Gold & Silver Soar Again As Trump Calls For 1% Rates

Gold & Silver Soar Again As Trump Calls For 1% Interest Rates

Submitted by GoldFix, Authored by Chris Marcus

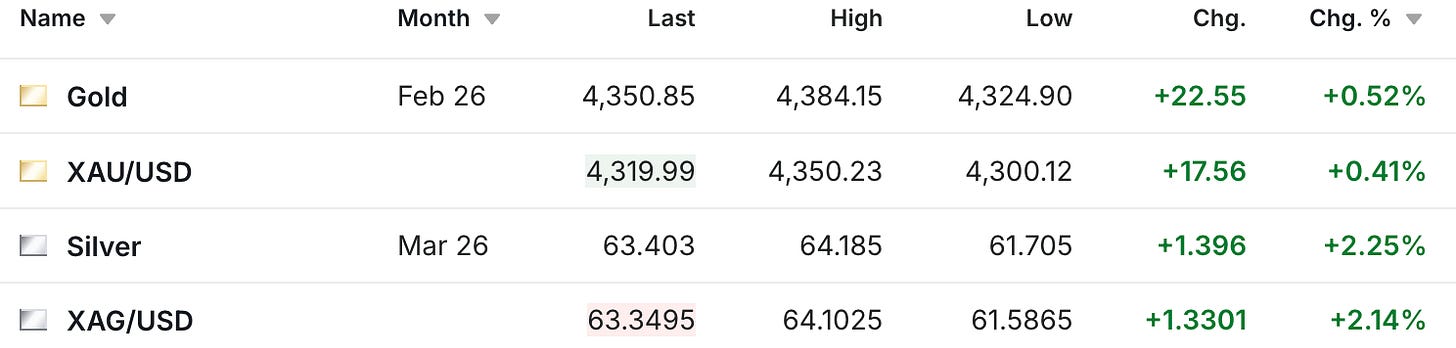

If you’re a gold and silver investor, then you woke up to good news this morning, as the prices of both metals are up substantially. Perhaps made even more significant in that the rally is following last Friday’s sharp sell-off.

In terms of why the metals are up so much, part of it is likely due to just a natural rebound after Friday’s sell-off, as it’s not as if anything happened on Friday that would materially alter the perception of the value of gold and silver.

Although perhaps maybe the market is also finally starting to have it all sink in, now that Trump has actually called for 1% interest rates, and suggested that the next Federal Reserve Chairman should consult him on rate decisions.

The president expressed his belief that the next Fed chair should consult with him on interest rate decisions. “Typically, that’s not done anymore. It used to be done routinely. It should be done,” Trump said. “It doesn’t mean—I don’t think he should do exactly what we say. But certainly we’re—I’m a smart voice and should be listened to.”

When asked about his preferred interest rate level a year from now, Trump stated, “1% and maybe lower than that.”

I guess if anyone was still holding out any hope that there actually was any independence between the Federal Reserve and the administration, we should be able to put that one to rest finally. Although you can probably guess what CNBC will be doing today.

And I can only imagine how concerned Mohammed must be this morning.

Trump calls for 1% rates AND for the Fed to consult him on decisions.....

— Chris Marcus (@ArcadiaEconomic) December 15, 2025

And you can only wonder how hard Mohamed's worrying about the Fed's independence this morning... pic.twitter.com/IzowDpBeOP

But funny Mohammed moments aside, what Trump just said about the Fed consulting him on decisions, and that he thinks rates should be 1%, is behind what I’ve been saying over the past few months about the December rate cut being somewhat inconsequential in the grander scheme of things. Because you had the market fighting over the timing of a 25 basis point cut, when Trump’s calling for 1% rates, and about to pick the person who will have the power to do that.

Speaking of which, while it was reported last week that Kevin Hassett seemed to be the frontrunner, the article also suggested that Kevin Warsh is still in the conversation.

While Hassett has recently emerged as the perceived front-runner following Trump’s hints about making a decision, the president’s latest comments suggest Warsh remains a strong contender.

Trump met with Warsh for 45 minutes on Wednesday at the White House, where he questioned whether Warsh would support interest rate cuts if appointed to lead the central bank. “He thinks you have to lower interest rates,” Trump said of Warsh.

So it sounds like no matter who wins, you can bet on lower interest rates. And if last week’s 25 basis point cut has already brought silver over $60, and gold back within a $50 of its all-time high, how exactly is this going to look if rates actually go down to 1%?

And that’s not even to mention that the Fed has started purchasing debt again as concerns about liquidity continue to emerge.

WASHINGTON, Dec 10 (Reuters) - The Federal Reserve on Wednesday said it would imminently start buying short-dated government bonds to help manage market liquidity levels to ensure the central bank retains firm control over its interest rate target system.

The technically oriented purchases will commence on Friday, the central bank said as part of the policy announcement associated with its latest Federal Open Market Committee meeting. When it begins buying, the initial round will total around $40 billion in Treasury bills per month.

Then add in that Europe continues its quest to confiscate the frozen Russian assets, and continues to hint at a willingness to go to war. To be clear, we’ve been hearing this on and off for the better part of a few years, although while it has not happened yet, it also hasn’t gone away.

Then of course you have the real elephant in the room, which is that unless the US is going to continue to be dependent on China (which doesn’t seem likely), reshoring manufacturing, while the debt burden is already beyond the point of no return, means that more inflation is coming, the bondholders are going to get stiffed, and you can take your own guess as to where at least some of that money will reallocate to as Wall Street continues to educate its clients about the new 60/20/20 portfolio strategy.

So it will be a fun last few weeks of the year for the gold and silver markets, and I’ll look forward to checking back in with you tomorrow.

Sincerely,

Chris Marcus