Deluge of Delayed Data

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 11,000 subscribers at MktContext.com for our weekly deep dives and analysis!

All of the delayed econ data from the last few months (due to government shutdown) was released last week. The main headline was that payrolls declined -105K in Oct, before rebounding to +64K in Nov. The Oct decline was driven by DOGE cuts and the shutdown, rendering it somewhat stale.

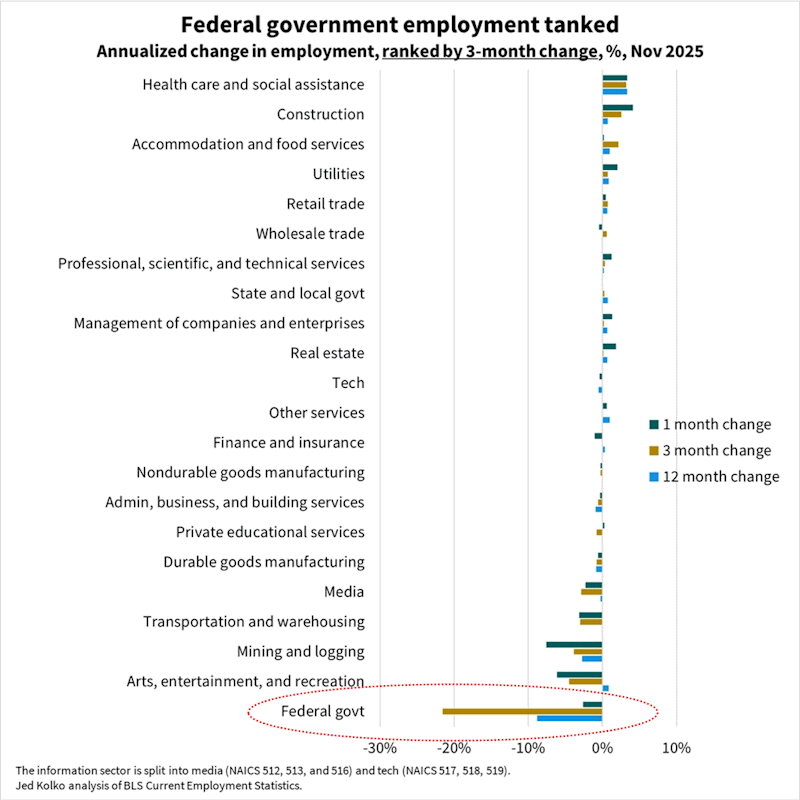

If we cherry-pick a bit, private (corporate) payrolls were up in both Oct and Nov. That suggests things are a bit more resilient away from the public sector noise. We can see in the chart below that nearly all of the job losses have been due to federal workers:

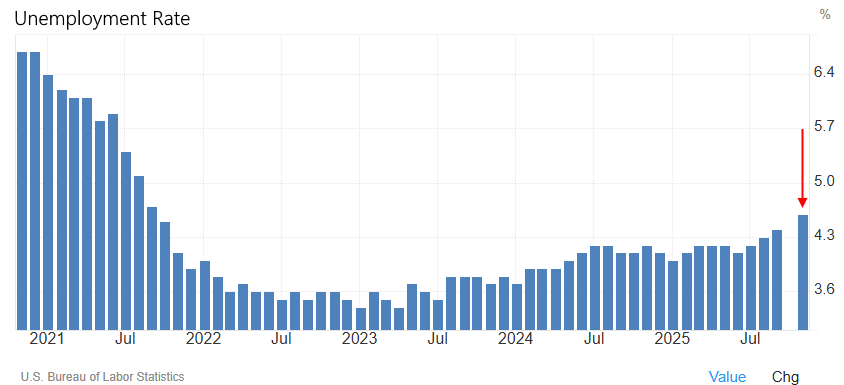

At the same time, overall unemployment rate hit 4.6%, two ticks above the prior level of 4.4%. It’s obvious the job market is slowing down; everyone has known for over a year now. The real question is how fast?

Earlier this year, Treasury Secretary Scott Bessent spoke about “detoxing” the economy from an overreliance on government spending. That’s why we’re seeing a decline in Federal jobs and why the labor market appears weak.

We think there’s a sweet spot where unemployment slowly grinds higher (due to re-entrants to the labor market, government detox, and AI-driven layoffs) but does not explode. That allows the Fed to cut rates more aggressively without the economy entering a recession. Everyone is calling for a recession, but remember that historical models have not worked well because of distortions to labor supply; these are unprecedented times.

Lastly, we leave this chart here as an open question: If the labor market is collapsing like so many economists think it is, why are temp jobs and overtime hours rising? These workers are the first to be let go entering a recession, and the first to be hired coming out of one:

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!