Silver: Who is Front-Running the US 232-Tariff Decision?

Silver is rising for reasons the market is not admitting. Behind refinery bottlenecks, quiet accumulation, and an overlooked policy deadline, a different framework may be forming. This piece examines why apparent abundance can coexist with higher prices, and why January 2026 matters more than it looks.

TL;DR — Key Takeaways

- Rising silver prices conflict with reports of domestic abundance, suggesting metal may be quietly reserved or hoarded rather than freely available to the market.

- JPMorgan’s sustained physical activity and coverage of Section 232 are treated as signal, implying positioning ahead of potential policy or regulatory shifts.

- Section 232 creates a mid-January 2026 policy window where silver could be designated tariffed, incentivizing accumulation before any tariff action.

- The broader context points to a mercantilist framework: accumulate first, restrict access later, resulting in (kind of orderly, policy-managed upside.

Is The US Front-Running Tariff Implementation?

Authored by GoldFix

Despite widespread and verified claims of ample silver availability within the United States, current market behavior diverges from historical patterns typically associated with oversupply. Silver prices continue to advance even as participants report access to raw material, none of which is coming from London. This inconsistency points toward a different explanation: silver entering the U.S. market is increasingly spoken for at the institutional or national level, even if it has not yet been refined into final, deliverable form.

Refining bottlenecks appear to be obscuring this dynamic. The issue is not the absence of metal, but the inability to process it into usable formats quickly enough. As a result, silver may be effectively reserved, awaiting refinement, regulatory clarity, or strategic deployment, rather than circulating freely through the market.

JPMorgan as a Key Intermediary

The bank does not withdraw physical metal from circulation without intent. Accumulation at this scale suggests deliberate positioning rather than opportunistic trading. Possible explanations include acting on behalf of sovereign or industrial clients, positioning inventory ahead of regulatory or policy shifts, or preparing for changes in market structure. Regardless of the specific motivation, the behavior indicates purpose rather than coincidence.

Section 232 and the Critical Minerals Review

Section 232 of U.S. trade law governs the imposition of tariffs on materials deemed relevant to national security. While the framework applies broadly across commodities, silver has received comparatively little public attention within this context.

Notably, Section 232 considerations continue to surface in institutional commentary on silver, suggesting it remains an active variable. The statutory timeline places the delivery of a Commerce Department report to the President in mid-January 2026. This date matters less as a point of decision than as a policy window that shapes incentives in advance. As JPMorgan noted on December 12th:

It has been nearly two months since the accelerated 180-day deadline for Section 232 critical minerals (initiated on April 22, 2025, implying October 19). Nonetheless, the standard deadline for the Secretary of Commerce to deliver a Section 232 report to the President is 270 days after initiation, which is January 17, 2026 for critical minerals.

Mercantilist Logic and the Copper Tariff Sequence

Potential tariff policy follows a mercantilist logic. Nations do not tariff materials they lack. Instead, they first secure domestic supply and processing capacity, then raise barriers once internal needs are satisfied.

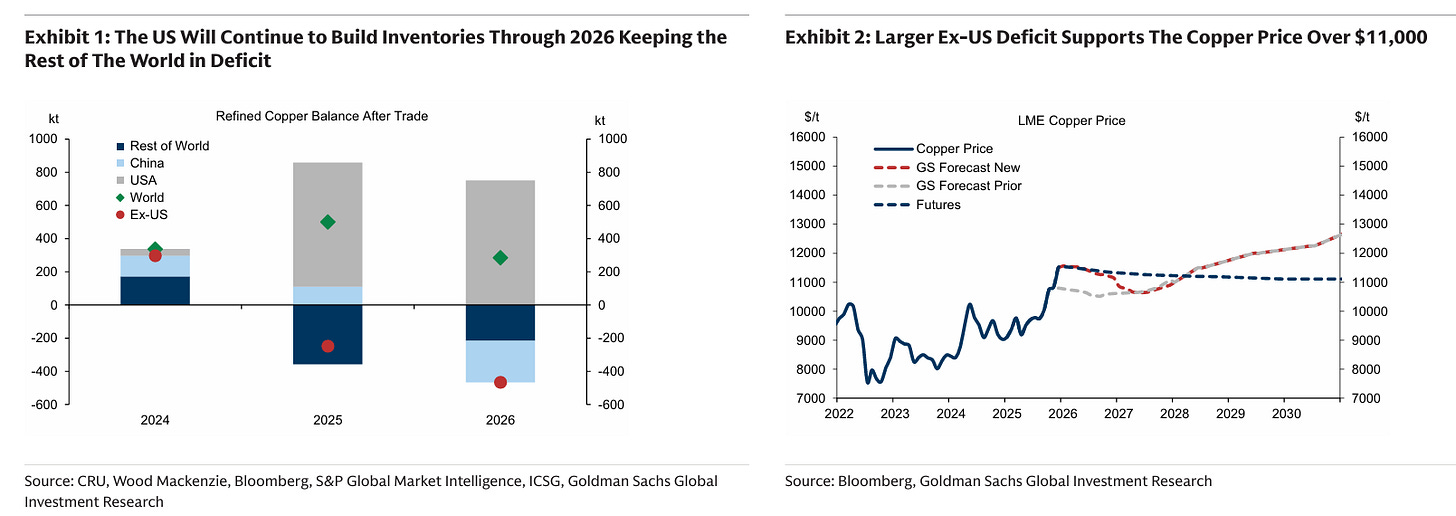

Copper provides a reference case. The United States refrained from aggressive tariff action until domestic availability and downstream capacity improves. Once those conditions are met, tariffs will become a tool to raise global prices, disadvantage competitors, and reinforce domestic supply chains. Now Goldman discuses openly the hoarding and a future US tariff being implemented. Silver increasingly fits this template. Accumulation precedes restriction. Tariffs follow sufficiency.

The Price Behavior Puzzle

Think this won't affect Silver as well?

This divergence suggests that price action is no longer responding to spot supply conditions alone. Instead, it reflects forward positioning ahead of anticipated policy outcomes or structural changes. The market appears to be discounting future constraints rather than present abundance.

Remaining Sections

- Probabilistic Assessment

- Positioning Implications

- Structural Context and Synthesis

- Bottom Line

Continues here