Oracle and the AI Capex Cycle

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

When we last wrote about Oracle (ORCL), they had just reported a blowout quarter of earnings and was threatening to shake up the cloud computing world with their debt-fueled capex spree. Since then, sentiment has completely soured, with the stock selling off -46% from Sept highs.

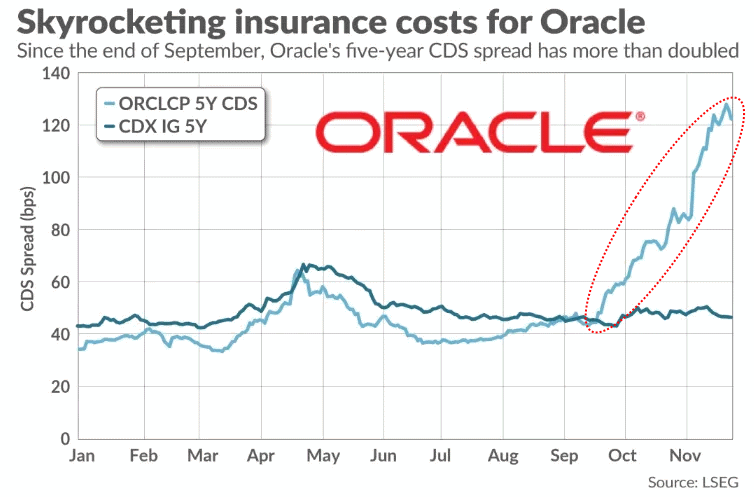

Oracle has become the main focus of worries about excessive spending and overbuilding in the AI data center boom. They’re pouring hundreds of billions into data centers, burning through borrowed cash, and the company’s creditworthiness has tanked. Oracle’s CDS, which measures their risk of default, has spiked:

This week the stock gapped down on their earnings announcement, despite reporting good earnings and strong pre-orders. The bad news? They increased their 2026 spending from $35B to $50B, probably linked to the $300B partnership with OpenAI. Investors are questioning the sustainability of the AI capex cycle and the creditworthiness of Oracle’s largest tenant, OpenAI.

Originally, OpenAI had the top language model, and they capitalized on this superstardom by making big deals with Oracle, CoreWeave, and others. Unfortunately, this was soon followed by Google’s cheaper and better Gemini 3, which posed formidable competition to OpenAI and all the debt-laden data center builders.

What if all that capex is for nothing? The prevailing fear is that OpenAI cannot honor its capex contracts — it generates revenues of only $13B, but has obligations of $60B per year.

Is ORCL oversold? Yes. Would we buy it here? No. The onus is still on them to demonstrate a return on their promised capex/investment. Only earnings growth can justify their high multiples. But due to their debt burden, they are on borrowed time.

Does this mean the AI bubble over? Again, no. But it will no longer be a “rising tide lifts all AI boats” type of environment. There will be winners and losers; picking the right ones will be of utmost importance. Many of the mega cap tech companies are still safe due to their fortress balance sheets.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!