Bonds: From Risk-Free to Riskiest

The student of cycles knows that when feasts last too long, the bill is never forgotten; America still dines well, but the waiter is already approaching—history may record the moment as the age of Trump Stagflation.

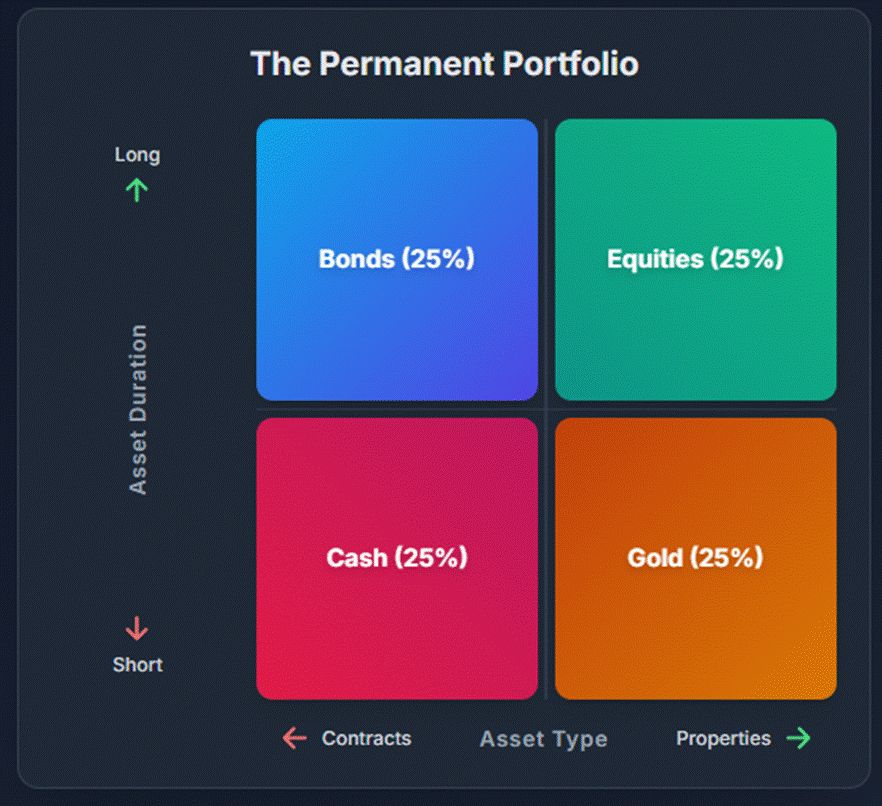

The patient student of markets knows the Permanent Portfolio as a humble bowl of rice: it draws no applause, survives every season from America to China, and quietly outlasts those who feast on speculation. Balanced between cash, bonds, equities, and gold, it neither chases excitement nor fears storms—while others rush about, it sits still and keeps its owner fed.

The quiet observer sees the Permanent Portfolio as a tidy household: promises on one side, possessions on the other; patience in the long term, readiness in the short. Bonds and cash make vows, stocks and gold keep substance, and together they form four calm corners that carry the investor through every season—proof that balance, not brilliance, is what keeps the house standing.

Debt is now praised as progress: borrow today, celebrate tomorrow, and let the bill visit someone else. Yet the student of history knows that when promises grow faster than production, the ledger is always corrected—sometimes with thunder, sometimes with silence. The ancients called it a jubilee, not from kindness but from arithmetic; modern rulers call it policy, hoping confidence will obey. It never does, and when trust finally leaves, it departs faster than it was ever borrowed.

The merchant borrows to grow before the harvest, knowing excess debt invites ruin; the ruler borrows to feast today, trusting tomorrow will somehow pay. What began as a useful tool became a habit, then a dependency, until promises multiplied faster than production. Now companies polish balance sheets, households borrow patience, and states issue IOUs as policy—forgetting the old lesson: when interest grows faster than real work, choices vanish. At that point, the wise prepare for inflation, repression, or default, while the rulers choose whichever delays confession the longest.

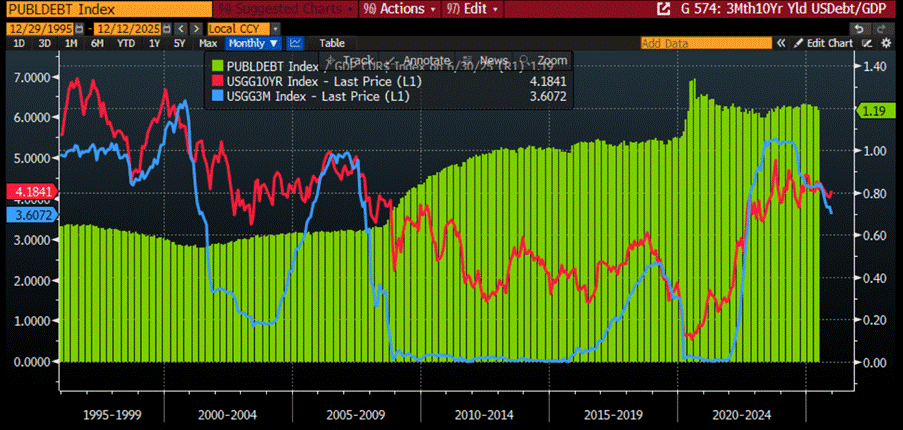

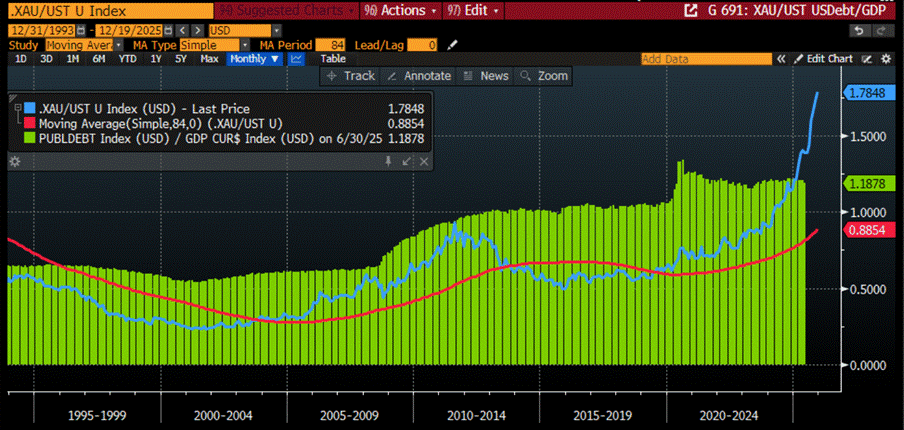

Anyone armed with basic logic would expect that as government debt-to-GDP takes a parabolic joyride—as it has in the U.S. since the 1990s—bond yields would politely follow upward, both at the short end and the long end. After all, more debt, more risk, higher yields… right? Not quite. Reality, as usual, chose satire. Long-dated yields instead spent decades drifting lower, apparently immune to arithmetic, until mid-2020—when the government, citing the great pandemic panic, discovered an unlimited spending button and leaned into a Malthusian-Keynesian binge. Meanwhile, short-dated yields, tethered tightly to the Fed funds rate like an anxious dog on a leash, bounced around wildly, faithfully reflecting every policy mood swing. In short, the bond market stopped behaving like a market and started behaving like a policy experiment—one where gravity was optional and common sense took a long vacation.

US Pubic Debt as a % of GDP (green histogram); US 3-Month Yield (blue line); US 10-Year Yield (red line).

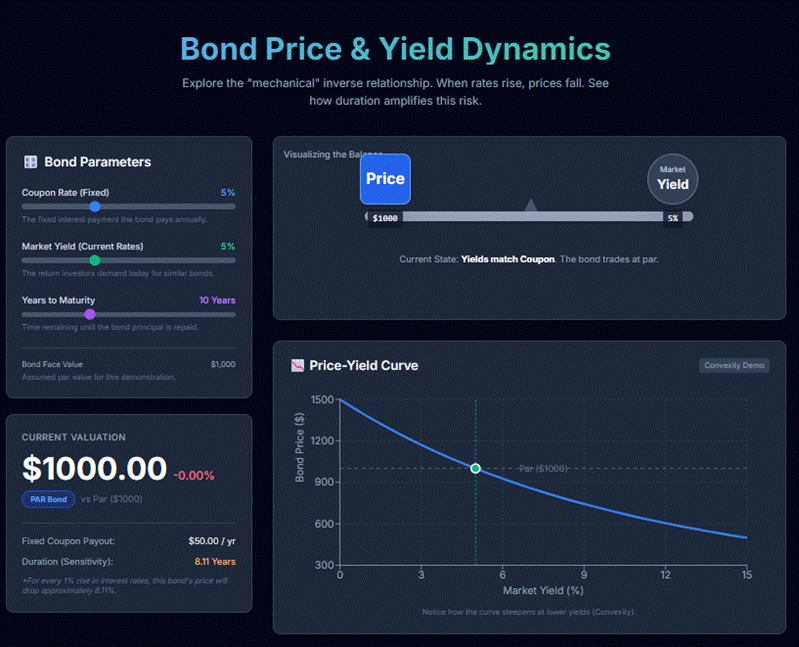

The student of fixed income markets understands that price and yield walk in opposite directions, like the balance of yin and yang. When rates fall, older bonds with richer coupons are valued more highly; when rates rise, their worth declines so harmony may be restored. This is not a matter of sentiment but of structure, and the longer the bond’s life, the more sharply it responds. Those who ignore this simple order discover, in times of rising yields, that small disturbances can bring large losses.

If you strip the bond market of its suits and slogans and look at it in real terms—gold versus U.S. Treasuries, seasoned with a dash of debt-to-GDP—the pattern becomes almost embarrassingly obvious. From 1995 to 2003, when Washington briefly practiced fiscal restraint, gold sulked, underperformed Treasuries, and stayed obediently below its 7-year moving average—deflation dressed as discipline. From 2003 to 2013, the debt binge resumed, the ratio exploded, and gold promptly woke up and outperformed, sensing inflation long before it was fashionable. Then came 2013 to 2019, another flirtation with restraint, another deflationary lull, and gold politely stepped aside—until the Covid “plandemic” spending spree blew the debt ratio into orbit and sent gold into parabolic outperformance against Treasuries. In short, betting that bonds will preserve wealth better than gold from here assumes the U.S. will rediscover debt orthodoxy—an event about as likely as Sunday refusing to hand the baton to Monday, especially while empire, deficits, and forever wars remain firmly on the agenda.

US Pubic Debt as a % of GDP (green histogram); Relative performance of Gold to Bloomberg US Treasury Total Return Index (blue line); 7-Year Moving Average of Gold to Bloomberg US Treasury Total Return Index ratio (red line).

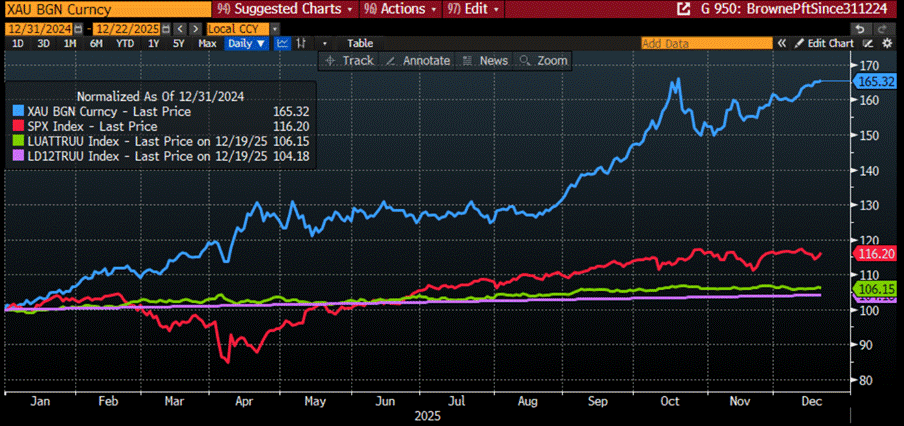

For decades, investors were taught that bonds are “safe,” like a seatbelt that works in all crashes—an idea born in a world of falling rates, modest debt, and central banks that at least pretended to fear inflation. Like it or not, that world is gone. Debt is exploding, purchasing power is optional, and policy now exists to protect borrowers, not savers. The deeper illusion—that bonds are somehow antifragile—came from years of bailouts that made fragility look like resilience. But bonds are just promises, and promises weaken when discipline disappears. As markets are now reminding us, duration is no longer safety but risk—and in this Jubilee year, even before adjusting for the CPI fairytale, real assets like gold and equities have quietly outpaced the paper comforts of bonds and cash.

Nominal (not ‘CP-Lie’ adjusted) performance of $100 invested in physical gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Index (green line); Bloomberg US Treasury Bill: 1-3 Months Index (purple line) since 31/12/2024

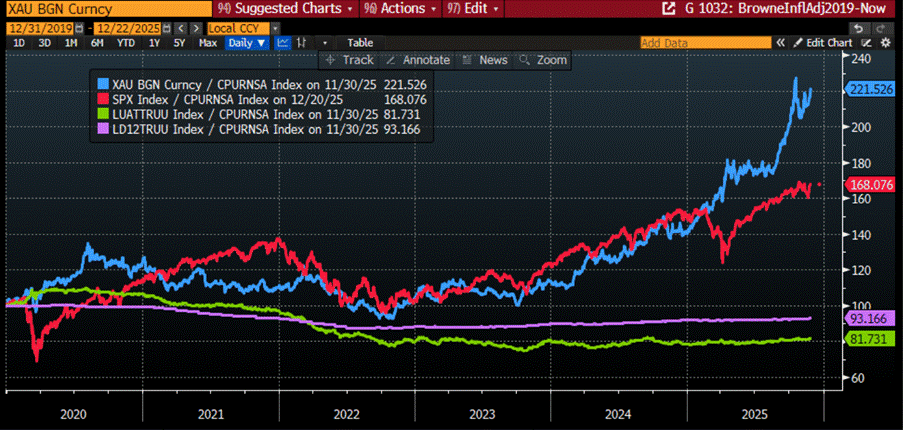

Since the Covid plandemic and wars scrambled supply chains, rewired supply and demand—the only things that actually cause inflation—and finished off what little trust remained in public institutions, inflation has been quietly chewing through investors’ nominal returns, even as measured by the generous CPI fairy tale. And the numbers are an excellent cure for bond-related bedtime stories. Over the past five years, a heroic $100 invested in U.S. cash shrank to $92.3 in real terms, while bonds performed an even finer disappearing act, leaving just $80.6. Meanwhile, the supposedly “risky” assets failed to get the memo: the same $100 became $201.2 in gold and $163.8 in the S&P 500, CPI-adjusted. For anyone still believing that bonds and cash preserve wealth, this is not a market signal—it’s an intervention.

CP-Lie adjusted performance of $100 invested in physical gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Index (green line); Bloomberg US Treasury Bill: 1-3 Months Index (purple line) since 31/12/2019.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/bonds-from-risk-free-to-riskiest

Visit The Macro Butler Website here: https://themacrobutler.com/

Join The Macro Butler on Telegram here : https://t.me/TheMacroButlerSubstack

You can contact The Macro Butler at info@themacrobutler.com

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence