Brics Launch Gold Supply-Chain 2026

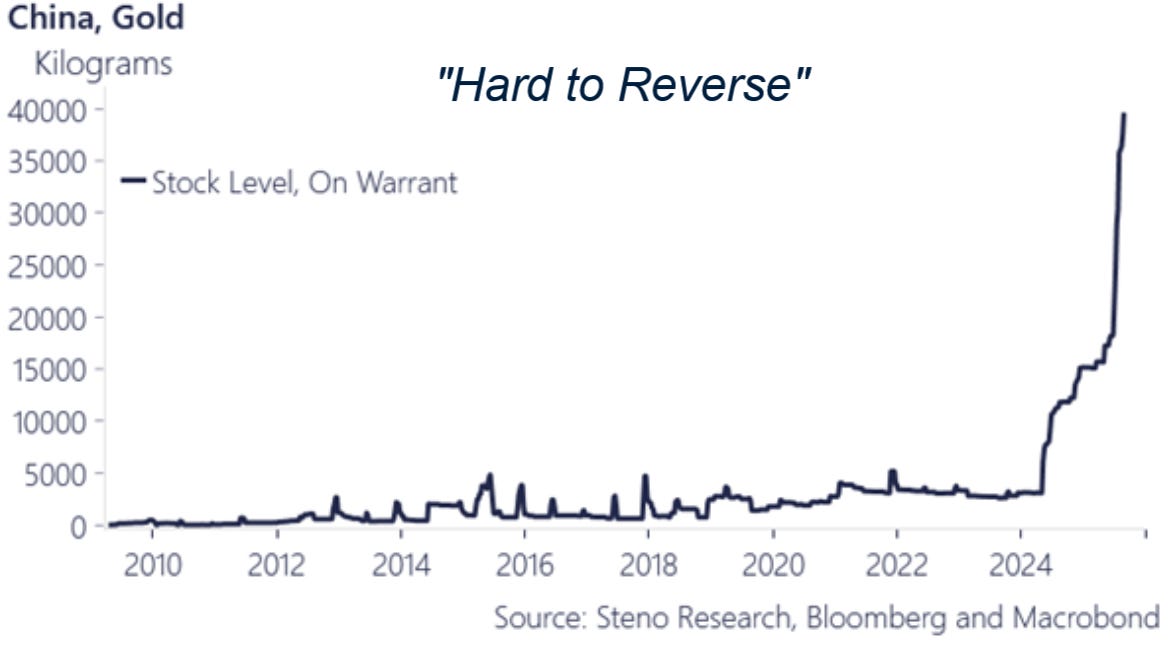

Good Morning: As detailed and tracked in this space with important signpost stories embedded below, Brics supply-chains are now completed, payment chains are ready, and metals pricing power has moved sufficiently to the East. Now the Brics make it official.

GFN – HONG KONG: Hong Kong is accelerating efforts to build itself into an international hub for gold trading, storage, clearing, and risk management, as the government moves to formalize a full-service gold market ecosystem anchored in physical infrastructure and financial market connectivity.

*Exclusive: China’s Next Move is HQLA/REPO Status

China’s next golden move may not be about holding gold, but about unlocking its collateral value. If that occurs, the repo market could become the arena where Treasuries face their first true challenge in decades.. or ever. Read full story

“Hong Kong’s gold market has initially formed a complete industry chain,” Hui said, adding that the government will continue working with market participants to enhance infrastructure and risk-management capabilities.

Officials said Hong Kong’s role as an international financial center, combined with its connection to mainland China and global markets, positions the city to serve as a regional gateway for physical gold flows and related financial activity. The government plans to further integrate trading, storage, clearing, and financing functions to support long-term market development.

Hong Kong: Gold Infrastructure as Bridge to Yuan Internationalization

The policy announcements by Chief Executive John Lee Ka-chiu must be understood as another step in the progression toward BRICS’ declared goal of elevating gold’s role in the global system. China’s ambitions for the yuan hinge not only on wider trade adoption but also on embedding credibility through tangible monetary anchors. Gold is the logical proxy, and Hong Kong’s development as a gold hub positions it as the offshore platform for this transition. Read full story

“Leveraging the advantages of being backed by the motherland and connected to the world, the HKSAR government will work with the industry to build Hong Kong into an international center for gold trading, storage, clearing, and risk management,” Hui said.

Authorities said measures already introduced have delivered early results, with further policy initiatives expected as Hong Kong seeks to anchor itself more firmly in the global gold market.

Market Rundown | Things are Happening (Much) Faster Now pic.twitter.com/7g86rfG7Nz

— VBL’s Ghost (@Sorenthek) December 23, 2025

KEY RELATED COVERAGE:

- China is Taking Gold Public September 27, 2023

Continues here