meeting:

Leading up to the meeting, the market was euphoric off a Trump reelection and expecting 4 rate cuts. The Dec cut occurred as predicted, but Fed members reduced future cuts from 4 to 2. Here’s what we wrote at the time:

It started with Wednesday’s FOMC meeting where the Fed cut 25bps as widely expected. However, the real surprise came from their projections, which was very hawkish: Instead of 4 cuts for next year, they’re now down to 2 cuts. Powell also revealed this week’s cut was a “close call”, meaning they considered pausing. One dissenter even called for no cuts.

That’s a big deal! Apparently, some members were taking into account potential inflationary effects of Trump’s fiscal policy. This is a complete 180 from their data-dependence stance, and contradicts comments made just last week. It suggests they are once again prioritizing disinflation over growth.

-MktContext, “Don’t Miss the Next Dip”, Dec 22 2024

We may have a similar setup brewing today. The market largely expects Powell or his successor to cut rates drastically, regardless of whether present economic conditions justify it. So if the Fed or Powell lower their expectations for future cuts (e.g. “hawkish presser”) then we may get a brief selloff this coming Wednesday.

An even bigger shocker would be if Powell announces he is staying on the board as a voting member after his Chairmanship is over. This has only happened twice in history. We doubt this will happen again, but it’s something to consider.

If a hawkish selloff does occur, we think it will not be very deep. This is because Powell is about to be replaced anyway so markets will ignore his views. The market already knows the Fed is divided this year, so that takes some of the surprise out of any hawkish announcement.

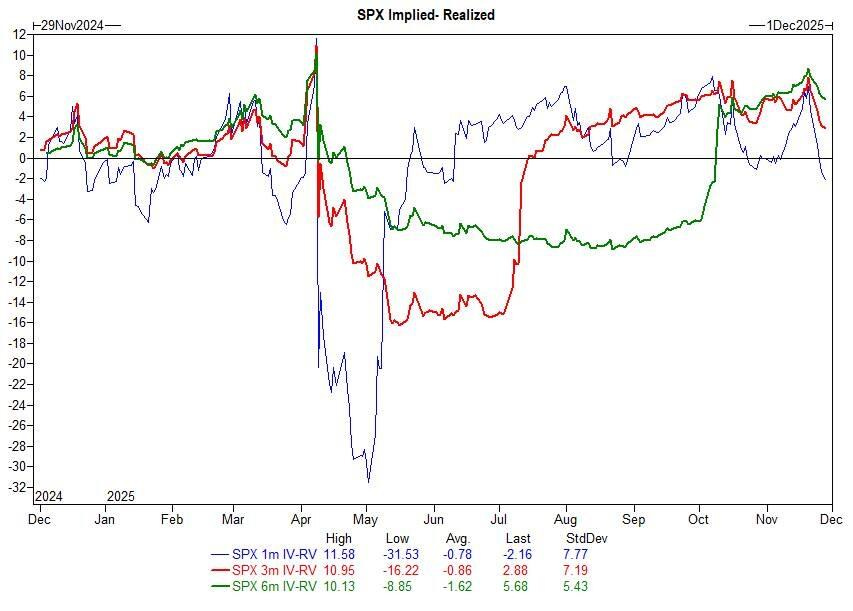

Checking positioning indicators, much of the tinder was already burnt off from the recent selloff in Nov. So the “fuel” for a downside move is not as combustible as it would’ve been. The messy chart below shows that options pricing (used as a hedging instrument) is not at extremes like they were a month ago. Institutional funds have de-risked over the past several weeks, so any negative reaction should be muted.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!