China's Silver-Play Decoded

TL;DR

Recent silver market disruptions (LBMA stress, leasing, India deliveries, CME halt, JPM inventory controls) form a coherent pattern when viewed through China’s long-standing focus on reputational risk and political economy, not isolated accidents.

Since SDR inclusion, China has prioritized optics and compliance, shifting currency management toward gold (a neutral asset) while avoiding visible silver accumulation to reduce accusations of manipulation or strategic hoarding.

Silver’s dual role as monetary and critical industrial material makes it politically sensitive; overt Chinese buying or bullish signaling would invite scrutiny, so China appears to maintain distance in both action and narrative.

The system is meeting current silver demand via leasing and inventory defensiveness, effectively borrowing from the future, highlighting growing fragility at the LBMA and rising strategic importance of physical silver.

China, Silver, and the Politics of Reputation

Authored by GoldFix

There is a tendency to look at recent developments in the silver market as a series of unrelated events: tightening conditions at the LBMA, unusual metal flows, India taking delivery, China stepping back, JP Morgan restricting access to deliverable inventory, and even the CME shutdown of futures trading. When viewed in isolation, these appear disparate. When viewed together, they form a coherent pattern that aligns closely with China’s long-standing approach to global economic participation and reputation management.

This is an attempt to understand intent, incentives, and behavior, particularly from a state actor that has demonstrated consistency over the past fifteen years.

China’s Long Arc Toward Global Acceptance

Since roughly 2008, China has been methodically integrating itself into the global economic system as a credible and disciplined participant. Entry into the World Trade Organization, followed later by inclusion of the renminbi in the IMF’s Special Drawing Rights basket as important examples. They were reputational achievements, contingent on China demonstrating restraint, compliance, and balance-sheet credibility.

During the inclusion process, China visibly increased its official gold purchases. The message, conveyed privately and later corroborated by behavior, was that a stronger and safer balance sheet would facilitate IMF acceptance. Once inclusion was secured, those visible purchases slowed, although accumulation never truly stopped. The distinction was between what China did and what China showed.

This pattern matters because China has learned that accusations of manipulation, even if toothless in enforcement terms, are costly in reputational terms. They complicate access, alliances, and credibility. China’s strategy since then has been to avoid overt actions that could be framed as destabilizing or predatory, particularly in markets with international political sensitivity.

Currency Policy Reframed Through Gold

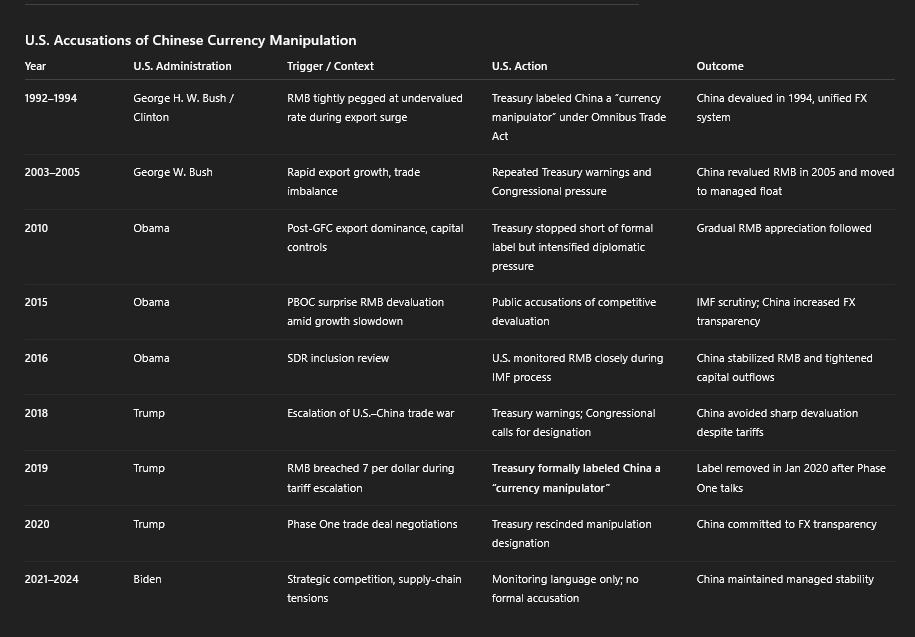

Key Observations from chart above

Accusations peak during trade stress or political escalation, not monetary instability.

Since 2019, China has avoided actions that could be framed as overt FX manipulation.

Post-SDR inclusion, optics and compliance have taken precedence over aggression

Why This Matters for Gold and Silver

This historical pattern reinforces the argument that China is highly sensitive to reputational risk tied to monetary behavior. Shifting currency debasement toward gold rather than the dollar reduces exposure to these accusations, while avoiding visible hoarding of silver limits the risk of a new category of strategic-material charges.

Ho Lee Sheet…

— Eric Yeung 👍🚀🌕 (@KingKong9888) December 13, 2025

NAILED IT!!!

All the Chinese physical #Silver that was leased by the LBMA in October was dropped shipped straight to India, bypassing London.

“INDIA RECEIVED 644.4 tonnes of physical #Silver via HK & China in October!”

Thanks @GoldFishCharts for the info! https://t.co/SUT0fkc3f3

Instead of debasing against the dollar, China has increasingly allowed its currency to weaken against gold. Printing currency to acquire gold is still debasement, but it is debasement against a neutral monetary asset rather than another nation’s fiat. In effect, China has shifted the axis of currency management away from bilateral optics and toward a metal anchor that cannot accuse anyone of manipulation.

This distinction becomes essential when considering silver.

Silver as a Political Liability

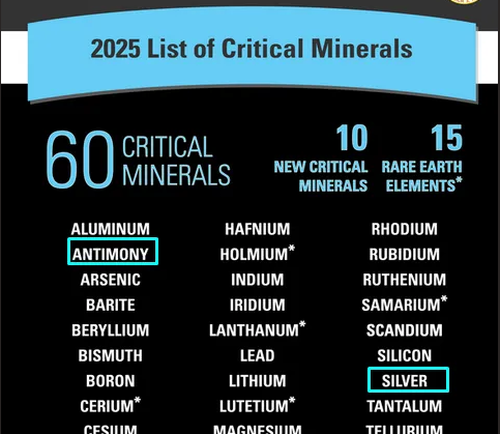

Silver occupies a different political category than gold. It is monetary, but it is also industrial. It is now explicitly listed by the United States as a critical material.

*Silver Officially Added As Critical Mineral

The United States has expanded its official list of critical minerals to include copper, silver, and uranium, signaling an intensified focus by the Trump administration on domestic resource security and supply chain independence.

Open hoarding, aggressive buying, or visible cornering of silver supply would invite scrutiny, accusations, and potential retaliation. For a country that is building alliances and parallel systems, that is an unacceptable risk.

As a result, China appears to have deliberately avoided being seen as an active buyer of silver during a tightening physical market, even as conditions deteriorated elsewhere.

LBMA Stress and the Role of Leasing

The LBMA positions itself as an open over-the-counter venue for physical delivery. When customers, particularly India, demanded silver delivery, the metal had to come from somewhere. China was not buying, but it had previously leased metal into the system. The United States also stepped in, leasing metal to London to facilitate deliveries.

BRICS Central Banks Cut LBMA Out

This type of supply chain action will put the LBMA out of business or at least cripple Western access to physical metals going forward. We will have contextual implications for LBMA, The West, and how this is part of a much bigger strategy to secure all resource supply chains in a global mineral war. What the Brics are doing in Gold, they are doing in everything. Gold is the tip of the economic spear out of BRICS nations.

Leasing is not supply creation. It is time arbitrage. Borrowed metal is delivered today, with an obligation to replace it later. Over recent weeks, the pattern has been clear: India is taking delivery, London is fulfilling those deliveries with leased metal, China’s available warehouse supply has been largely withdrawn, and U.S. metal has been used as a stopgap.

The result is a system meeting present obligations by borrowing from the future.

JP Morgan and Defensive Behavior

Against this backdrop, JP Morgan’s decision to restrict access to deliverable silver inventory during the recent futures market disruption becomes more understandable. Whether acting independently, defensively, or in coordination with broader flows, the behavior is consistent with a desire to preserve optionality and inventory under stress conditions.

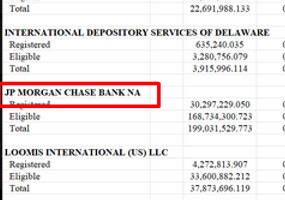

JPM Reportedly Made 13.4 Million Ounces Unavailable During CME Shutdown

“This [reclassification] occurred amid a reported 10-hour trading halt at the CME due to a cooling system failure”

This does not require coordination with China to be meaningful. It only requires recognition that physical silver availability has become strategically sensitive.

Influencers, Messaging, and Plausible Distance

Another explanation fits our observed broader China-pattern. China is deliberately staying out of the silver market during stressed moments and is equally careful to avoid influencing prices higher through messaging, particularly in Western-facing channels. Maintaining distance, both in action and narrative, protects China from accusations of hoarding or manipulation at a moment when silver’s importance is increasing.

This aligns with increased monitoring of cross-border financial messaging and the broader sensitivity around strategic materials.

The CME Shutdown and Systemic Fragility

The decision to halt futures trading globally, rather than draw attention to silver specifically, suggests sensitivity rather than confidence. Combined with JP Morgan’s inventory behavior and the reliance on leased metal to meet deliveries, it reinforces the idea that silver has become systemically awkward.

Breaking: Massive CME Outage Jolts Markets

GFN – CHICAGO: CME Group halted trading across its futures and options markets late Thursday after a data-center cooling failure disrupted the CME Globex platform, interrupting live pricing in commodities, Treasuries, equity-index futures and foreign exchange during early Asian trading.

Why the Dots Matter

Understanding why actors behave as they do allows better anticipation of what comes next. China’s behavior over the past fifteen years shows consistency: avoid open confrontation, avoid reputational risk, allow others to bear visible stress, and intervene indirectly when necessary.

Continues here unlocked

Free Posts To Your Mailbox