Michael Oliver: The Bigger Game Has Just Begun for Metals

Precious Metals and Mining Stocks vs Broader Markets

Note: No tactical timing is emphasized this week. The focus remains on regime change, comparative performance, and the unwinding of multi-decade pricing distortions. We observe that all the resistance levels in his methodology as being broken recently now; with the Nasdaq being the final boss. The upside is quantified where it can be and the risk to performance vs SP 500 is known (breakout levels)

A Cross-Asset Breakout Takes Hold

In his latest 360 weekend report Michael Oliver identifies November as the decisive turning point for monetary metals, marking the resolution of a long basing phase and the beginning of a broad relative-performance breakout. The analysis stresses that this is not a narrow price phenomenon, but a structural change observable across multiple equity benchmarks.

Gold has now broken out of multi-year relative bases versus the Dow Jones Industrial Average, the NYSE Composite, the S&P 500, and, most recently, the NASDAQ 100. These developments follow earlier downtrend resolutions, indicating a staggered but coherent transition in leadership.

“While all eyes and cheers are still for the stock market, the monetary metals have just signaled that the bigger game has only just begun.”

Gold vs. NASDAQ 100 monthly relative-performance spread (2013–2025), showing clearance of long-term resistance...

Gold Viewed Through a Long-Cycle Lens

The analyst situates the current gold advance within a multi-decade framework, noting that prior secular bull markets, despite weaker supporting fundamentals, produced gains on the order of eightfold from bear-market lows. By comparison, the present cycle remains smaller in proportional terms.

MSA contrasts gold’s long-term performance with fiat currency expansion and equity returns. Over the past twenty-five years, broad equity indices have largely tracked monetary debasement, while gold has materially exceeded it. In this framing, fiat currencies are treated as unstable units of account rather than reliable benchmarks.

“A fiat currency—whether it be the Dollar, Euro, Yen, or Pound—is a laughable yardstick.”

The analysis emphasizes that U.S. investor participation remains limited, a condition Michael associates with the early to middle stages of secular advances rather than mature tops.

Silver and the Mechanics of Upside Acceleration

Silver is assessed primarily through its relative performance against gold. The report highlights two historical episodes, late 1979 to early 1980 and 2010 to 2011, in which silver’s explosive advances were preceded by decisive silver-to-gold spread breakouts.

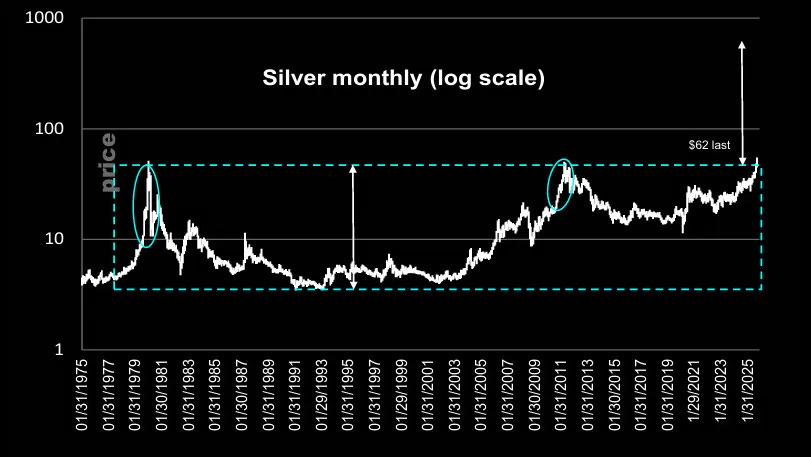

Log Cup-Handle Measured Move of the 50 Year Silver Chart is quite impressive...

At the November close, silver broke out of a multi-year relative-performance base versus gold. According to the analysis, this event signals the onset of a major rediscovery phase. Prior analogs produced price moves ranging from more than a doubling to several multiples over compressed timeframes.

“For MSA that signaled the start of a massive upside ‘rediscovery’ move.”

Michael further examines silver’s half-century price confinement, applying measured-move logic to that range. While acknowledging uncertainty around magnitude, the analyst frames the potential upside as structurally consistent with past regime shifts.

Silver vs. gold relative-performance spread, multi-decade view...

Continues here

- Mining Equities and Historical Stress Events

- Miners Versus Gold and the Broader Market

- Bottom Lines: