Gold Milkshake: Sovereign Blockchain Gold Is Here

How To Retire US Debt, Monetize Assets, Help Americans Hedge Financial Risks and Keep the USD as World’s GRC

Balance-Sheet Event With Monetary Consequences

Authored by GoldFix

Recent sovereign gold token announcements are often framed as experiments in digital payments or crypto infrastructure. That framing understates what is taking place. What is emerging is a shift in how sovereign balance sheets are managed. Gold, when paired with blockchain rails, is becoming a programmable monetary instrument that operates alongside fiat currencies (SOV asset) rather than in place of them as a settlement medium currency.

The developments in Bhutan and Kyrgyzstan point toward a broader direction. Nations are preparing to monetize existing assets to manage debt, inflation, and external monetary risk. Gold and silver sit at the center of that strategy.

The Re-Emergence of Dual Money

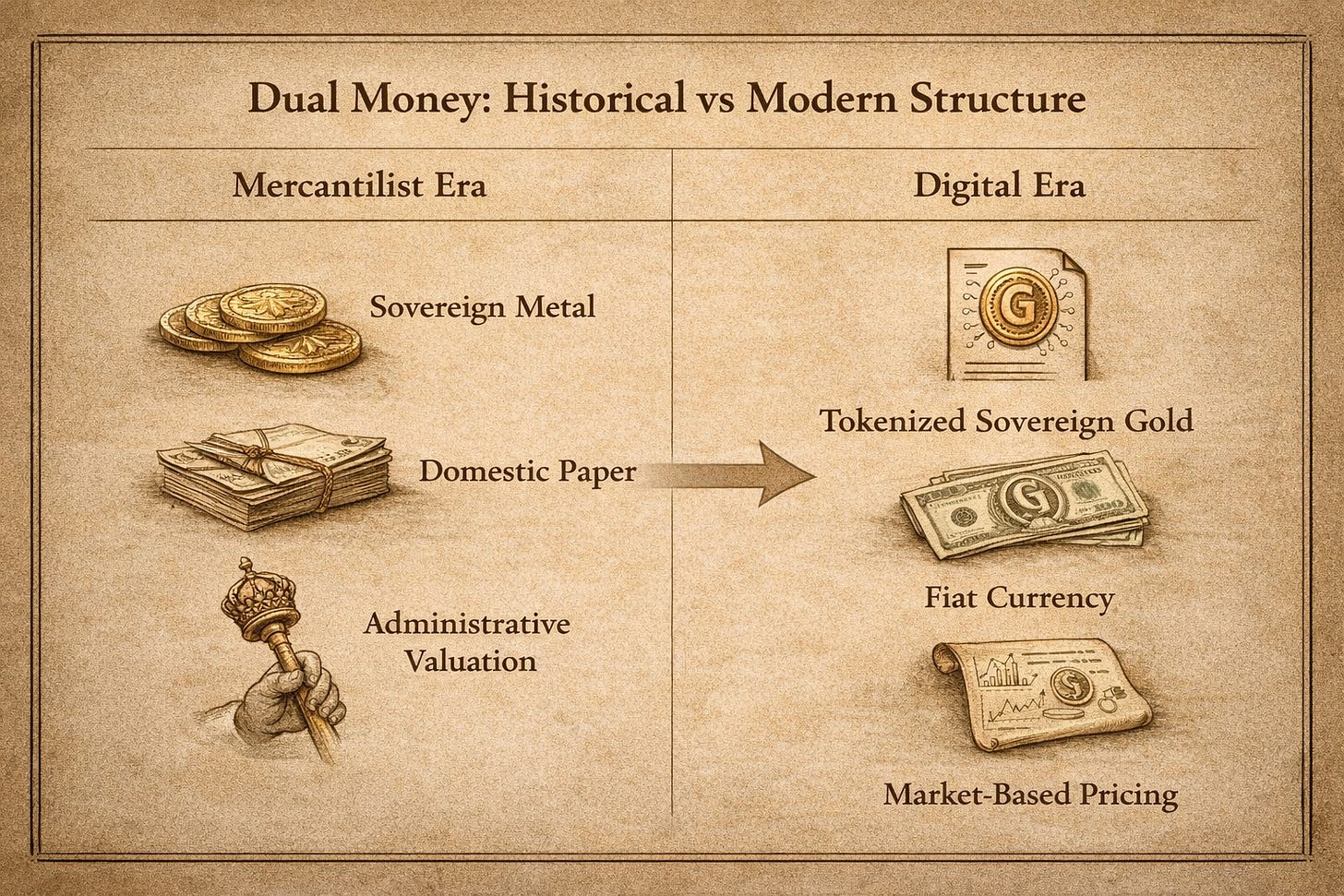

Historically, monetary systems operated in layers. Sovereign money and domestic money existed simultaneously, each serving a different function. Gold and silver anchored external obligations and inter-sovereign settlement. Domestic currencies circulated internally and adjusted to political and economic needs.

A similar structure is forming again.

In the modern version, fiat currency remains the medium of exchange. Gold assumes a balance-sheet and informational role. The mechanism differs from earlier systems in how value is established. Pricing now emerges continuously through markets rather than episodically through proclamation.

Gold does not need to circulate to exert influence. Visibility, accessibility, and credible pricing are sufficient.

Tokenized Gold as a Sovereign Instrument

Sovereign gold tokens function as state-backed monetary instruments. They are issued against existing reserves and designed to operate within regulated frameworks.

The mechanics are straightforward:

A sovereign allocates gold already held on its balance sheet.

Claims on that gold are tokenized.

Citizens or institutions exchange fiat for those claims.

The gold remains in custody.

Currency is absorbed from circulation.

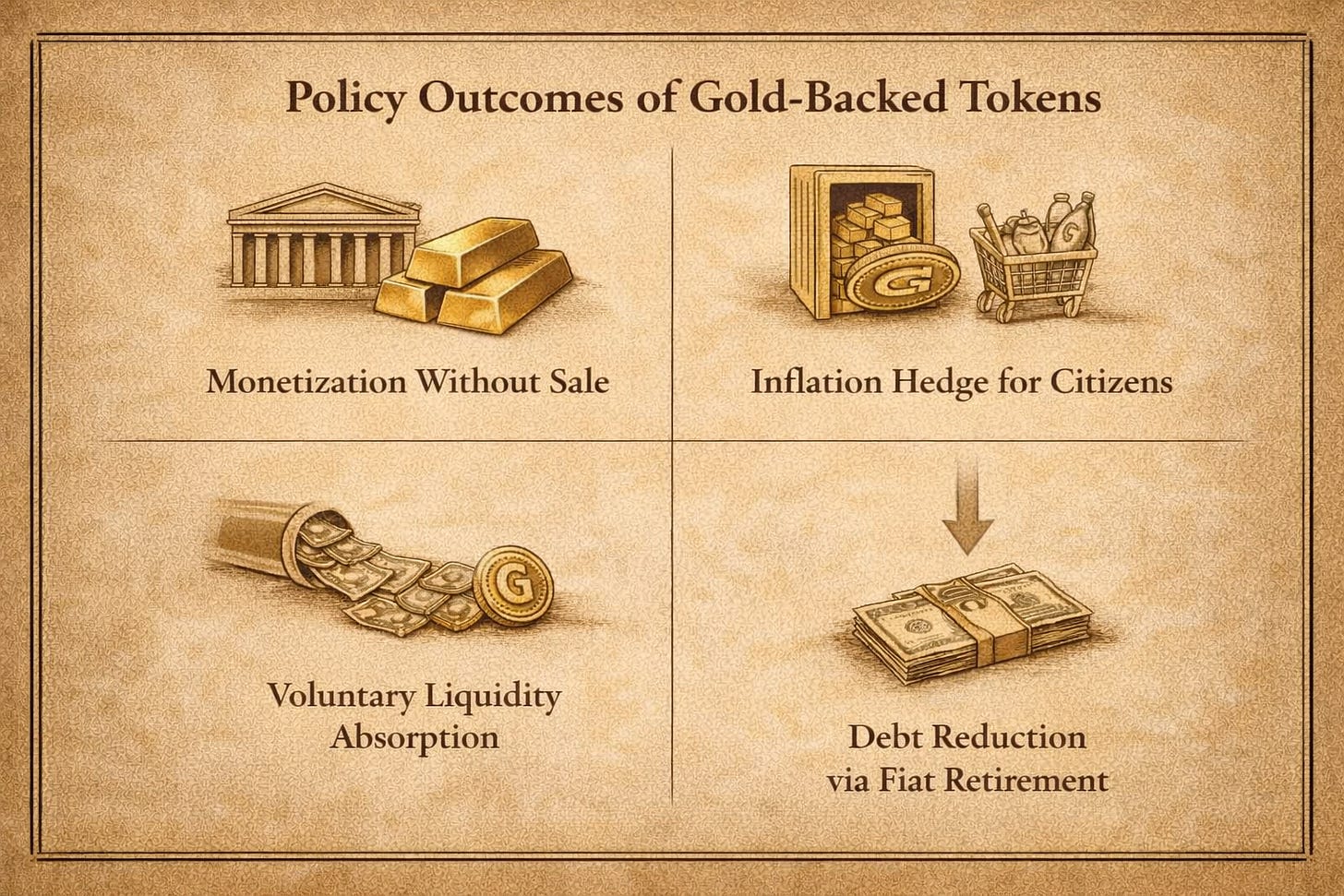

This process converts gold from a passive reserve into an active balance-sheet asset. Fiat liabilities decline without the sale of physical gold, without additional borrowing, and without forced fiscal tightening.

Policy Incentives Behind the Structure

The incentives are structural and economic rather than ideological.

Gold-backed tokens allow governments to monetize assets they already own. Gold in a vault generates no cash flow. Gold backing a digital claim does.

They also provide citizens with a domestic store of value. That access stabilizes confidence in local fiat and reduces pressure for capital flight.

From a policy perspective, excess liquidity can be absorbed voluntarily. Market participation replaces coercive measures. Monetary control improves without aggressive rate adjustments.

At the balance-sheet level, fiat exchanged for gold claims represents debt reduction. Currency is retired rather than rolled forward.

Early Adopters: Bhutan and Kyrgyzstan

Bhutan’s gold-backed token initiative, combined with its openness to stablecoin infrastructure, illustrates how smaller nations can act early. With limited monetary reach and fewer legacy constraints, experimentation carries lower systemic risk.

Kyrgyzstan’s exploration of similar structures reflects the same logic. These efforts focus on asset management and balance-sheet flexibility rather than transactional innovation.

Smaller nations tend to move first because necessity compresses decision-making. Larger nations tend to observe, evaluate outcomes, and adopt later.

Stablecoins and the Offshore Dollar System

When sovereigns or their institutions hold USD-denominated stablecoins, they are holding dollars offshore. The economic function mirrors the Eurodollar system which is well explained in context of Brent Johnson’s Milkshake theory, which postulates that the USD is reinforced as GRC through default use globally in the Eurodollar system1

Stablecoins extend dollar usage beyond the traditional banking system. They operate outside direct Federal Reserve balance-sheet expansion while remaining within the dollar ecosystem.

In this framework, dollars facilitate transactional flow. Gold provides balance-sheet stability. The two coexist without displacing one another.

Remaining Sections

- The United States and the Advantage of Incumbency

- Domestic Gold Ownership and External Confidence

- Regional Pricing and the Return of Gold Reference Points

- System Characteristics

- Closing Perspective

Continues here