Silver: Samsung Prepays Mine For 2 Years Supply.

GFN – TORONTO: Canadian miner Silver Storm Mining has secured a US $7.0 million prepaid offtake financing facility with Samsung Construction and Trading and two of its subsidiaries to restart operations at its La Parrilla Silver Mine Complex in Durango, Mexico. The agreement, announced October 10, 2025, includes a two-year offtake commitment for all concentrates produced as part of the financing arrangement. First seen and noted by Arcadia today, where Chris Marcus gives some insights into its importance; This news insight gives much credence to the silver supply scramble that is beginning to ensue

“The Agreement with Samsung represents a key step in our strategic vision of transitioning the Company into an operating entity.” Greg McKenzie, President and CEO of Silver Storm, said in the company’s release. “Samsung’s involvement as a guaranteed purchaser for the concentrates reflects the confidence of a leading industry participant in our path forward.”

Under the offtake arrangement, Samsung will receive 100 percent of the lead-silver and zinc concentrates produced at the La Parrilla complex over a two-year period, granting the trading house full offtake rights in exchange for early financing. The facility is secured by a corporate guarantee, share pledge, and first-ranking security over the mine’s assets.

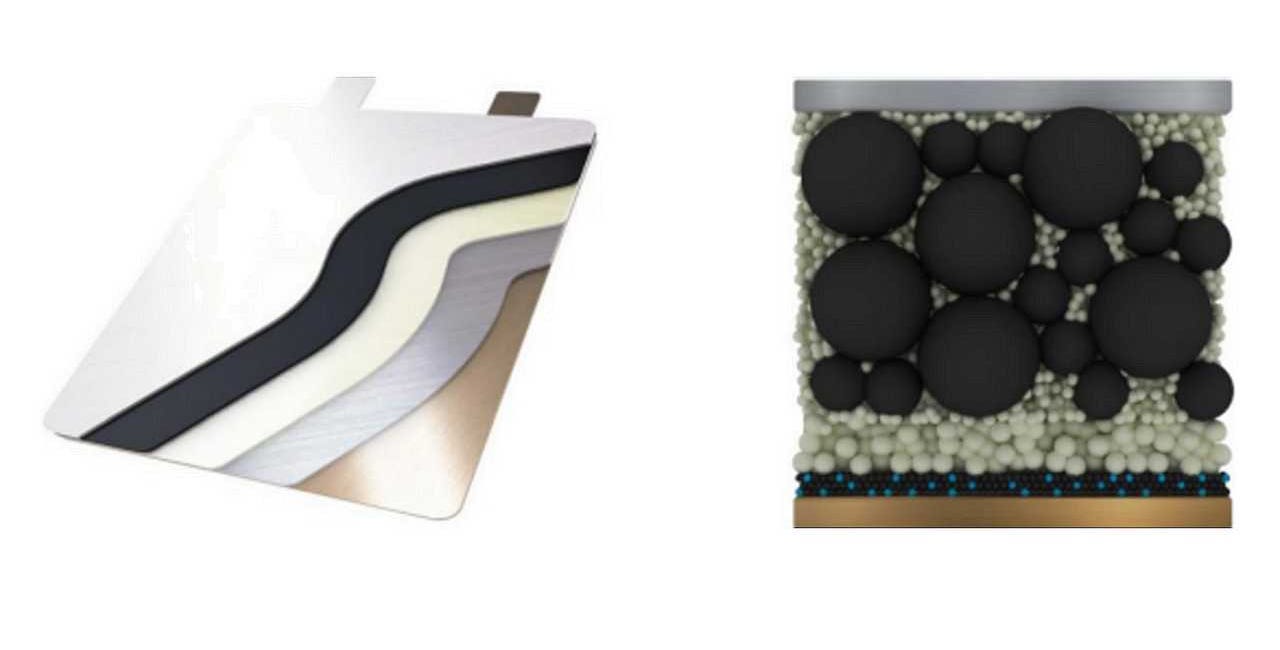

Is Silver The Answer For Solid-State Cells? Samsung Thinks So

You are probably aware of the many advantages a solid-state battery may offer to EVs, but what if it also had high energy density? Would 900 Wh/l be enough? This is what Samsung researchers managed to get with their most recent study. You could call their breakthrough a silver bullet, in some sense. Mostly because it is not a bullet, but a film.

“The company has sufficient liquidity to complete the planned restart and rehabilitation activities at La Parrilla.” McKenzie added, underscoring management’s view that the financing positions the junior miner to advance construction and recommissioning work

La Parrilla, a prolific past producer with a 2,000-tonne-per-day mill and multiple underground mine portals, has been inactive since 2019. The new offtake financing marks a key milestone toward unlocking the project’s near-term production potential and delivering value to shareholders.

Financing amount: US $7.0 million prepaid offtake facility (18 months).

Offtake: 100 % of lead-silver & zinc concentrates for two years.

Interest & repayment: SOFR + 4.75 %; six-month grace period, then monthly instalments.

Use of proceeds: rehabilitation, upgrades, underground development, working capital

Continues here